|

by Eric Janszen, Jan. 2, 2009

2008? Let's just say the year did not go exactly as planned for most, but much as we expected. So much happened that if we tried to say it in words we'd need 33,000. We use 33 pictures instead to cover the year and make our 2009 forecast on the markets and economy.

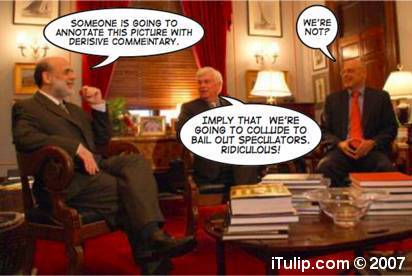

The Fed's reputation for mastery over the economy via carefully crafted monetary policy grew for decades since the hard nosed Paul Volcker Fed rescued the institution from the ignominious tenure of George Burns under the thumb of the Nixon administration. It came apart in 2008 as the Bernanke Fed tried this and tried that when one circuit after another blew in the US credit markets and banking system. The Greenspan Fed was managed for 18 years by decisions guided in principle, but not practice, that markets know best. In practice, under the Greenspan Fed the most knowing markets are those of an economy and government run by banks. The accumulation of error and fraud over that period then fell on Bernanke's shoulders.

Running the Fed after Greenspan was a goat job, a surefire loser. We can only speculate as to why Bernanke took it. Savior complex? Delusions of grandeur? A bit of both?

But we're getting ahead of ourselves. We review 2008 in pictures we created to go along with our analysis and use these as jumping off points for our 2009 forecasts, starting with our depiction of investing hero Warren Buffett.

We thought Warren wasn't seeing things quite as clearly as he might have from a macro-economic standpoint. His rosy outlook contradicted ours. Not surprisingly, he lost money in 2008. In an article in the latest Barron's Magazine Joe Queenan opines in "A Bull Market in Lies":

INDEED, THERE IS SOMETHING ALMOST HEROIC about the sight of an entire nation's populace stepping forward to admit they have been annihilated by the recession. That's why those newspaper articles discussing the market losses of Buffett and Gates and Ellison are so uplifting. Some of us lost a few hundred thousand clams here and there, but those poor clowns lost billions. That's gotta take some of the sting out of it for the rest of us.

|

We got out of the stock market back when iTulip opened shop in 1998 when the buy and hold stock market died (see Debt Deflation Bear Market Update Part I: 2009 Windup). Our reasoning? A stock market run like a casino that demands investors posses the skills of a professional forensic accountant to make sound short term investment decisions is not for us. Further, with stock prices primarily driven long term by the forces of asset price inflation, as can be witnessed in our Real DOW section since early 2006, an ugly reversion to the mean was inevitable. As you can see from the graphs there, it isn't over.

When the market crashed on schedule per the Debt Deflation Bear Market forecast in 2008, the SEC responded by rounding up the usual suspects, "speculators" and "short sellers," just as in early 1930.

Toward the end of year the uncle of a woman who worked at the Fed let it be known that he'd bilked investors, allegedly, out of billions of dollars in what he described as a Ponzi scheme. His name? Bernard Madoff. Who will round up the regulators?

October 2006 we forecast a recession to start Q4 2007. Finally, after the recession had been on for a year in November 2008 the NBER confirmed it.

Recession, standard version

Recession, iTulip parody version

That's how the recession started back when we wrote the Dual Cycles of Demand Destruction and the Economic Face Plant. Since then the inflationary impact of a weak dollar has backed off, and the demand destruction from rising unemployment, falling incomes and access to credit has intensified.

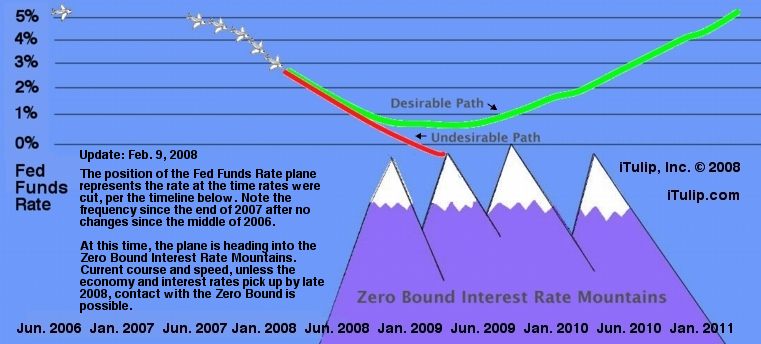

The stock market crash is not the only predictable development in the recession and debt deflation. The Fed's race to zero interest rates was depicted in the image below of the Fed's Funds Rate Airplane and its proximity to the Zero Bound Interest Rate Mountains from an article we published February 2008. Each position of the plane corresponds to a rate cut.

We forecast the Fed to reach what we called the Zero Bound Interest Rate Mountains between January and June 2009. This turned out to be optimistic. As of December 15, 2008 the Fed discontinued the Fed Funds Target Rate series started on September 27, 1982 and replaced it with two new series that establish upper and lower target bounds.

In early fall 2008 when the global credit markets began to break down, the Effective Fed Funds Rate (orange line) stopped cooperating with Fed efforts to meet its 2% target through open market operations. After two rate cuts to 1% the effective rate never reached more than half the target (green line). So on December 15, 2008 the Fed dumped the old series after 26 years and replaced it December 16, 2008 with two new ones: one upper bound (red line) and another lower bound (blue line) Fed Funds Target. These just happen to be the range that the market had already set for the Fed Funds Rate before the switcheroo, between zero and 0.25%.

We are reminded of the famous Pee-wee Herman line in his 1985 film "Pee-Wee's Big Adventure" after he fell off his bicycle: "Hee, hee! I meant to do that!" If anyone had any illusion that the Fed had any significant influence over the money markets via cost of money after rates were lowered to 2%, by now they are gone. We figured back in February that the Fed was due to switch to a strategy of managing the quantity of money after 2%, and that appears to be what happened (see Zero Bound Diaries: Is Bernanke Volcker's Mirror Image?). That leads us to make the following update to our ZIRP Mountains trajectory.

We expect more Pee-wee Herman Fed adventures in 2009 but rather than being scripted by Hollywood writers, the Fed will continue to ad lib off the Fed's Deflation Playbook that we first presented to readers in April 2006.

Written in 2003, the playbook outlines a number of radical monetary measures that the Fed might take if by some odd confluence of unlikely factors, risk of an actual deflation spiral appeared. All of the items on the "Making sure it doesn't happen here" checklist have so far been checked and then some.

The Fed's latest gambit is printing money without a corresponding issuance of new debt, that is, true debt monetization.

The MBS purchases are significant; for the first time they turn the Fed into a direct lender to consumers. Many homeowners, though they do not know it, will be sending their monthly mortgage payments to the Fed. The Fed will finance these programmes with newly created reserves: that is, it will print money. Its balance-sheet, which has ballooned from $900 billion to $2.2 trillion since August, could grow by another $800 billion, making it a larger lender than any commercial bank. - The Economist, Plan C, Nov. 27, 2008

In 2008, the Fed continued to confound the forecasts of anyone who believed in the inevitability of a deflation spiral in the US as the inexorable outcome of the 1980 to 2007 credit bubble that grew during the FIRE Economy era. They contended that there are statutory limits to poiu8iuthe Fed's and Treasury's largess. Our contention is that there are no rules, no limits, and even those that do exist will be thrown out the window to expedite a desperate attempt at asset price reflation. The Fed provided a perfect Nth example in the bailout last week of GM financing arm GMAC. We have long contended that GM is a bank that makes cars. GM's 10-K filed 2/28/2008 reads:

A significant proportion of GMAC’s revenues and profits in recent years came from originating, servicing and securitizing residential mortgages, including subprime loans. In 2007 the real estate market in the United States declined significantly, with falling residential sales, decreased housing construction and rising rates of defaults and foreclosures. GMAC’s revenues and profits have been adversely affected by this decline, particularly at its residential mortgage subsidiary Residential Capital LLC (ResCap). GMAC had a net loss of $2.3 billion in 2007, compared to net income of $2.1 billion in 2006. ResCap’s 2006 net income of $705 million decreased in 2007 to a net loss of $4.3 billion, and in the third quarter of 2007, GMAC recognized an impairment loss of $455 million. Our consolidated financial results have been adversely affected by this decline in GMAC’s revenues and profits. For the year ended December 31, 2007, GMAC’s consolidated mortgage servicing fee income was approximately $2.2 billion.

