Can someone please help me better reconcile the following 3 concepts?

1. Bubble economy - irrational excuberence driven, me-too waves which push up prices to unsustainable levels and then collapse.

2. Boomer economy - boomers drive certain markets as they all discover a need or want for the same things at the same time. See the Bill Gross article that JavaCat97 pointed out: http://www.pimco.com/LeftNav/Late+Br...ember+2006.htm

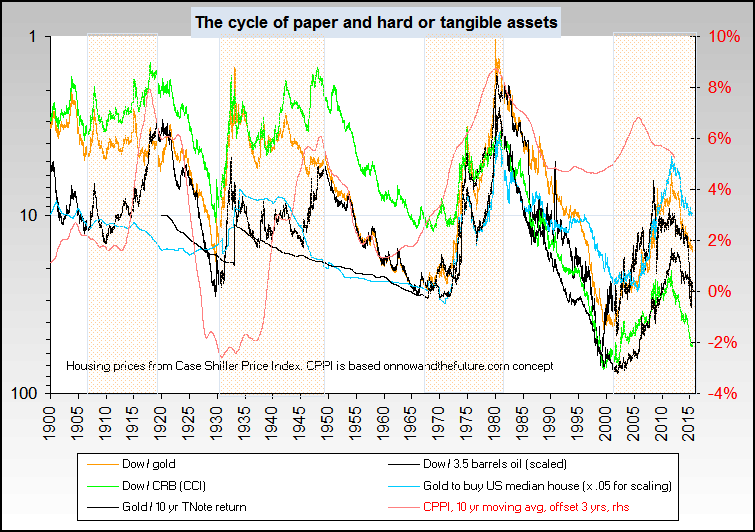

3. Inflation happens in waves - Finster pointed this out in another thread, and basically asserted that inflation doesn't happen all at once, but comes in waves with different items affected at different times. While this doesn't explain the late 90's NASDAQ, perhaps it explains energy costs, precious metals and even housing (i.e. housing is fairly flat if priced in oz of gold or barrels of oil)... so perhaps these things have risen so much, solely because the value of the dollar has gone down, and lots of other things are deflating with it obscuring the truth.

Seems to me that theory 1 is the hardest to plan around. Where will the next bubble be? Is gold a bubble now? iTulip is a wonderful resource on this, but it clearly isn't a cakewalk to figure out.

If you give more weight to item 2 then it becomes easier to figure out how the trends will play out. Simply follow the boomer crowd and pay attention to the talk at cocktail parties. Follow their lead, and then exit early... a strategy that appears would have worked pretty well for the tech and housing bubbles.

Finally, if item 3 is the fundamental driver, then do what you can to protect your assets against dollar devaluation. No reason to sell the house, possibly better off leveraging it to buy gold, and then when things stabilize exchange the gold for cheap dollars and pay off the debt (extreme example, nothing I'm truly contemplating).

Hopefully this at least conveys the issue I'm struggling with. My current belief is that we are experiencing a combination of all 3, and that each will have different impacts at different times, making just about everything risky, including just sitting on the sidelines in cash. Perhaps Eric's Ka-Poom theory adequately reconciles all three, but that isn't completely clear to me... especially the boomer dynamic. I don't think the housing bubble will be the last boomer impact, regardless of what else is happening in the economy.

Thanks for the help.

SeanO

1. Bubble economy - irrational excuberence driven, me-too waves which push up prices to unsustainable levels and then collapse.

2. Boomer economy - boomers drive certain markets as they all discover a need or want for the same things at the same time. See the Bill Gross article that JavaCat97 pointed out: http://www.pimco.com/LeftNav/Late+Br...ember+2006.htm

3. Inflation happens in waves - Finster pointed this out in another thread, and basically asserted that inflation doesn't happen all at once, but comes in waves with different items affected at different times. While this doesn't explain the late 90's NASDAQ, perhaps it explains energy costs, precious metals and even housing (i.e. housing is fairly flat if priced in oz of gold or barrels of oil)... so perhaps these things have risen so much, solely because the value of the dollar has gone down, and lots of other things are deflating with it obscuring the truth.

Seems to me that theory 1 is the hardest to plan around. Where will the next bubble be? Is gold a bubble now? iTulip is a wonderful resource on this, but it clearly isn't a cakewalk to figure out.

If you give more weight to item 2 then it becomes easier to figure out how the trends will play out. Simply follow the boomer crowd and pay attention to the talk at cocktail parties. Follow their lead, and then exit early... a strategy that appears would have worked pretty well for the tech and housing bubbles.

Finally, if item 3 is the fundamental driver, then do what you can to protect your assets against dollar devaluation. No reason to sell the house, possibly better off leveraging it to buy gold, and then when things stabilize exchange the gold for cheap dollars and pay off the debt (extreme example, nothing I'm truly contemplating).

Hopefully this at least conveys the issue I'm struggling with. My current belief is that we are experiencing a combination of all 3, and that each will have different impacts at different times, making just about everything risky, including just sitting on the sidelines in cash. Perhaps Eric's Ka-Poom theory adequately reconciles all three, but that isn't completely clear to me... especially the boomer dynamic. I don't think the housing bubble will be the last boomer impact, regardless of what else is happening in the economy.

Thanks for the help.

SeanO

Comment