PM eyes regional trade pact (Update 2)

January 16, 2007 (The Australian)

AUSTRALIA would join a free trade zone of 16 Asian and Pacific nations under a plan for a landmark East Asia economic bloc being pushed by Japan.

The free trade area - stretching from Japan to China, India, Southeast Asia, Australia and New Zealand - would cover almost half of the world's population, three billion people, with an economic output of $9 trillion.

Speaking at the East Asia Summit in The Philippines yesterday, John Howard said the Japanese idea of an East Asia free trade bloc, which would rival the European Union and the North American Free Trade Agreement, was discussed at the meeting and that Australia "supports the feasibility study being carried out".

"It's a done deal that we are going to have an East Asia Summit. People today were talking about what it should do and were no longer marvelling that it was happening."

AntiSpin: An aging, US-centric, dollar unilateral, modified WWII era global monetary system is about to go through its next stage of stress. When trade among large and fast growing Asian countries increases, relative dependence on US consumers for demand for their exports declines along with their incentive to finance US trade deficits via purchases of US financial assets. At an average annual growth rate of 7% versus 3% for the US, the $9 trillion Asian free trade area will catch up to the US in about 2013 at around $14 trillion. Demand for US debt will decline by 20% to 30% between now and then. The US does not have to do badly to create a crisis. All that needs to happen is for the rest of the world to continue doing well relative to the US.

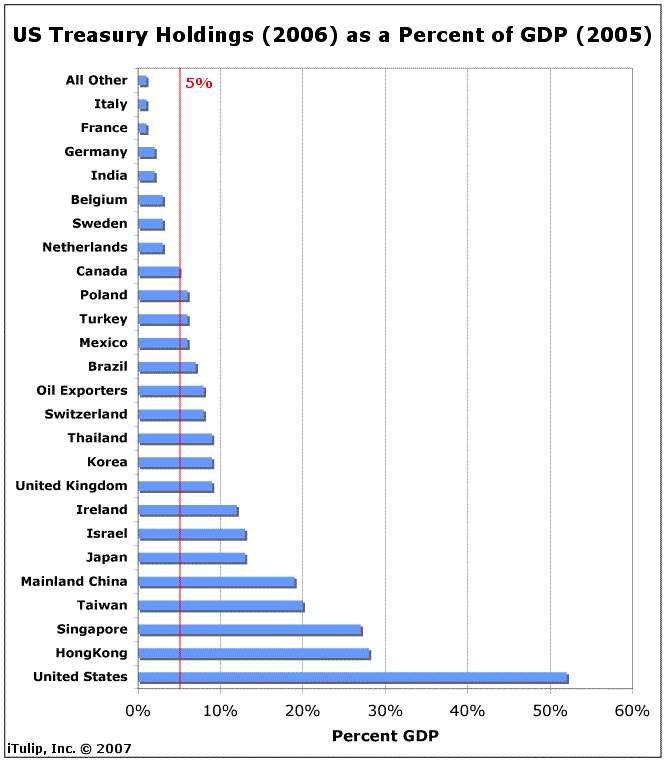

The US needs: imports made cheap by inexpensive non-US production export block labor–especially Asian–and low interest rates maintained by demand for US treasury and agency debt by the export block, foreign purchases of US treasury debt to finance deficit spending, and the demand for dollars created by the conversion of export block currencies to dollars to purchase dollar denominated assets.

Relative CPI inflation: traded versus non-traded goods

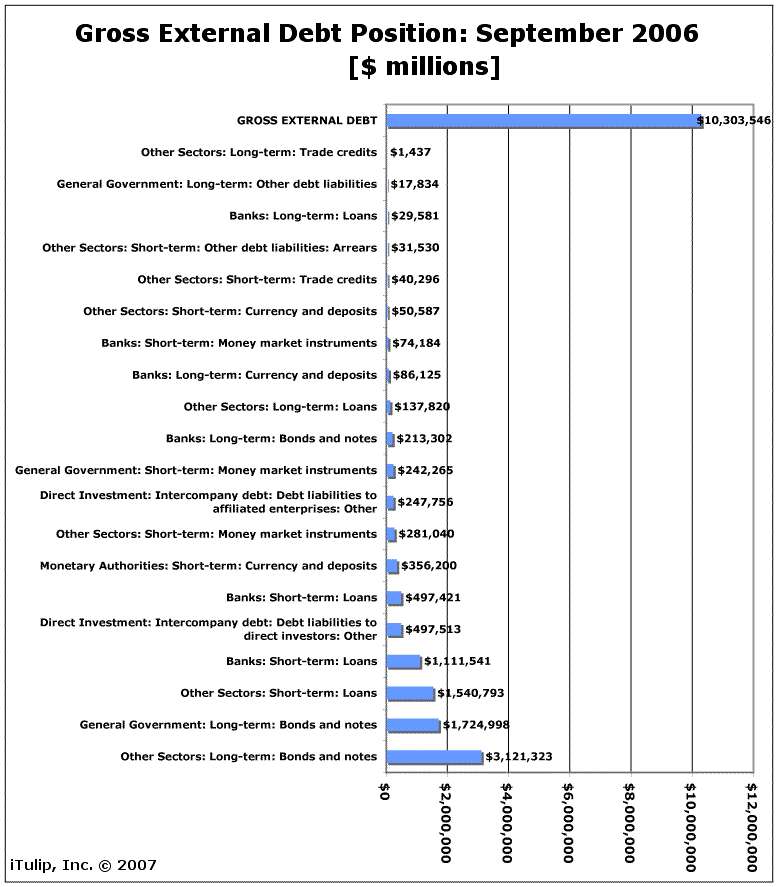

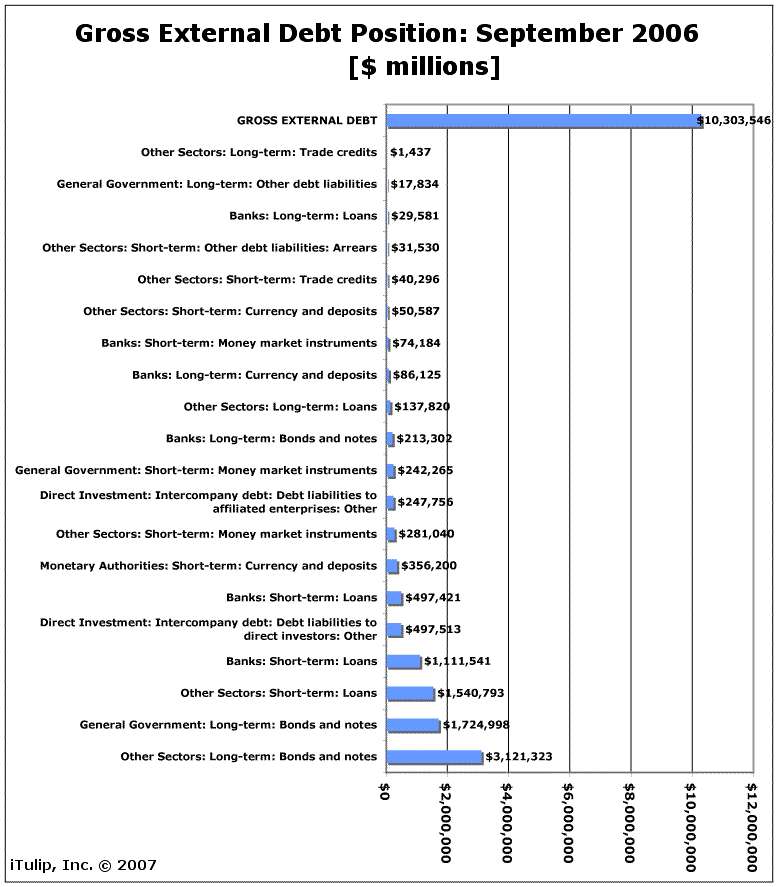

An economy with $12 trillion in annual output carries $10 trillion in external debt. Accountants among our

audience will appreciate the Treasury Department's creativity in labeling the largest line item figure on the

sheet, one that's nearly two times the size of the next largest item–$3.1 trillion–to "Other Sectors."

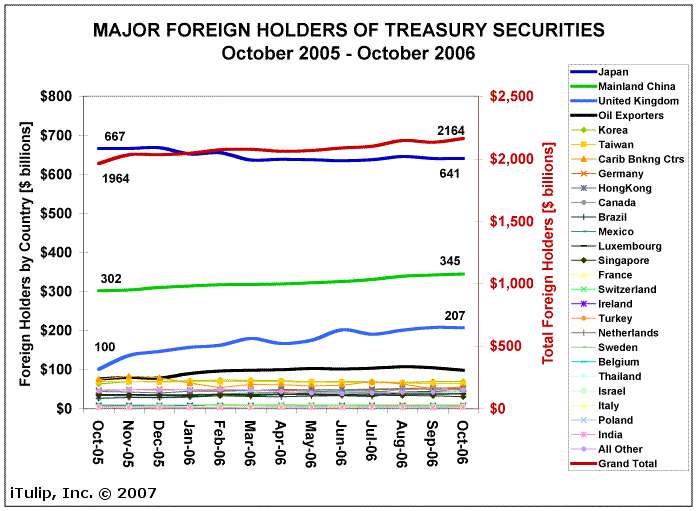

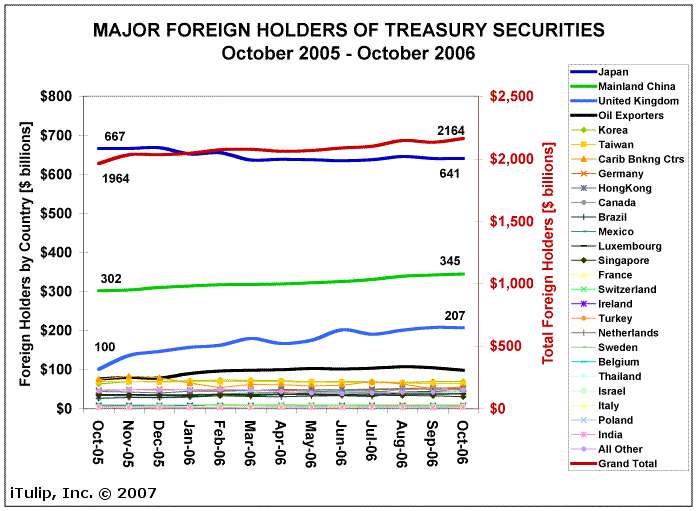

Of the $2.2 trillion in foreign owned Treasury securities outstanding, between Oct. 2005 and Oct. 2006

the UK doubled down, increasing their bet from $100 billion to $207 billion while China stepped in with

a 12% increase from $302 billion to $345 billion, perhaps not coincidentally only a few billion more

than Japan's 4% cut from $667 billion to $641 billion. An innocent could be forgiven for seeing in these

numbers the USA's partner in Iraq, the UK, helping the US avoid the pain of monetizing its own debt

to pay for th Iraq war, while China sends a message about limits to the Asian trade block's willingness

to vendor finance US consumption of Asian exports.

The relative increase in interdependence among export block nations and corresponding decrease in dependence on the US for demand creates three inflationary biases in the US economy.

Inflation Bias #1: Without cheap imports to balance rising non-traded goods and services inflation, net CPI inflation may rise in the US.

Inflation Bias #2: With less foreign demand for US debt, the US needs to purchase the treasury debt created to pay for government spending, especially the wars in Afghanistan and Iraq. The US monetized its own debt during the Vietnam War, resulting in 36% inflation over six years.

Inflation Bias #3: Without foreign purchases of US debt, the demand for dollars to pay for foreign purchases of US debt will decline. The dollar will depreciate as a result, requiring more dollars to pay for imports, especially oil.

The US can choose to, 1) reduce spending, 2) increase taxes, 3) inflate, or some combination of the three. This without any doomsday scenario, only a continuation of 30 year trends.

That's without a recession that lowers demand for imports. What if a US recession 2007/2008 occured to slow demand?

January 16, 2007 (The Australian)

AUSTRALIA would join a free trade zone of 16 Asian and Pacific nations under a plan for a landmark East Asia economic bloc being pushed by Japan.

The free trade area - stretching from Japan to China, India, Southeast Asia, Australia and New Zealand - would cover almost half of the world's population, three billion people, with an economic output of $9 trillion.

Speaking at the East Asia Summit in The Philippines yesterday, John Howard said the Japanese idea of an East Asia free trade bloc, which would rival the European Union and the North American Free Trade Agreement, was discussed at the meeting and that Australia "supports the feasibility study being carried out".

"It's a done deal that we are going to have an East Asia Summit. People today were talking about what it should do and were no longer marvelling that it was happening."

AntiSpin: An aging, US-centric, dollar unilateral, modified WWII era global monetary system is about to go through its next stage of stress. When trade among large and fast growing Asian countries increases, relative dependence on US consumers for demand for their exports declines along with their incentive to finance US trade deficits via purchases of US financial assets. At an average annual growth rate of 7% versus 3% for the US, the $9 trillion Asian free trade area will catch up to the US in about 2013 at around $14 trillion. Demand for US debt will decline by 20% to 30% between now and then. The US does not have to do badly to create a crisis. All that needs to happen is for the rest of the world to continue doing well relative to the US.

The US needs: imports made cheap by inexpensive non-US production export block labor–especially Asian–and low interest rates maintained by demand for US treasury and agency debt by the export block, foreign purchases of US treasury debt to finance deficit spending, and the demand for dollars created by the conversion of export block currencies to dollars to purchase dollar denominated assets.

Relative CPI inflation: traded versus non-traded goods

An economy with $12 trillion in annual output carries $10 trillion in external debt. Accountants among our

audience will appreciate the Treasury Department's creativity in labeling the largest line item figure on the

sheet, one that's nearly two times the size of the next largest item–$3.1 trillion–to "Other Sectors."

Of the $2.2 trillion in foreign owned Treasury securities outstanding, between Oct. 2005 and Oct. 2006

the UK doubled down, increasing their bet from $100 billion to $207 billion while China stepped in with

a 12% increase from $302 billion to $345 billion, perhaps not coincidentally only a few billion more

than Japan's 4% cut from $667 billion to $641 billion. An innocent could be forgiven for seeing in these

numbers the USA's partner in Iraq, the UK, helping the US avoid the pain of monetizing its own debt

to pay for th Iraq war, while China sends a message about limits to the Asian trade block's willingness

to vendor finance US consumption of Asian exports.

Inflation Bias #1: Without cheap imports to balance rising non-traded goods and services inflation, net CPI inflation may rise in the US.

Inflation Bias #2: With less foreign demand for US debt, the US needs to purchase the treasury debt created to pay for government spending, especially the wars in Afghanistan and Iraq. The US monetized its own debt during the Vietnam War, resulting in 36% inflation over six years.

Inflation Bias #3: Without foreign purchases of US debt, the demand for dollars to pay for foreign purchases of US debt will decline. The dollar will depreciate as a result, requiring more dollars to pay for imports, especially oil.

The US can choose to, 1) reduce spending, 2) increase taxes, 3) inflate, or some combination of the three. This without any doomsday scenario, only a continuation of 30 year trends.

That's without a recession that lowers demand for imports. What if a US recession 2007/2008 occured to slow demand?

Comment