The Wall Street Journal wrote yesterday that the Fed stipulated that GMAC raise $30 billion to meet the capital requirements to be anointed a bank-holding company by the Fed eligible for Treasury bailout funds. GMAC was apparently unable to do so but the Fed granted bank-holding company status on December 24 anyway. Whatever. If you found the 2008 no-rules for FIRE Economy players policy disconcerting, gird yourself for outright chaos in 2009. Every possible effort will be made to attempt to stop the process of debt deflation.

The inflation/deflation debate continued in 2008 with some deflation spiral forecasters declaring victory as asset prices deflated, the dollar surged, commodity prices fell, and all bonds crashed except US Treasuries in the latter half of the year. But this development is also consistent with Ka-Poom Theory, that defines a period of disinflation after a credit driven asset bubble pops, followed by inflation when the Fed at last succeeds all too well in countering it. Tired of playing deflation whack-a-mole with market commentators who do not distinguish between asset price deflation in the FIRE Economy and all-goods and wages price deflation in the Productive Economy, we published Ka-Poom Theory deflation-inflation two-step to tamp down the little guys that pop up to shout "Deflation spiral!" every time the dollar spikes or the price of a haircut or gallon of gasoline falls.

Hat tip to iTuliper GRG for calling our attention to our friend Jesse's post: Must-Have Titles for the Deflation Section of Your Financial Library:

- Deflation by A. Gary Shilling (Paperback - 2002)

- Deflation: How to Survive and Thrive in the Coming Wave of Deflation by A. Gary Shilling (Paperback - 1999)

- Deflation: Why It's Coming, Whether It's Good or Bad, and How It Will Affect Your Investments, Business, and Personal Affairs by A. Gary Shilling, 1998

- After the Crash : Recession or Depression : Business and Investment Stategies for a Deflationary World by A. Gary Shilling (Paperback - Mar 1988)

- The World Has Definitely Changed by A. Gary Shilling ( Hardcover - 1986)

- Is Inflation Ending: Are You Ready? A Sober Look At the Prospects for a Decline in Inflation by A. Gary Shilling and Kiril Sokoloff (Hardcover - Mar 1983)

Shilling didn't know it but he was documenting the unique disinflationary period of the birth and development of the FIRE Economy, born in 1980 and R.I.P. 2009. In a similar vein, current deflation commentators are inadvertently mistaking the disinflationary end of the FIRE Economy with the beginning of a deflation spiral ala 1930 to 1933.

Ultimately, from a monetary management standpoint, the Fed will get its inflation, but toward the end of 2009 from the goods supply side of the pricing equation a la 1975 rather than the asset price re-inflation as it prefers. At the same time, the dollar has resumed its downward trend after a massive spike of panic buying of Treasury bonds by holders of assets denominated in other currencies, except yen. That process appears to be coming to an end earlier than expected. In fact, one thing we can say categorically about all of our forecasts in 2008 is that processes that typically take years or months were compressed to months and weeks. Does this mean that the credit markets, banks, and the economy might recover as quickly in 2009 as they collapsed in 2008 once the markets and economy stabilize? No. Only the acute phase of the credit crisis appears rapid. The US and global economy have been getting into this trouble for more than 20 years and will not get out of it quickly.

The Fed's heroic effort in 2008 to reflate the US banking system via increased reserves will in our opinion continue to fail.

Total Reserves = Required reserves plus excess reserves

- Required Reserves = Deposits X Reserve Requirement

- Excess Reserves = Total Reserves - Required Reserves

We agree with TIME Magazine’s take on why the Fed's attempts to get the banking system moving again are failing.

