|

Rick Ackerman today posted here part of an email exchange he and I had over the weekend. Rick, bless his stubborn soul, is for some reason still trying to talk me out of Ka-Poom Theory, which I developed in 1999, and which already happened once since then, and which made me money by leading me to buy a bunch of precious metals in 2001 at the time I posted this one and only article I'd ever written on gold up to that point–not coincidentally, near the exact bottom of a 20 year bear market in gold. Ka-Poom Theory cycles are a fact, and profitable to trade, so I'm not sure why Rick keeps talking as if the Ka-Poom Theory debate is between "inflationists" and "deflationists," framed as a purely philosophical argument of the "number of angels dancing on the head of a pin" variety.

Too much ideology and not enough science. By any standard definition of economic terms, a hyper-inflation is a debt deflation. Rick does not accept this from me so I guess he needs to sit in on an macro econ class at his local college. In any case, I have never said I expect a hyper-inflation–he must be confusing me with someone else–but have written many pieces over the years about the possibility of a major inflation. A major inflation also destroys debt, as do debt defaults, and is therefor also a form of debt deflation.

We will edit and post the entertaining discussion Rick and I had a few weeks back, after we post the Dr. Hudson interview. (Rick wins the Most Amusing Line prize when he says, by way of explaining why his theory of debt deflation can't account for $200 oil, "I'm a demagogue!"*

In our "discussion," I make these points in summary:

Central bankers have learned how to deal with debt defaults

Doctors no longer slap leaches on us when we have the flu or drill holes in our heads when we have headaches. At least mine doesn't. (Maybe Rick's does, which if a fact would provide a simple answer to the question of how he arrived at his conclusions about deflation.) In the same vein, so to speak, central bankers no longer sit around waiting for a nation's banking system to collapse and take the economy down in a run-away process of falling all-goods prices and debt defaults. That's what they did in the 1930s, what the Japanese almost did in the 1990s, and what the U.S. most certainly did not do in the early 2000s–the Fed printed like crazy after the stock market crashed in 2000, as predicted by Ka-Poom, and we experienced in consequence a big run-up in precious metals prices, which we did predict, and a massive real estate bubble, which we did not. One of these bubble cycles, perhaps the next, the reflation process may go haywire, resulting in a major inflation. This inflation may occur by accident, or be accepted as an optimum policy choice under the circumstances which prevail at the time.

The U.S. will not experience a hyper-inflation

Every piece I have written, including Ka-Poom Theory going back to 1999, models a major inflation, but not technically a hyper-inflation. Price Waterhouse and Coopers & Lybrand defines a hyper-inflation as 100% in one year.

December 2005 - Inflation is Dead! Long Live Inflation

April 2006 - Can the U.S. have a "Peso Problem"?

September 2006 - No Deflation! First Disinflation, then Lots of Inflation

September 2006 - Ka-Poom is a Rhyme not a Repeat of History

These articles model an inflation of approximately 100% over a period of four to six years, not one.

The reason I do not believe we will have a hyper-inflation is that the U.S. does not now, nor is likely to have in the near future, the pre-conditions for a hyper-inflation. This point is lost even among some very bright guys in the industry.

I started to listen an interview sent to me by a reader this weekend but stopped about two minutes into it when the interviewee stated that printing more money in 1930s was not an option for the Fed because that would have produced a hyper-inflation in the U.S. as had happened earlier in Weimar Germany. That's nonsense. Hyper-inflations occur when a nation a) has external debts and internal government entitlement obligations which together exceed the economy's national surplus and foreign and domestic borrowing capacity, that is, the means to pay the debts, and b) has suffered a complete loss of political control over major institutions of national government, so that all officials have left to deal with the debt deflation and currency depreciation crisis is the "print" button on the printing press, which, while solving short term nominal payroll and debt obligation problem makes all other economic matters worse.

"The Kapp Putsch took place on March 13, 1920, involving a group of Freikorps troops who gained control of Berlin and installed Wolfgang Kapp (a right-wing journalist) as chancellor. The national government fled to Stuttgart and called for a general strike. While Kapp's vacillating nature did not help matters, the strike crippled Germany's ravaged economy and the Kapp government collapsed after only four days on March 17."

Without both (a) and (b), you do not have the pre-conditions for hyper-inflation. The U.S. was a net creditor in 1930s, its government payroll was miniscule relative to its economy even after the economy had contracted by 25%, and while there was political unrest there was no putsch in Washington–not even close. There was, therefor, no chance of a hyper-inflation in the U.S. in the 1930s.

Today Government is the largest employer as a segment of the economy at 17% with 22,122,000 on the payroll (up from 3,988,000 in 1939), about the same as the Goods Producing sector. It is also one of the fastest growing, increasing by 18% in February, according to a report issued by the Labor Department last week. Only Booze, food, and hotels grew faster. Construction and mining fell off a cliff, of course, decreasing by 23% and 24% respectively, tech fell 14%, and demand for people selling mortgages to drug addicts and poor old ladies declined 9%

War and Inflation go together like rats and rat turds

The U.S. suffered a 35% inflation over the six years of the Vietnam War. The only reason we haven't already experienced an even more serious inflation due to the Iraq War, which has cost us much more in real dollars, is because of massive lending by Asia.

But make no mistake. Today's massive foreign debts, taken on for non-productive purposes such as war, are tomorrow's high taxes, high inflation, or both.

Inflation is no more or less moral than deflation

As a side-effect of mixing economic theory and ideology, Rick has gotten this nutty idea stuck in that big brain of his that if there's a big inflation that all these carefree debtors, who've been living high off the hog, get off scott free while careful, gratification delaying savers get creamed. He seems to think a major inflation is unfair, nay, immoral! Tell that the citizens of the now defunct Soviet Union who were wiped out in the inflation that raged there from 1992 to 1996:

"In 1992, the first year of economic reform, retail prices in Russia increased by 2,520 percent. A major cause of the increase was the decontrol of most prices in January 1992, a step that prompted an average price increase of 245 percent in that month alone. By 1993 the annual rate had declined to 840 percent, still a very high figure. In 1994 the inflation rate had improved to 224 percent.

"Trends in annual inflation rates mask variations in monthly rates, however. In 1994, for example, the Government managed to reduce monthly rates from 21 percent in January to 4 percent in August, but rates climbed once again, to 16.4 percent by December and 18 percent by January 1995. Instability in Russian monetary policy caused the variations. After tightening the flow of money early in 1994, the Government loosened its restrictions in response to demands for credits by agriculture, industries in the Far North, and some favored large enterprises. In 1995 the pattern was avoided more successfully by maintaining the tight monetary policy adopted early in the year and by passing a relatively stringent budget. Thus, the monthly inflation rate held virtually steady below 5 percent in the last quarter of the year. For the first half of 1996, the inflation rate was 16.5 percent. However, experts noted that control of inflation was aided substantially by the failure to pay wages to workers in state enterprises, a policy that kept prices low by depressing demand."

Annual inflation in Russia now, by the way, is around 15%."Trends in annual inflation rates mask variations in monthly rates, however. In 1994, for example, the Government managed to reduce monthly rates from 21 percent in January to 4 percent in August, but rates climbed once again, to 16.4 percent by December and 18 percent by January 1995. Instability in Russian monetary policy caused the variations. After tightening the flow of money early in 1994, the Government loosened its restrictions in response to demands for credits by agriculture, industries in the Far North, and some favored large enterprises. In 1995 the pattern was avoided more successfully by maintaining the tight monetary policy adopted early in the year and by passing a relatively stringent budget. Thus, the monthly inflation rate held virtually steady below 5 percent in the last quarter of the year. For the first half of 1996, the inflation rate was 16.5 percent. However, experts noted that control of inflation was aided substantially by the failure to pay wages to workers in state enterprises, a policy that kept prices low by depressing demand."

If it's any consolation for Rick, a major inflation wipes out debtors' debts, but it wipes out what little savings debtors have, too, unless they've moved them–such as they are–overseas. That's what savers do just before a major inflation, in a "Poom" process that becomes self-reinforcing (as inflation expectations rise, capital flows out of the country, the currency slides, causing an increase in inflation expectations, and so on.) A saver who has his money overseas in bonds denominated in other currencies and in precious metals still has most of his savings. A debtor, by definition, doesn't have any savings to send overseas or store in PMs. So how does he make out better?

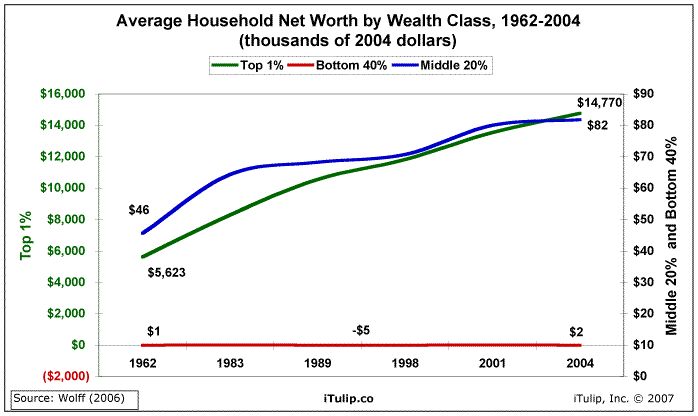

The U.S. doesn't have a lot of savers, of course. It has a few, and–boy–they've saved a lot. So much, in fact, that they need their own scale; in the chart below, the saver's scale is on the left, the everyone else scale is on the right.

We're working on an update to Ka-Poom Theory called "The Last Ka-Poom: When Reflation Fails," which is less like a World Wrestling Federation style match between "inflationists" versus "deflationists" than a careful examination of the prospect of a failure of monetary policy to achieve the objective of continued credit expansion without causing a decline in the value of the U.S. currency. A summary will be available to all, with details available to available to iTulip Select subscribers.

* Wikipedia says: "Demagogy (Demagoguery) (from Greek demos, "people", and agogos, "leading") refers to a political strategy for obtaining and gaining political power by appealing to the popular prejudices, fears and expectations of the public — typically via impassioned rhetoric and propaganda, and often using nationalistic or populist themes. The early 20th century American social critic and humorist H. L. Mencken, known for his 'definitions' of terms, defined a demagogue as 'one who preaches doctrines he knows to be untrue to men he knows to be idiots.'"

I do not agree with Rick that he is a demagogue. A man dripping with leeches, holes drilled in his head, needs to be granted broad poetic license.

iTulip Select: The Inside Scoop.

__________________________________________________

Special iTulip discounted subscription and pay services:

For a book that explains iTulip concepts in simple terms see americasbubbleeconomy

For a macro-economic and geopolitical View from Europe see Europe LEAP/2020

For macro-economic and geopolitical currency ETF advisory services see Crooks on Currencies

For macro-economic and geopolitical currency options advisory services see Crooks Currency Options

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment