|

Stocks crash up, crash down, crash up, crash down. Are we having fun yet?

And how did we get here?

After the 1990 technology stock market bubble–that the Greenspan Fed claimed never existed–crashed in 2000, the Fed and Congress hit the economic policy panic button to stimulate the economy before the next elections: low interest rates, tax cuts, deficit spending, and dollar depreciation. The dollar was at a 20 year high, oil near all time inflation-adjusted lows, the Fed Funds rates at a 10 year 6.5% peak, and the fiscal budget–as Bill Clinton will not let us forget–in surplus.

The post-bubble economy faced a steep downhill run but at least it started from fiscal and monetary high ground.

The economy weakened. So did the dollar; from 2002 to 2008 the trade-weighted exchange value of the dollar fell by 37%. The weak dollar let US manufacturers increase revenue from exports, one leg of the two legged stool of economic recovery.

Here's how the dollar depreciation stimulus was reported from the perspective of one of the beneficiaries.

Weaker Dollar Strengthens U.S. Agriculture

February 2007 (USDA.gov)

The depreciation of the dollar lifted U.S. agricultural exports to record-high levels, despite the gains falling short of their full potential.

The depreciating U.S. dollar combined with strong economic growth in developing countries has increased the competitive advantage of U.S. agriculture and stimulated export demand for U.S. agricultural products.

Despite depreciating against currencies of some U.S. trading partners, the dollar has been largely fixed against currencies of others, such as China, reducing potential gains in competitiveness.

Trade policies and imperfect markets can also reduce the effects of depreciation, further diminishing the gains.

In other words, a weak dollar has help US farmers' export sales, but "we" can do more. "We" can pressure the Chinese to let their currency float. Then "we" can depreciate the dollar more broadly and send even more exports overseas. February 2007 (USDA.gov)

The depreciation of the dollar lifted U.S. agricultural exports to record-high levels, despite the gains falling short of their full potential.

The depreciating U.S. dollar combined with strong economic growth in developing countries has increased the competitive advantage of U.S. agriculture and stimulated export demand for U.S. agricultural products.

Despite depreciating against currencies of some U.S. trading partners, the dollar has been largely fixed against currencies of others, such as China, reducing potential gains in competitiveness.

Trade policies and imperfect markets can also reduce the effects of depreciation, further diminishing the gains.

The article above includes two charts to make its point.

This was not the first time the US used monetary inflation and currency depreciation to re-inflate the economy. The 2003 to 2007 experiment bears striking parallels to the post Great Depression 1933 to 1937 period, but executed with modern monetary tools.

Dollar Depreciation Re-inflation Echo

Anchored to gold the dollar inflated 170% against a basket of commodities between 1929 and 1933. This dollar appreciation is popularly recalled as "deflation." Asset and commodities prices fell in turn. After reaching an exchange rate peak in 1933, the dollar plunged to pre-1929 levels after the US government called in gold, re-priced it, and deflated the dollar against gold by 41% from $20.67 to $35 per ounce.

A return trip of 170% cumulative inflation in commodity prices over the next four years was even larger than the 112% inflation in commodities produced by the 37% dollar deflation that occurred during the 2002 to 2008 period.

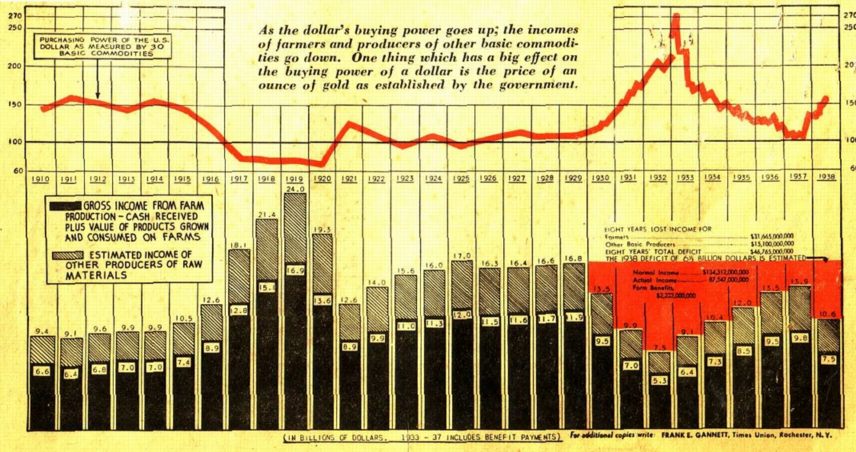

Between 1934 and 1937 dollar depreciation based re-inflation benefited farmers, commodity producers, and manufacturers much as today. Exports boomed and the incomes of farmers nearly doubled. iTuliper Jeff sent us an issue of American Agriculture, July 30, 1938. The 1938 cover article was similar to the USDA article from 2007, excerpted above. It was dramatically titled "Save Agriculture to Save America" and it makes its case with a decidedly low tech chart (scan below) that conveys parallel data from 60 years ago.

The post 1929 bubble crash Keynesian cure of monetary inflation and currency depreciation ended the sharp contraction in the money supply that was, much like the impact of the credit default swap market today, feeding on itself, driving lenders and borrowers out of the market and choking off credit.

Infrastructure programs employed millions, cutting the unemployment rate by more than 50%, from 25% to 10%. Yet by 1938, a mere four years after the re-inflation program began, the US economy was again running out of steam and slowing rapidly. It was again in recession in 1938, but when the US entered WWII in 1941 the economy was growing again. Whether the Keynesian re-inflation had finally taken hold or not will never be known–and will be forever debated–as demand created by the war economy took over.

In 2008, the US policy makers find themselves trying to re-inflate an economy after the failure of efforts to re-inflate the post 2000 bubble economy but without the demand stimulus of a foreign war. Unlike 2001, the dollar is starting from near all time lows, oil from multi-decade highs, and the budget in deficit versus surplus.

After attempts to re-inflate a re-inflated bubble economy fail, what do you do next?

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer __________________

Comment