Buyers vs. homesellers: Standoff could lead to recession

January 11, 2007 (Scott Van Voorhis - Boston Herald)

How bad is the real estate market?

At a national conference today, Wellesley College housing guru Karl Case will release the results of a five-month groundbreaking survey of the housing market in Boston’s suburbs.

And it’s not happy reading.

After tracking 628 homes on the market from July through November, Case found that fewer than a third actually sold.

It paints a picture of a market nearing a standstill, in which would-be sellers are opting to take their homes off the market rather than accept big markdowns.

Over such a lengthy period, even in a slow market, one could expect 70 percent of these homes to have sold, Case estimates.

But Case’s study found only 30 percent moved.

AntiSpin: The picture that you see painted by the nine economists in Jane Burns' report "Can Anything Bring Down the Monthly Payment Consumer?" is one of mainstream economists who are less willing to project a recession as a potential outcome of the collapse of the housing bubble. But Karl Case, who knows real estate and wrote the book on macro economics–literally–says recession is a likely outcome. I agree.

The observation of "a market nearing a standstill" is of events catching up with a predictable process. If you're new here, read our prediction from January 2004 that explains how housing market bubbles end:

In case you don't know who Karl Case is, he none other that co-author of the seminal textbook on macro economics used at MIT and other pretty good schools, "Principles of Economics (7th Edition) (Case/Fair Economics 7e Series) by Karl E. Case, Ray C. Fair. For a mere $86.50, you can buy a copy used from Amazon. Go here to test yourself on your understanding of macro economics (it's the companion web site with an online study guide.)

by Karl E. Case, Ray C. Fair. For a mere $86.50, you can buy a copy used from Amazon. Go here to test yourself on your understanding of macro economics (it's the companion web site with an online study guide.)

Speaking of MIT, William C. Wheaton, Department of Economics, Center for Real Estate, MIT, and Gleb Nechayev, Vice President, Senior Economist, Torto Wheaton Research, Boston MA, issued a report titled: "Past Housing 'Cycles' and the Current Housing 'Boom': What’s Different This Time?" PDF

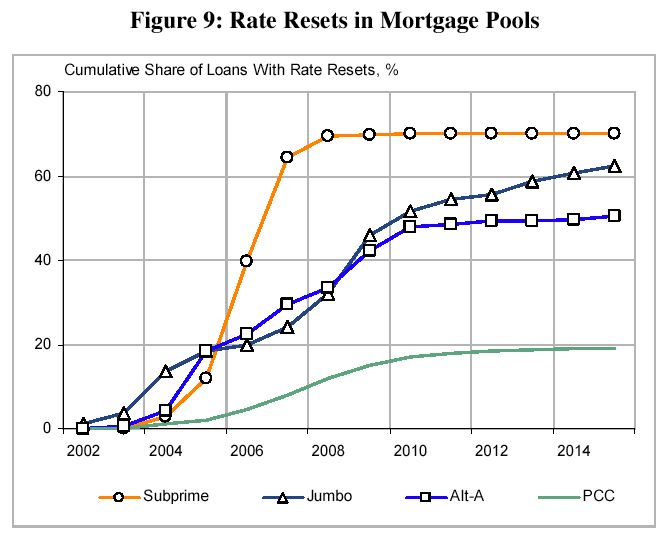

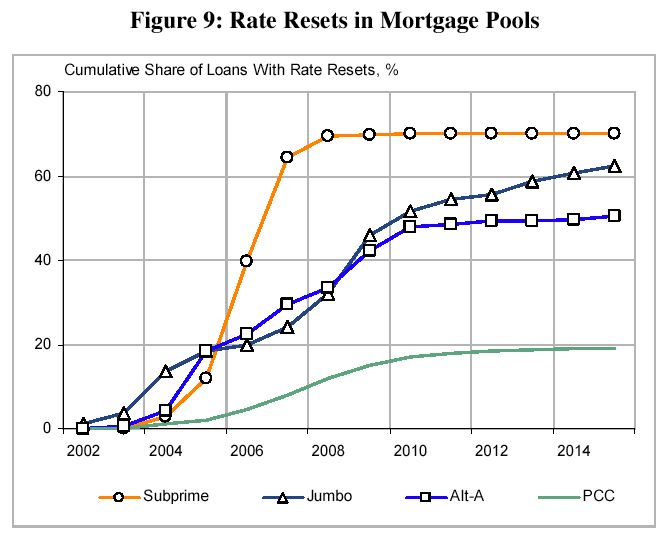

I hope no one is surprised by the political outcome when 70% of the sub-prime loans that are ARMs reset before the 2008 elections.

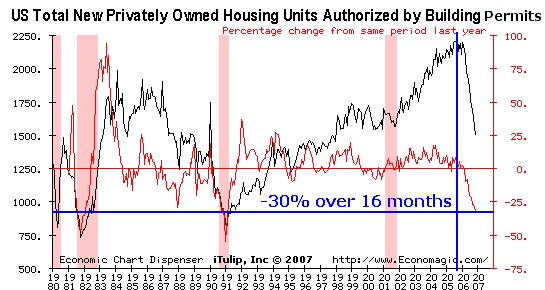

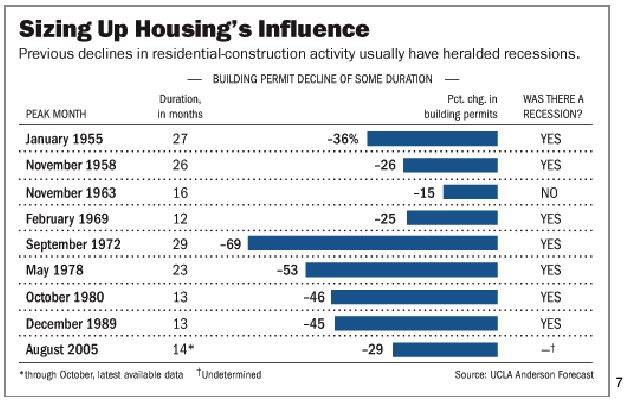

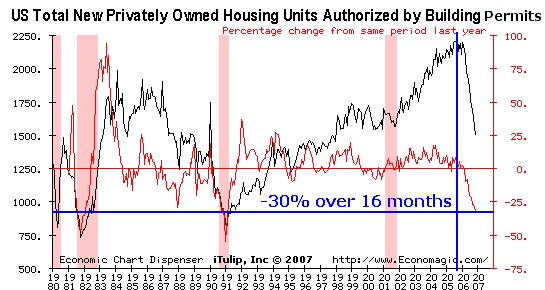

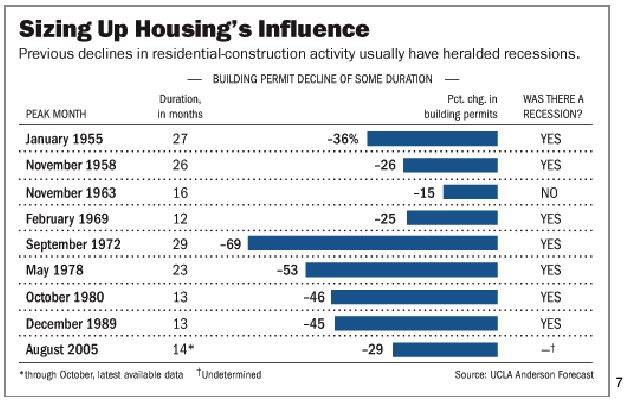

The correlation between major declines housing permits and recession is unmistakable.

Permits down 30% over previous period as of January 2007.

The last two recessions before the tech bubble collapse recession

started after permits declined 20% from the previous period.

The current instance of a veritable collapse in housing permits issuance is without precedent; usually the decline is more choppy. Given the evidence, it's surprising that mainstream economists haven't arrived at a consensus forecast for recession more in line with Case's and Wheaton's position.

January 11, 2007 (Scott Van Voorhis - Boston Herald)

How bad is the real estate market?

At a national conference today, Wellesley College housing guru Karl Case will release the results of a five-month groundbreaking survey of the housing market in Boston’s suburbs.

And it’s not happy reading.

After tracking 628 homes on the market from July through November, Case found that fewer than a third actually sold.

It paints a picture of a market nearing a standstill, in which would-be sellers are opting to take their homes off the market rather than accept big markdowns.

Over such a lengthy period, even in a slow market, one could expect 70 percent of these homes to have sold, Case estimates.

But Case’s study found only 30 percent moved.

AntiSpin: The picture that you see painted by the nine economists in Jane Burns' report "Can Anything Bring Down the Monthly Payment Consumer?" is one of mainstream economists who are less willing to project a recession as a potential outcome of the collapse of the housing bubble. But Karl Case, who knows real estate and wrote the book on macro economics–literally–says recession is a likely outcome. I agree.

The observation of "a market nearing a standstill" is of events catching up with a predictable process. If you're new here, read our prediction from January 2004 that explains how housing market bubbles end:

Unlike stock market bubbles, real estate bubbles don't pop. Collapsing stock market bubbles are characterized by a sudden collapse in prices because stock markets are highly liquid. You see huge volumes of transactions at ever lower prices during a stock market collapse. Collapsing housing bubbles, on the other hand, are characterized by illiquidity, a sudden collapse in transactions. Buyers and sellers seem to disappear.

To see where things go from here, see our reversion to the mean forecast from January 2005.In case you don't know who Karl Case is, he none other that co-author of the seminal textbook on macro economics used at MIT and other pretty good schools, "Principles of Economics (7th Edition) (Case/Fair Economics 7e Series)

Speaking of MIT, William C. Wheaton, Department of Economics, Center for Real Estate, MIT, and Gleb Nechayev, Vice President, Senior Economist, Torto Wheaton Research, Boston MA, issued a report titled: "Past Housing 'Cycles' and the Current Housing 'Boom': What’s Different This Time?" PDF

Abstract

This paper examines the historic cyclic movement in house prices since 1975. Past swings in home prices have been largely a result of economic recessions. The exception is the 2001 recession caused by a plunging stock market wherein the Fed loosened credit, rather than fighting inflation with tight credit. Home prices have soared since then, while income, job, and rent growth were slow to recover.