It is true that the Great Depression of the 1930s was a crisis of liquidity. Stocks plunged, banks went under, and the value of assets disintegrated. Our current policies would have been appropriate in the Great Depression, but they are not appropriate now. Liquidity problems are not the source of our current financial and economic woes. Incredibly, excess reserves of depository institutions have increased from under $2 billion in August to a record $774 billion in mid-December, according to the Federal Reserve's Dec. 18 release. But the banks have not taken advantage of this liquidity to increase their lending.

Why not? Because what we have is not a crisis of liquidity but rather a crisis of confidence. With tremendous excess reserves, it is obviously not the case that banks are not lending money because they do not have the money to loan. Instead, they are afraid that other institutions, including other banks, will not pay it back. The banks do not have confidence in each other. - TIME Magazine, Fighting the Last Depression: The Fed's Policy Errors, Dec. 30, 2008

The Fed is not addressing the crux of the issue: Bank X with crud loans on its balance sheet won't lend to Bank Y with equally cruddy loans on its balance sheet. The crud is proportionate to the credit default swaps purchased to insure against defaults on the bad loans. The largest banks have the largest proportion of credit default swaps, medium sized banks less, small banks hardly any at all.Why not? Because what we have is not a crisis of liquidity but rather a crisis of confidence. With tremendous excess reserves, it is obviously not the case that banks are not lending money because they do not have the money to loan. Instead, they are afraid that other institutions, including other banks, will not pay it back. The banks do not have confidence in each other. - TIME Magazine, Fighting the Last Depression: The Fed's Policy Errors, Dec. 30, 2008

The TIME writer does not propose a solution. Here's ours. If the market won't clear on its own, the Fed will have to clear if for them. The Fed did this with the banking system as a whole in 1934 and with the S&Ls in the late 1980s. How about this solution broken down into three steps:

We have no idea how this conundrum will work out in 2009 but suffice it to say that continuing the same program of adding excess reserves until the cows come home will not work any better this year than it did last year. The largest banks in the US banking system will at some point have to be toaster-reset, as they say in the computer business -- a phrase that refers to the practice of unplugging and plugging back in a computer that is not responding to traditional operator efforts to restart it. When that happens, expect sparks to fly. We do not believe this eventuality is yet priced into the markets.

Another unfortunately predictable event in 2008 was the complete collapse of the wider credit market due to widespread credit market risk pollution by toxic debt as we warned about in early 2006.

The combination of money running away from corporate bond default risk; risk in securities denominated in rubles, rupees, pesos, and everything but yen and dollars; a predictable run on hedge funds; and widespread avoidance of the mundane bank savings or money market account; these factors all together have driven trillions into "safe" US government Treasury bonds in a short period producing what many have termed a "Treasury bond bubble." Same deal in 1930 debt deflation. The question is, what will dislodge the bond hoarders this time? Will the government pull another drastic 1934 style maneuver to crash the bond market with a radical currency depreciation? We don't think so. We think the central banks of US trade partners will do it for us, first by not buying more Treasuries, which with that market being dependent on continuous inflows will in and of itself weaken prices, perhaps leading to a run in the manner of all bubbles. Subscribers will note that we have not issued a "Time at last to short US Treasuries" call yet in the manner of our December 2007 "Time at last to short stocks" and June 2008 "Time at last to short commercial real estate." We're keeping an eye on it, but we're not there yet. When it does happen it will be decided by a currency-related event, as in 1934.

To complicate the issue, the eventual end of the love affair with Treasuries will be more politically than market driven. Let's review the characters involved.

Bernanke was hired by the Bush White House in 2005, billed as a scholar of the Great Depression. His "What Me Worry?" approach early in the credit debacle did not instill confidence in those of us who understood the gravity of the crisis. It meant that either Bernanke didn't understand what he'd gotten himself into or that he was overestimating his ability to manage the crisis. In either case, Bernanke was an easy short in 2008.

Predictably, the Fed chairman's job quickly turned into what we call a "goat rodeo."

There was nothing he could do to undo decades of errors, so everything he did or didn't do drew criticism. He was criticized for acting too slowly, too quickly, for not acting at all, or for acting when he should do nothing. He made a fine target, and the whooping and hollering across the financial press and blogosphere was a major source of entertainment in 2008. We doubt he was having as much fun. Notice how we refer to him in the past tense?

Running the Fed through a depression is not a long term gig. Our forecast is that Bernanke is the Eugene Meyer of our modern debt deflation era. Meyer's September 16, 1930 to May 10, 1933 stint ended when the White House turned over; we expect that Bernanke will be sent packing in 2009.

The signature character of the 2008 financial crisis drama was Henry Paulson. The best quote on Paulson all year came out of Larry Lindsey in a Robert Novak article. Commenting on Paulson's efforts to sell Fannie Mae and Freddie Mac bonds:

Financial consultant Lawrence Lindsey, President Bush's former national economic director, told clients Sunday, "Surely things are somewhat amiss when a country's finance minister plays bond salesman for a supposedly privately owned company."

One incredible statement and decision by Paulson was followed by another. On more than one occasion, such as when his initial demand for $700 billion in bailout funds included a "No meddling from Congress" clause, we asked, is he serious?

But he was serious. In any case, Paulson will shortly be on his way, and later in the year followed by Bernanke.

Not that either he or Bernanke will mind. We suspect they have both had enough of pretending that The System, as Greenspan liked to call it, is reparable.

In 2009 turnover of personnel in the first first two of the three positions shown above is guaranteed.

The question remains, how much will a personnel change effect the modus operandi of the Fed and Treasury? Confronting the private sector debt hangover of the FIRE Economy with only 15% unemployment versus 25% means exploding the public sector debt at a time when foreign creditors will rightly wonder who, politically, the US will pay back first, foreign creditors or domestic, and with what? Exactly how much credit creation capacity does the US government have by borrowing against claims on the economic surplus of the American people?

Larry Summers at least acknowledged the extent of the problems facing the economy at a time when others were waxing optimistic. Of course, he was running for office at the time, and appears to have won it as Obama's key political adviser. He has immediately set to work setting very low expectations, forecasting a mini depression in 2009. He may not be setting expectations low enough.

He is also laying the groundwork for massive spending programs, stating that the economy will run $1 trillion under capacity, and implying that an offset of $1 trillion in government spending is therefore needed.

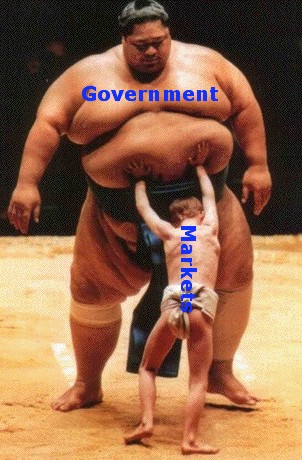

The fact is, there is no painless path out of this corner. Especially difficult is the task of roping in US trade partners to bail the US out again as in 2003 with the globe in its first contraction since the late 1950s. No matter what, we expect more of this.

And this.

As the government attempts to keep families in "their" homes making payments into the FIRE Economy.

The excitement over investing in emerging markets, including China, was lost on us in 2008. Greenspan was right about this one.

China's political response to its first recession in 30 years will challenge the world in 2009 as rising global unemployment challenges governments world wide. Formerly cocky dictators and single party governments will have to reconsider strategies and alliances.

We had a few lively discussions early in 2008 about whether oil was a bubble or not. As oil prices surged to $147, Congress claimed OPEC was holding back supply in the face of surging demand. OPEC claimed dollar weakness as the culprit.

The argument died in a hurry when the credit market collapsed in Q4 2008, the dollar surged on US Treasury bond sales and oil prices fell. Surprisingly, they remain today only $7 below the $50 level called a "bubble" in 2004 when in the National Review stated, "...oil prices today should be in the $20-per-barrel range." If so, they "should" be in the $10 range today, with global demand declining. The question is, why aren't they? In 2009, oil prices will confound most forecasters by going more or less nowhere as falling oil supply races against falling demand, and the dollar continues to act as the worst currency except for all the others -- but one: the fourth currency.

No annual review and forecast is complete without at least a glancing blow at a gold price forecast. As readers know, our DJIA bottom forecast from 2006 is 5000 and top for gold $2500 in the current cycle, representing a 2:1 DJIA/gold ratio. That DOW 5000 forecast sounded outlandish in 2006 when we made it, when the DOW traded over 11,000, just as gold at $2500 looked nutty when gold traded under $650 as it did at the time. Yes, gold is down from its peak over $1000, but pricing other assets in gold reveals interesting truths.

Gold priced in barrels of oil

Gold priced in the DJIA

We see gold in 2009 continuing to act as a hedge against the tendency of nations to devalue currencies to create inflation to deflate debt.

Some day we will sell our gold, but we are sticking to our thesis since 2001 that gold is worth holding by individuals for the same reason central banks hold it, even though gold is officially no longer a monetary metal. They hold gold is as a fall-back, in case the floating exchange rate and bond-backed currency system suffers an untimely fate. So do we. If they don't trust their own monetary system enough to sell off gold as a reserve asset, then neither do we. We think of gold as a reserve asset in our portfolio. There it stays until we see evidence to change our thesis.

Summary

If you look back at our doomerish 2006 forecast for 2007 Twelve Days of Christmas Bust 2007 note that none of the events darkly noted there -- the market crash, investors fleeing from emerging markets and hedge funds, bank runs, global recession -- were on the mainstream radar yet. We presented them in a lurid way to get your attention at a time of widespread complacency. The only event of twelve noted that has not occurred since then: a currency dislocation. We do not know how it will unfold but expect to see a major currency event this year.

As much as it pains us to say it, we cannot shirk from our responsibility to note that the politics of a shrinking global economic pie will not improve prospects for peace in 2009. Our international institutions for regulation of trade and economic development are geared to managing the challenges of growth, not shrinkage. The tendency of nations to withdraw into themselves in times of economic trouble when increased cooperation is all the more critical must be countered with a concerted effort to maintain close and constructive economic and political ties. Europe is especially vulnerable, and we hope that US leadership stays particularly close to its European allies during the year ahead.

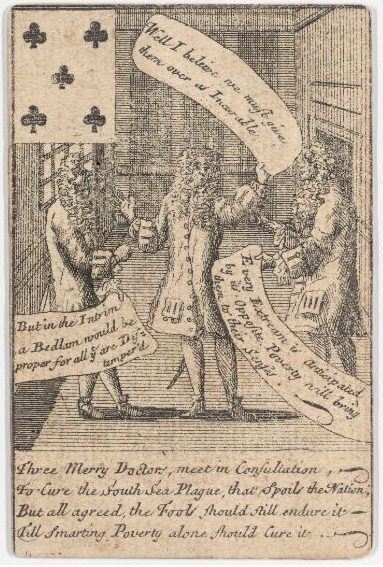

After an asset bubble collapses, the State is confronted with a political question, to use the power of the State to intervene in the inevitable economic correction or not? This question has confronted governments since at least the time of the 1718 to 1720 South Sea Bubble, the world's first true global financial bubble and implosion. As these two playing cards from the era attest, the question of intervention is not a new one.

As much as it pains us to say it, we cannot shirk from our responsibility to note that the politics of a shrinking global economic pie will not improve prospects for peace in 2009. Our international institutions for regulation of trade and economic development are geared to managing the challenges of growth, not shrinkage. The tendency of nations to withdraw into themselves in times of economic trouble when increased cooperation is all the more critical must be countered with a concerted effort to maintain close and constructive economic and political ties. Europe is especially vulnerable, and we hope that US leadership stays particularly close to its European allies during the year ahead.

After an asset bubble collapses, the State is confronted with a political question, to use the power of the State to intervene in the inevitable economic correction or not? This question has confronted governments since at least the time of the 1718 to 1720 South Sea Bubble, the world's first true global financial bubble and implosion. As these two playing cards from the era attest, the question of intervention is not a new one.

Birth of Keynesian Economics?

Ladies whose husbands are undone by Bubbles,

Meet at a Tavern to Lament their Troubles,

At length they all agree upon Petition,

To Pray the State to Mend their Bad Conditions.

Meet at a Tavern to Lament their Troubles,

At length they all agree upon Petition,

To Pray the State to Mend their Bad Conditions.

Birth of Austrian Economics?

Three Merry Doctors meet in Consultation,

To Cure the South Sea Plague that Spoils the Nation,

But all agreed the Fools should still endure it,

Till smarting Poverty alone should cure it.

Three Merry Doctors meet in Consultation,

To Cure the South Sea Plague that Spoils the Nation,

But all agreed the Fools should still endure it,

Till smarting Poverty alone should cure it.

As you can see, our view of 2009 is less specific at this point than our view of 2008 at this point last year.

As has been the case since 1998, in 2009 preserving wealth will be for the nimble, the quick, the attentive, the fleet of foot. Staying on top of developments is a community effort. We look forward to your lively and active support in the tough year ahead.

See also:

Pop goes the Globaloney Economy - Eric Janszen

Fed cuts dollar, Fire sales and F.I.R.E. sales, Duh-flation, and the Bezzel is shrinking... again - Eric Janszen

Deflation - A banker's view. What does iTulip say? - Eric Janszen ($ubscription)

The US economy glides like a box of rocks. Don't stand under it. - Eric Janszen

Lessons from Japan: The Devil's in the Details Part I - Asset price deflation versus general prices deflation - Eric Janszen ($ubscription)

Report from the Front: Conditions of employers

You too can forecast recessions! Secrets revealed! Here’s how! - Eric Janszen

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

In retrospect, the two best strategies in 2008 were to hold cash and to short the market. I did a bit of both but certainly nowhere near enough. Bravo to Eric Janszen and the iTulip team who as usual called everything pretty much perfectly (see "You too can forecast recessions! Secrets revealed! Here’s how!"). - 2008 Report Card, DeForest McDuff, December 18, 2008

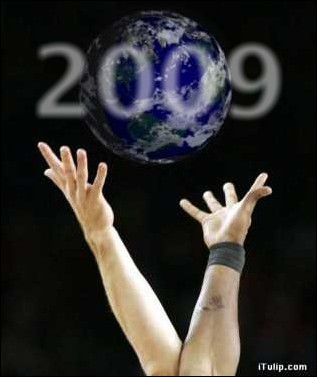

There is no over-priced stock market to short, no over-hyped commodities and emerging markets to avoid, and unpopular short term Treasuries and gold to buy. That made shorting stocks, going to cash, and holding a rump of gold a simple choice for 2008. In 2009, determinants will be driven more by domestic and global political considerations than market mean reversion. We are working on a more specific update for iTulip Select subscribers, "2009: Year of the Jump Ball" that wrestles with the outlandish array of variables that will come into play as established economic and political relationships go through a period of rapid change. As has been the case since 1998, in 2009 preserving wealth will be for the nimble, the quick, the attentive, the fleet of foot. Staying on top of developments is a community effort. We look forward to your lively and active support in the tough year ahead.

See also:

Pop goes the Globaloney Economy - Eric Janszen

Fed cuts dollar, Fire sales and F.I.R.E. sales, Duh-flation, and the Bezzel is shrinking... again - Eric Janszen

Deflation - A banker's view. What does iTulip say? - Eric Janszen ($ubscription)

The US economy glides like a box of rocks. Don't stand under it. - Eric Janszen

Lessons from Japan: The Devil's in the Details Part I - Asset price deflation versus general prices deflation - Eric Janszen ($ubscription)

Report from the Front: Conditions of employers

You too can forecast recessions! Secrets revealed! Here’s how! - Eric Janszen

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Signs that the middle class's tolerance for the wage and wealth gap that arose in the past twenty years is no more may be seen in 2009. The electorate has changed horses with the election of Obama, and is now thought by many to have returned to political quiescence for now. This inactive period may come to an end before the mid-term elections. If I were Obama, I'd buy time by scheduling the replacement of Paulson and then Bernake to show responsiveness to this expected dissatisfaction with the economy.

Signs that the middle class's tolerance for the wage and wealth gap that arose in the past twenty years is no more may be seen in 2009. The electorate has changed horses with the election of Obama, and is now thought by many to have returned to political quiescence for now. This inactive period may come to an end before the mid-term elections. If I were Obama, I'd buy time by scheduling the replacement of Paulson and then Bernake to show responsiveness to this expected dissatisfaction with the economy.

Comment