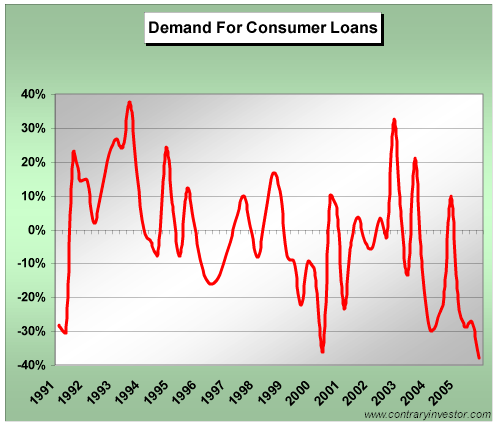

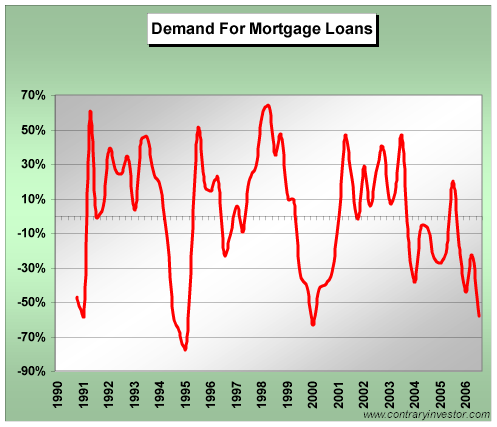

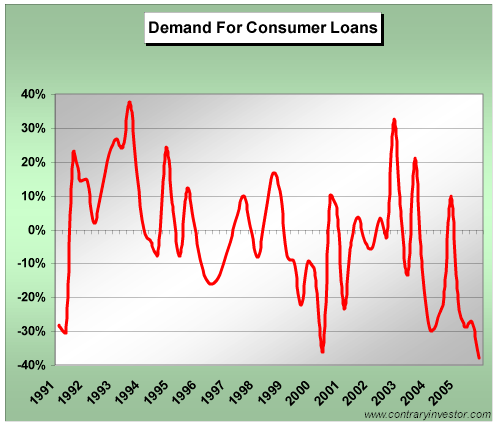

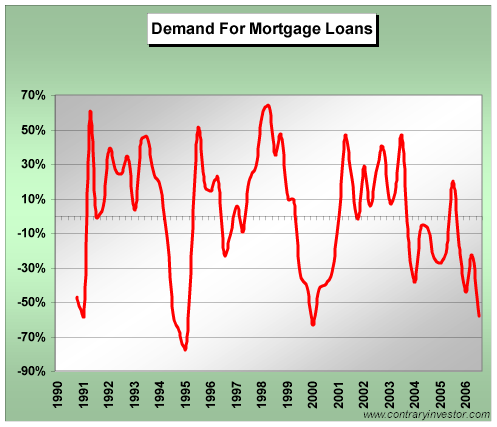

charts from contraryinvestor.com

consumer loan demand

consumer mortgage demand

"the banks have not tightened standards for consumer mortgage lending. Remember, restrictive OCC guidelines regarding bank mortgage lending have yet to be implemented as of the latest Bank Officer Survey. For now, the banks remain about as lax in terms of credit standards for consumer mortgages as any time over the last decade and one half. And, of course, the tell is that housing in general continues to weaken despite there really being no credit crunch of substance. In other words, it’s a death by ice (lack of demand) as opposed to fire (credit crunch)." contraryinvestor.com

consumer loan demand

consumer mortgage demand

"the banks have not tightened standards for consumer mortgage lending. Remember, restrictive OCC guidelines regarding bank mortgage lending have yet to be implemented as of the latest Bank Officer Survey. For now, the banks remain about as lax in terms of credit standards for consumer mortgages as any time over the last decade and one half. And, of course, the tell is that housing in general continues to weaken despite there really being no credit crunch of substance. In other words, it’s a death by ice (lack of demand) as opposed to fire (credit crunch)." contraryinvestor.com

Comment