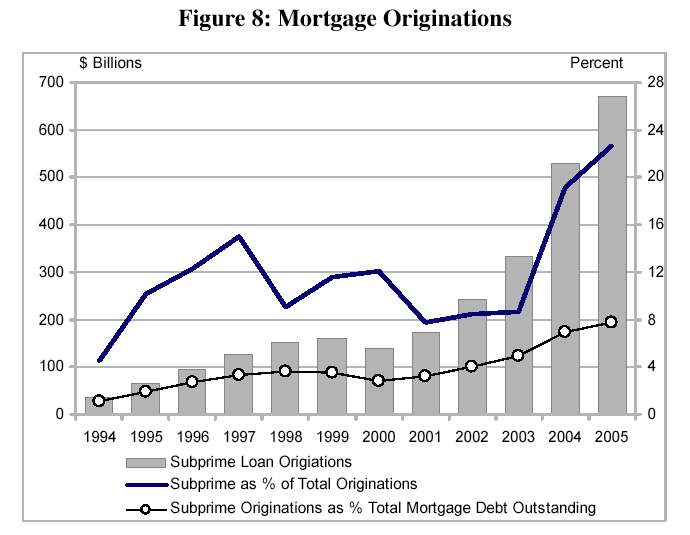

We show that incorporating all the actual movements in economic variables (including mortgage rates), forecasts made back in 1998 completely fail to capture the recent rise in prices. The current housing market however has been subjected to two "shocks" not seen previously. The emergence of an active sub-prime lending market has raised the homeownership rate nationally to historic highs. In a state cross-section we show that recent increases in homeownership correlate strongly with increases in Price/rent ratios.

Secondly, households have been purchasing homes as a "2nd" residence or for "investment" at record rates. In 2005 total housing production exceeded household formation by 60%! Again using a cross section, we show that markets where this has been on the rise are also experiencing greater price inflation. These new factors are "outside" of model forecasts and hence a cause for concern. Going forward, rising interest rates could both reduce homeownership and cause a more sudden exodus from the 2nd home investment market. These changes would cause prices to correct more severely than in the past.

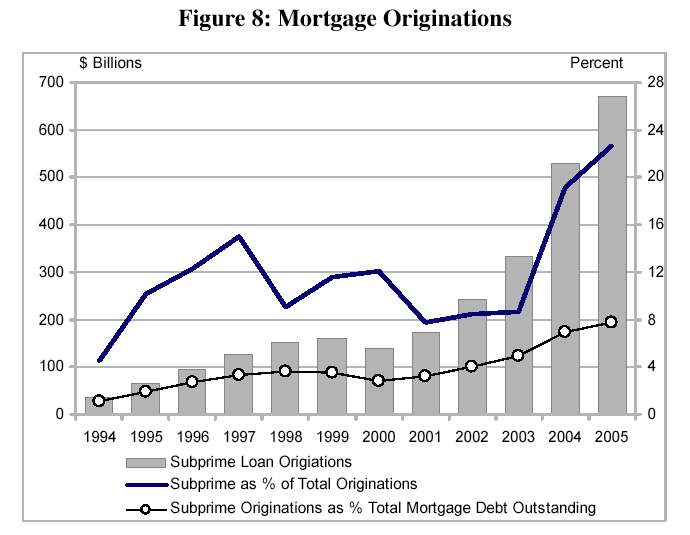

The report shows how much lenders have depended on sub-prime loans to grow their business.This paper examines the historic cyclic movement in house prices since 1975. Past swings in home prices have been largely a result of economic recessions. The exception is the 2001 recession caused by a plunging stock market wherein the Fed loosened credit, rather than fighting inflation with tight credit. Home prices have soared since then, while income, job, and rent growth were slow to recover.

We show that incorporating all the actual movements in economic variables (including mortgage rates), forecasts made back in 1998 completely fail to capture the recent rise in prices. The current housing market however has been subjected to two "shocks" not seen previously. The emergence of an active sub-prime lending market has raised the homeownership rate nationally to historic highs. In a state cross-section we show that recent increases in homeownership correlate strongly with increases in Price/rent ratios.

Secondly, households have been purchasing homes as a "2nd" residence or for "investment" at record rates. In 2005 total housing production exceeded household formation by 60%! Again using a cross section, we show that markets where this has been on the rise are also experiencing greater price inflation. These new factors are "outside" of model forecasts and hence a cause for concern. Going forward, rising interest rates could both reduce homeownership and cause a more sudden exodus from the 2nd home investment market. These changes would cause prices to correct more severely than in the past.

I hope no one is surprised by the political outcome when 70% of the sub-prime loans that are ARMs reset before the 2008 elections.

The correlation between major declines housing permits and recession is unmistakable.

Permits down 30% over previous period as of January 2007.

The last two recessions before the tech bubble collapse recession

started after permits declined 20% from the previous period.

The current instance of a veritable collapse in housing permits issuance is without precedent; usually the decline is more choppy. Given the evidence, it's surprising that mainstream economists haven't arrived at a consensus forecast for recession more in line with Case's and Wheaton's position.