|

April 18, 2007 (iTulip)

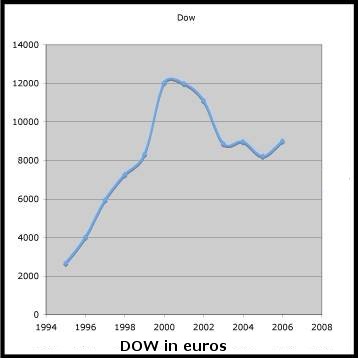

Readers older than 30 will recall the B52s song, "You're living in your own private Idaho." Makes a good theme song for today's stock market party. If not Idaho, then at least a private national market. While the DOW was making new highs, from the perspective of European investors in US stocks, there wasn't much to party about.

Dow Closes Above 12,800 for First Time

April 18, 2007 (Madlen Read - AP)

The Dow Jones Industrials Closed Above 12,800 for First Time in Mixed Session on Wall Street

The Dow Jones industrial average closed above 12,800 for the first time Wednesday, signaling Wall Street's recovery from its steep decline in February as investors rewarded companies with strong earnings.

AntiSpin: Strong earnings? Nah. Wall Street Journal writers Justin Lehart and E.S. Browning have it right: "Dow Industrials Regain Ground on Buyout Wave."

Dow Industrials Regain Ground on Buyout Wave

April 18, 2007 (JUSTIN LAHART and E.S. BROWNING - WSJ)

After February Plunge, Market Nears a Record; Echoes of '80s Froth?

What's driving the run-up? It isn't the economy. Economic growth has been slowing. Instead, it's the ocean of cheap loans available to private investment funds that's permitting them to buy publicly traded companies and take them private, bidding up share prices in the process. The current wave of buyouts has swelled to a point that, in many ways, it now dwarfs the buyout frenzy of the 1980s.

Skeptics are worried that the growing fascination with such deals may be distracting investors from taking a hard look at the performance of the companies whose stocks they own, injecting an element of froth into the market, as happened in the '80s.

So far this year, almost $183 billion in buyouts have been announced, putting the value of deals this year on pace to surpass $700 billion. That compares with $99 billion in 1988, at the height of the '80s boom.

|

Dollar at multi-decade lows, European stocks hit

April 18, 2007 (Reuters)

The dollar fell to 26-year lows versus sterling and closed in on record troughs against the euro on Wednesday, putting pressure on European stocks as investors fretted about the possible impact of currency moves on exports.

Dollar weakness boosted gold prices and spread caution on Wall Street which is seen opening lower after disappointing results from Yahoo Inc and IBM.

Maybe euro markets are worried about exports to the US. More likely they are worried about the hangover from the blow-off phase of the buyout party as global central banks continue to ever so slowly take away the punch bowl they run on. I'll mix metaphors to quote the first and last word on the liquidity extraction process:

No mercy now, no bail-out later

April 4, 2006 (Telegraph UK)

As Ben Bernanke knows all too well, monetary policy is like pulling a brick across a rough wooden table with a piece of elastic. Tug, tug, tug: nothing happens. Tug a little harder: it leaps off the surface and knocks your teeth out.

Which all leads to the question: during the next correction, will US stocks decline nominally or only in real terms as they have since 2000?

We'll tackle that topic over the coming weeks.

Comment