Dow, Nasdaq Slide on Fed Rate Concerns (Update 1)

January 5, 11:35 am ET (Madlen Read, AP Business Writer)

Dow, Nasdaq Fall in Midmorning Trading As Investors See Hopes for Interest Rate Cut Dwindling

NEW YORK (AP) -- A surprising surge in job creation and wages sent stock and Treasury prices falling Friday as investors saw their hopes for an interest rate cut dwindle.

The markets shuddered at the Labor Department's report that U.S. employers increased their payrolls by 167,000 in December and boosted workers' hourly wages by 0.5 percent. The unemployment rate, meanwhile, held steady at a historically low 4.5 percent.

AntiSpin: More jobs! Better pay! Boooo!

There's nothing like a bit of good news to send Wall Street into a frenzy of selling. That, of course, is because the one element of inflation that the Fed really cares about is wages. They clearly don't care about all-goods inflation and really, really don't care about asset inflation. But they watch wage inflation like, well, inflation hawks, because it is via wages that price increases are transmitted through the economy. If you can hold down wage rates, you can keep inflation where it belongs, on the balance sheets of Wall Street firms and the bank accounts of oil producers.

Note that with this Daily News we are making a modest change to the format. Daily News will be updated several times a day on days when the markets are volatile, indicated as Update 1, Update 2, etc.

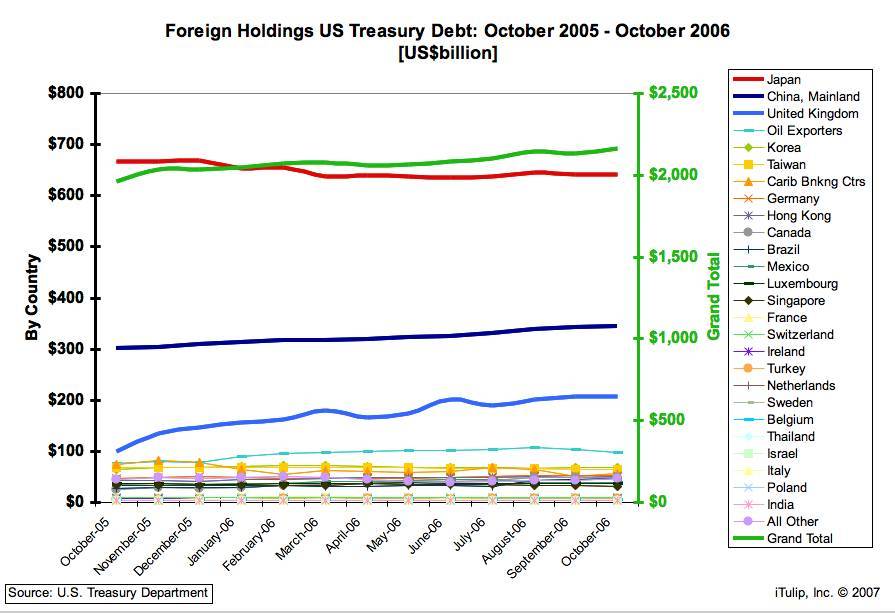

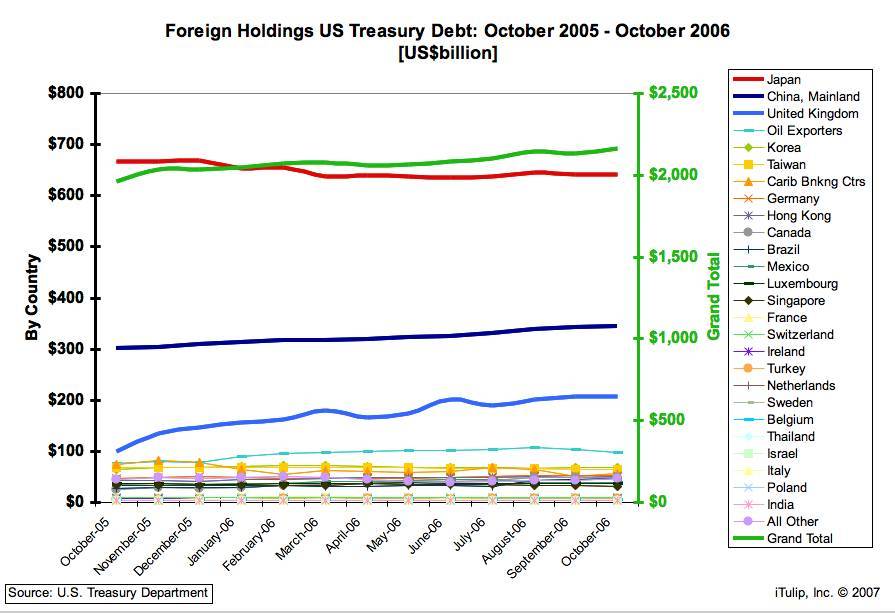

One of the measures of stress on the U.S. economy and its markets that we will track closely this year is foreign holdings of U.S. treasury debt. The challenges are concentration...

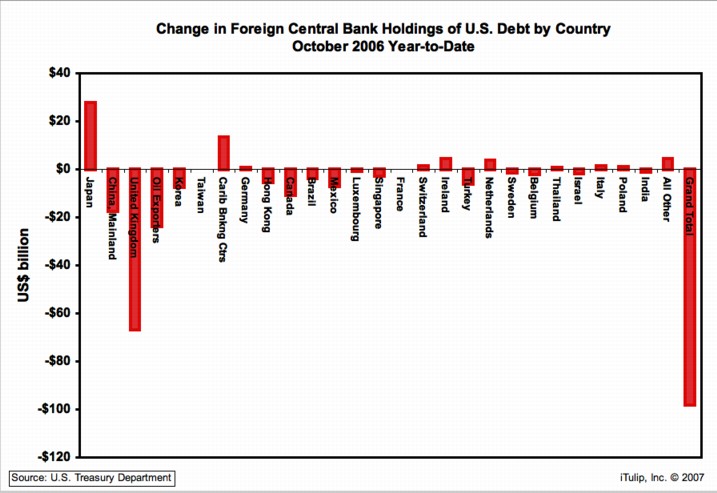

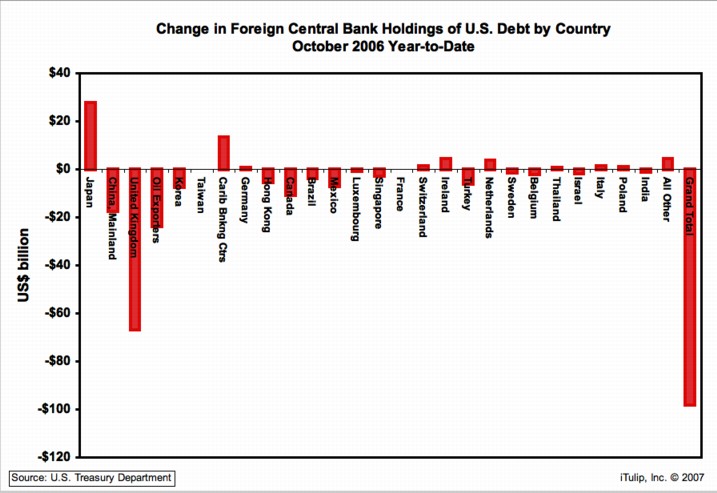

...and a decline of $100 billion in holdings from Oct. 2005 to Oct. 2006, the latest reporting period...

Two of the Big Three were down, with Japan and Caribbean Banking Centers–and the mystery buyers there–stepping in to fill some of the gap. Without their help, the reduction in total holdings for the period would have been closer to $140 billion. This can't be making Paulson's sleep any better. A couple of extra jars of Ambien for him, please.

_____

Stocks Fall on Interest Rate Concerns

January 5, 4:46 pm ET (Madlen Read, AP Business)

Stocks Fall on Interest Rate Concerns After Labor Department Reports Gains in Jobs, Wages

NEW YORK (AP) -- Wall Street and the Treasury market ended the first week of 2007 with sharp losses Friday after a surprising surge in new jobs and wages diminished investors' hopes for an interest rate cut.

The markets shuddered at the Labor Department's report that U.S. employers increased their payrolls by 167,000 in December and boosted workers' hourly wages by 0.5 percent. The unemployment rate, meanwhile, held steady at a historically low 4.5 percent.

The report suggests the economy won't be slowing as much as investors anticipated -- news that should prove positive for stocks in the long-term, but which raised concerns Friday that the Federal Reserve might use it as a reason to raise interest rates. A rise in rates could crimp consumer spending, and further weaken the housing market by making mortgages pricier.

At this point, though, economists see policy makers keeping rates steady.

"Until we get an uptick in the unemployment rate, in this environment the Fed will probably stay in a holding pattern," said Commonfund chief economist Michael Strauss, pointing to the slowing, but still expanding, economy. "Moderate economic growth is historically good for the equity market, not a bad thing," he said.

AntiSpin: So there you have it, the 2007 trading year in a nutshell. The markets are waiting for the Fed to cut, fearing that the Fed might drive the U.S. economy into a recession cycle. The Fed is waiting for an event that gives them a reason to cut rates, so they can do so without spooking the bond market. For example, Y2K in Q4 1999 was a good excuse. A few million dot com shareholders marking their post-crash technology stock portfolios to market Q3 2000 was another. But as I explain in my Recession 2007 prediction, housing bubbles don't deflate all at once. A home owner only marks his or her home to market when trying to get money out of it, by selling or refinancing. That happens over several years. Then there's the lag time between the awareness of a decline in home value and change in consumer behavior, usually about a year lag. That puts the housing decline-based recession in the latter part of 2007, and accelerating into 2008, an election year. Then there's the recession in what I call the OPM Sector, the hundreds of thousands professionals who are employed in the business of managing Other People's Money, especially Private Equity and Hedge Funds. Their ranks have grown faster than Federal government payrolls since 2001.

There's a school of thought that the Fed won't allow the economy to tank in an election year. Well, tell that to George Bush I while considering that with large obligations to Japan, China, and the UK, the Fed cannot cut rates without an event that is a clear and present forcing function, an event that lends urgency to the decision to change course. A few negative bits of economic news aren't going to do it, especially with cross-currents of good news coming in at the same time. Paradoxically, said urgent event is likely to be a market crash of some sort. I hope it's merely a stock not a bond market crash, although a hedge fund manager I talked to today seemed to think distress in some areas of the bond market, similar to the kind of pain we saw in the corporate bond market a few years ago, is inevitable. In fact, he has a large fund structured to make money off the event.

Gold investors didn't much like the economic news either, crashing from $625 to $609 in just four hours today. Our sponsor BullionVault had this to say about it:

Tomorrow, Saturday January 6, you can hear me interviewed by Jim Paplava over at the Financial Sense Newshour podcast, where Jim and I discuss these issues.

_____

For a macro-economic and geopolitical View from Europe see Europe LEAP/2020

For macro-economic and geopolitical currency ETF advisory services see Crooks on Currencies

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

January 5, 11:35 am ET (Madlen Read, AP Business Writer)

Dow, Nasdaq Fall in Midmorning Trading As Investors See Hopes for Interest Rate Cut Dwindling

NEW YORK (AP) -- A surprising surge in job creation and wages sent stock and Treasury prices falling Friday as investors saw their hopes for an interest rate cut dwindle.

The markets shuddered at the Labor Department's report that U.S. employers increased their payrolls by 167,000 in December and boosted workers' hourly wages by 0.5 percent. The unemployment rate, meanwhile, held steady at a historically low 4.5 percent.

AntiSpin: More jobs! Better pay! Boooo!

There's nothing like a bit of good news to send Wall Street into a frenzy of selling. That, of course, is because the one element of inflation that the Fed really cares about is wages. They clearly don't care about all-goods inflation and really, really don't care about asset inflation. But they watch wage inflation like, well, inflation hawks, because it is via wages that price increases are transmitted through the economy. If you can hold down wage rates, you can keep inflation where it belongs, on the balance sheets of Wall Street firms and the bank accounts of oil producers.

Note that with this Daily News we are making a modest change to the format. Daily News will be updated several times a day on days when the markets are volatile, indicated as Update 1, Update 2, etc.

One of the measures of stress on the U.S. economy and its markets that we will track closely this year is foreign holdings of U.S. treasury debt. The challenges are concentration...

...and a decline of $100 billion in holdings from Oct. 2005 to Oct. 2006, the latest reporting period...

Two of the Big Three were down, with Japan and Caribbean Banking Centers–and the mystery buyers there–stepping in to fill some of the gap. Without their help, the reduction in total holdings for the period would have been closer to $140 billion. This can't be making Paulson's sleep any better. A couple of extra jars of Ambien for him, please.

_____

Stocks Fall on Interest Rate Concerns

January 5, 4:46 pm ET (Madlen Read, AP Business)

Stocks Fall on Interest Rate Concerns After Labor Department Reports Gains in Jobs, Wages

NEW YORK (AP) -- Wall Street and the Treasury market ended the first week of 2007 with sharp losses Friday after a surprising surge in new jobs and wages diminished investors' hopes for an interest rate cut.

The markets shuddered at the Labor Department's report that U.S. employers increased their payrolls by 167,000 in December and boosted workers' hourly wages by 0.5 percent. The unemployment rate, meanwhile, held steady at a historically low 4.5 percent.

The report suggests the economy won't be slowing as much as investors anticipated -- news that should prove positive for stocks in the long-term, but which raised concerns Friday that the Federal Reserve might use it as a reason to raise interest rates. A rise in rates could crimp consumer spending, and further weaken the housing market by making mortgages pricier.

At this point, though, economists see policy makers keeping rates steady.

"Until we get an uptick in the unemployment rate, in this environment the Fed will probably stay in a holding pattern," said Commonfund chief economist Michael Strauss, pointing to the slowing, but still expanding, economy. "Moderate economic growth is historically good for the equity market, not a bad thing," he said.

AntiSpin: So there you have it, the 2007 trading year in a nutshell. The markets are waiting for the Fed to cut, fearing that the Fed might drive the U.S. economy into a recession cycle. The Fed is waiting for an event that gives them a reason to cut rates, so they can do so without spooking the bond market. For example, Y2K in Q4 1999 was a good excuse. A few million dot com shareholders marking their post-crash technology stock portfolios to market Q3 2000 was another. But as I explain in my Recession 2007 prediction, housing bubbles don't deflate all at once. A home owner only marks his or her home to market when trying to get money out of it, by selling or refinancing. That happens over several years. Then there's the lag time between the awareness of a decline in home value and change in consumer behavior, usually about a year lag. That puts the housing decline-based recession in the latter part of 2007, and accelerating into 2008, an election year. Then there's the recession in what I call the OPM Sector, the hundreds of thousands professionals who are employed in the business of managing Other People's Money, especially Private Equity and Hedge Funds. Their ranks have grown faster than Federal government payrolls since 2001.

There's a school of thought that the Fed won't allow the economy to tank in an election year. Well, tell that to George Bush I while considering that with large obligations to Japan, China, and the UK, the Fed cannot cut rates without an event that is a clear and present forcing function, an event that lends urgency to the decision to change course. A few negative bits of economic news aren't going to do it, especially with cross-currents of good news coming in at the same time. Paradoxically, said urgent event is likely to be a market crash of some sort. I hope it's merely a stock not a bond market crash, although a hedge fund manager I talked to today seemed to think distress in some areas of the bond market, similar to the kind of pain we saw in the corporate bond market a few years ago, is inevitable. In fact, he has a large fund structured to make money off the event.

Gold investors didn't much like the economic news either, crashing from $625 to $609 in just four hours today. Our sponsor BullionVault had this to say about it:

Gold sank in US trading after the much-anticipated US jobs report came in well ahead of Wall Street's expectations.

Gold dropped to $609 per ounce at the PM Fix in London. It was marked at $625 only four hours earlier. Technical analysts had cited $620 as key support.

"You're getting liquidation on the back of the strengthening Dollar," said Michael Guido, director of hedge-fund marketing at Societe Generale in New York to Bloomberg. "Obviously this number is a big surprise."

The Labor Dept. said at 13:30 GMT on Friday that the US economy added 167,000 jobs in Dec. Economists had been expecting nearer 100,000. The data also showed average US wages rising by 0.5% against 0.3% as expected.

A cut in US interest rates any time soon now looks unlikely – and that has sent the US Dollar higher across the board. But gold's sharp losses also extend to Sterling, Euro and Yen investors.

Gold has now lost nearly £10 per ounce for British investors. French and German buyers are offered a €13 discount from this time last week.

"Right now investors are cautious about stepping into gold given this week's Dollar strength," says David Holmes, director of precious metals sales at Dresdner Kleinwort in London. Yet retail investors are sticking with it, according to data from the gold ETFs.

Exchange Traded Gold says it's holding 18.142 million ounces of gold today, barely changed from last week after a 3.3% rise in volume during Dec.

So if it's not retail investors selling out, who's dumping gold? Gold has fallen $22 this week, a 3.5% drop. The US Dollar, meantime, has risen only 1.4% on a trade-weighted basis. And news earlier this week that a major European central bank bought gold – instead of selling it – at the end of Dec. has signally failed to support the market.

"For the clueless out there who still don’t understand," said an email to BullionVault on Thursday, "the gold market is managed by a Gold Cartel...Free markets do not trade this way."

Oh yeah? No one ever pretended the gold market was free or transparent. Central banks, after all, hold more gold than anyone else. Why act surprised if they try to rig prices?

Nor is gold a free ride to easy gains, either. Its volatility since the start of 2006 has wildly outstripped the volatility of US equities, for instance. And all this while, the global market turns over 1,500 tonnes every day or more.

If the world's central banks have indeed lent and loaned 3,000 tonnes into the market, as some conspiracists claim, they're up against a huge international market that's fragmented, volatile and opaque.

And whatever they might be up to in the spot market for gold, central bankers are doing all they can to send its price soaring in future.

Stocks down, bonds down, commodities down. Sure looks like market participants are expecting, as we overheard today, that the Fed is going to crash the economy if necessary in order to keep wage inflation from spooking U.S. creditors. We have been on the lookout for signs of the start of the All Assets Down move to cash, or "Ka" phase of "Ka-Poom." (We had a dry run mid-2006.) Before the Bubble Cycle replaced the Business Cycle, stocks, bonds, and commodities did not all rise and fall together. Now all assets are strongly correlated–and what goes correlated-up, must come correlated-down. Gold dropped to $609 per ounce at the PM Fix in London. It was marked at $625 only four hours earlier. Technical analysts had cited $620 as key support.

"You're getting liquidation on the back of the strengthening Dollar," said Michael Guido, director of hedge-fund marketing at Societe Generale in New York to Bloomberg. "Obviously this number is a big surprise."

The Labor Dept. said at 13:30 GMT on Friday that the US economy added 167,000 jobs in Dec. Economists had been expecting nearer 100,000. The data also showed average US wages rising by 0.5% against 0.3% as expected.

A cut in US interest rates any time soon now looks unlikely – and that has sent the US Dollar higher across the board. But gold's sharp losses also extend to Sterling, Euro and Yen investors.

Gold has now lost nearly £10 per ounce for British investors. French and German buyers are offered a €13 discount from this time last week.

"Right now investors are cautious about stepping into gold given this week's Dollar strength," says David Holmes, director of precious metals sales at Dresdner Kleinwort in London. Yet retail investors are sticking with it, according to data from the gold ETFs.

Exchange Traded Gold says it's holding 18.142 million ounces of gold today, barely changed from last week after a 3.3% rise in volume during Dec.

So if it's not retail investors selling out, who's dumping gold? Gold has fallen $22 this week, a 3.5% drop. The US Dollar, meantime, has risen only 1.4% on a trade-weighted basis. And news earlier this week that a major European central bank bought gold – instead of selling it – at the end of Dec. has signally failed to support the market.

"For the clueless out there who still don’t understand," said an email to BullionVault on Thursday, "the gold market is managed by a Gold Cartel...Free markets do not trade this way."

Oh yeah? No one ever pretended the gold market was free or transparent. Central banks, after all, hold more gold than anyone else. Why act surprised if they try to rig prices?

Nor is gold a free ride to easy gains, either. Its volatility since the start of 2006 has wildly outstripped the volatility of US equities, for instance. And all this while, the global market turns over 1,500 tonnes every day or more.

If the world's central banks have indeed lent and loaned 3,000 tonnes into the market, as some conspiracists claim, they're up against a huge international market that's fragmented, volatile and opaque.

And whatever they might be up to in the spot market for gold, central bankers are doing all they can to send its price soaring in future.

Tomorrow, Saturday January 6, you can hear me interviewed by Jim Paplava over at the Financial Sense Newshour podcast, where Jim and I discuss these issues.

_____

For a macro-economic and geopolitical View from Europe see Europe LEAP/2020

For macro-economic and geopolitical currency ETF advisory services see Crooks on Currencies

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment