North American Equities: over- or under-valued? (pdf)

September 15, 2006 (National Bank Financial Economy and Strategy Group)

Investors tend to attach a great deal of importance to price/earnings ratios in their calculations of whether markets are over or under-valued. However, these valuations are only useful if analysts’ projections are realistic.

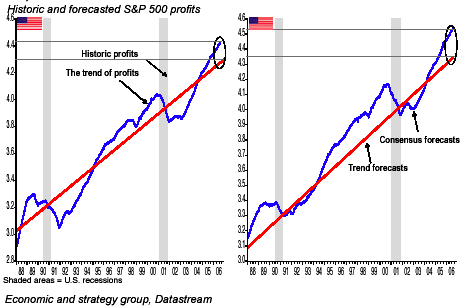

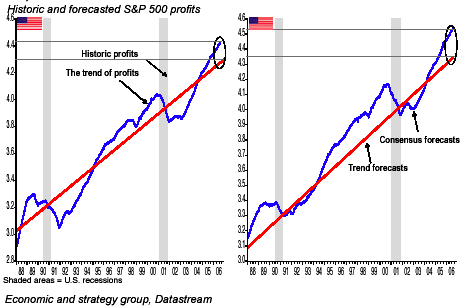

The problem is that analysts tend to be overoptimistic at the end of long growth cycles and in periods prior to economic slowdowns. Given that our economic scenario is based on a significant slowdown in the United States (which should lead to a marked drop in profits throughout North America), there is a real risk that current forward PE ratios may well be over-optimistic. During strong economic slowdowns, profit growth tends to return to trend levels. By recalculating forward P/E levels using trend profit growth levels (as opposed to analysts’ consensus estimates), North American equities markets no longer appear undervalued.

AntiSpin: To find US stock market analysis that doesn't require AntiSpin, we find ourselves reaching out to our northern neighbor. A daily news item previously noted a Toronto Dominion Bank Economics analysis that explains how the housing-driven economic slowdown in the US may impact the Canadian economy. The analysis holds lessons for other economies as well.

This report by Pierre Lapointe and Jean-Christophe Daigneault of Canada's National Bank Financial Economy and Strategy Group is a solid examination of the track record of US equity analyst projections versus outcomes over a long period of time. Seems that analysts are just as prone to optimism at cycle tops as are stock buyers. In fact, analysts' optimism at the end of cycles appears predictable and measurable. Right now, their optimism is yet another signal that a correction in the near term is likely.

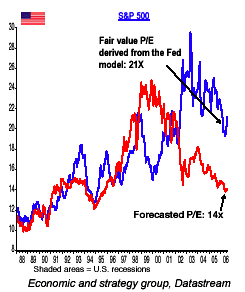

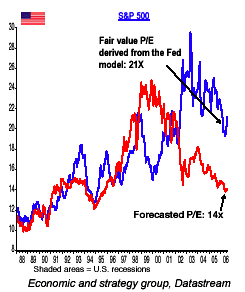

Not only do analysts tend to be optimistic, the Fed's stock pricing model–that didn't work so well in 1999 either–does not appear to be giving an accurate reading now.

The Fed model indicates that the S&P is undervalued

The CNB's analysis says that the S&P is overvalued

and to expect downward revisions by analysts

Who is more likely to be right? We got our money on our Canadian friends.

(Portions of National Bank Financial Economy and Strategy Group report above reprinted with written permission from National Bank Financial)

September 15, 2006 (National Bank Financial Economy and Strategy Group)

Investors tend to attach a great deal of importance to price/earnings ratios in their calculations of whether markets are over or under-valued. However, these valuations are only useful if analysts’ projections are realistic.

The problem is that analysts tend to be overoptimistic at the end of long growth cycles and in periods prior to economic slowdowns. Given that our economic scenario is based on a significant slowdown in the United States (which should lead to a marked drop in profits throughout North America), there is a real risk that current forward PE ratios may well be over-optimistic. During strong economic slowdowns, profit growth tends to return to trend levels. By recalculating forward P/E levels using trend profit growth levels (as opposed to analysts’ consensus estimates), North American equities markets no longer appear undervalued.

AntiSpin: To find US stock market analysis that doesn't require AntiSpin, we find ourselves reaching out to our northern neighbor. A daily news item previously noted a Toronto Dominion Bank Economics analysis that explains how the housing-driven economic slowdown in the US may impact the Canadian economy. The analysis holds lessons for other economies as well.

This report by Pierre Lapointe and Jean-Christophe Daigneault of Canada's National Bank Financial Economy and Strategy Group is a solid examination of the track record of US equity analyst projections versus outcomes over a long period of time. Seems that analysts are just as prone to optimism at cycle tops as are stock buyers. In fact, analysts' optimism at the end of cycles appears predictable and measurable. Right now, their optimism is yet another signal that a correction in the near term is likely.

Not only do analysts tend to be optimistic, the Fed's stock pricing model–that didn't work so well in 1999 either–does not appear to be giving an accurate reading now.

The Fed model indicates that the S&P is undervalued

The CNB's analysis says that the S&P is overvalued

and to expect downward revisions by analysts

Who is more likely to be right? We got our money on our Canadian friends.

(Portions of National Bank Financial Economy and Strategy Group report above reprinted with written permission from National Bank Financial)

Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Copyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment