The Post-Market Economy – Part I: Chaos on Planet ZIRP

Faith can overcome evidence but not forever.

Two trends will be with us for the next 20 years:

Inexorable Trend #1: Peak Cheap Credit

Inexorable Trend #2: Peak Cheap Oil

Within these two long term trends, the latest diversions

• Late gold investors on board since 2008 exit market as the USD again becomes GAGFO as Europe, Japan, and China falter

• Credit Bubble temporarily reflated

• Stock market temporarily levitated

• U.S. oil import trade deficit and dollar crisis temporarily averted

• Housing market temporarily… you get the idea

Six months. That’s how long we’ve wrestled this greased pig, this drunken monkey, this long, stinky cat running for its life barely inches ahead of a pack of rabid coyotes.

These markets. This economy.

Sheesh.

The problem is not in understanding human nature. That never changes.

We want. We hope. We kid ourselves.

We fuss about the house. Fix the broken gutter, the rotted trim, the chipped paint, the cracked concrete step. But our hair is on fire.

We don’t notice. No one told us and there are no mirrors on Planet ZIRP.

No, we understand human nature. Humans want and what we want more than anything is to be told what to believe.

A story that makes sense of the world, that puts it all together in logical order with a happy ending.

The good and hard working, the brave, the smart, and the righteous, will prevail.

“We” deserve to win, don’t we?

Except those are not the rules on Planet ZIRP.

I get this all the time. The questions.

What’s with the stock market? Bonds? Housing? Gold?

My answer: Do you really want to know?

We exited stock mutual funds, stock indexes, and individual tech stocks in the spring of 2000.

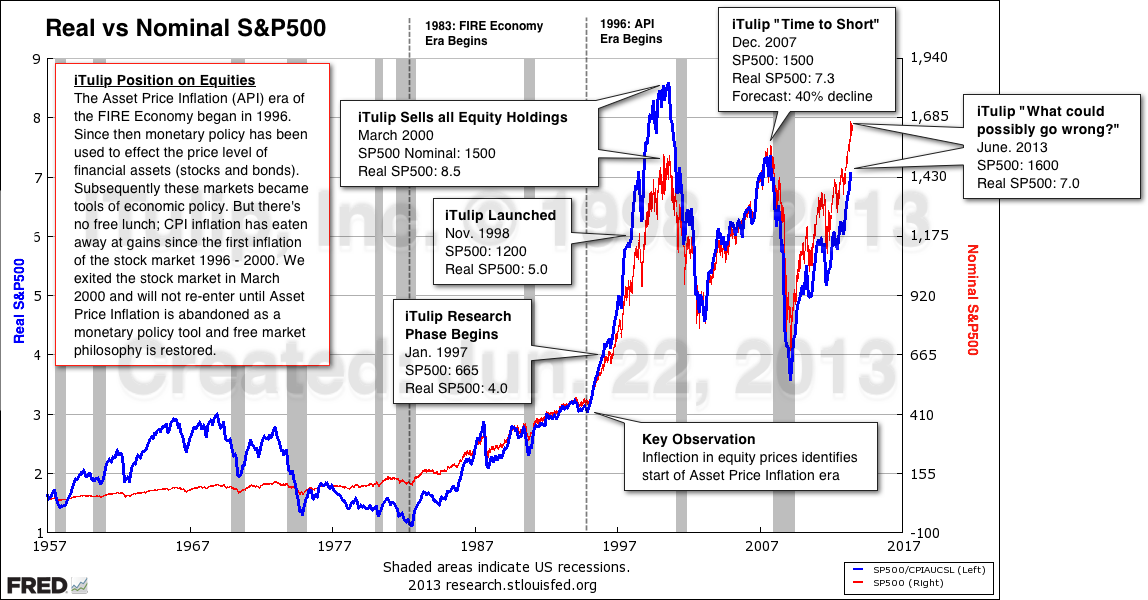

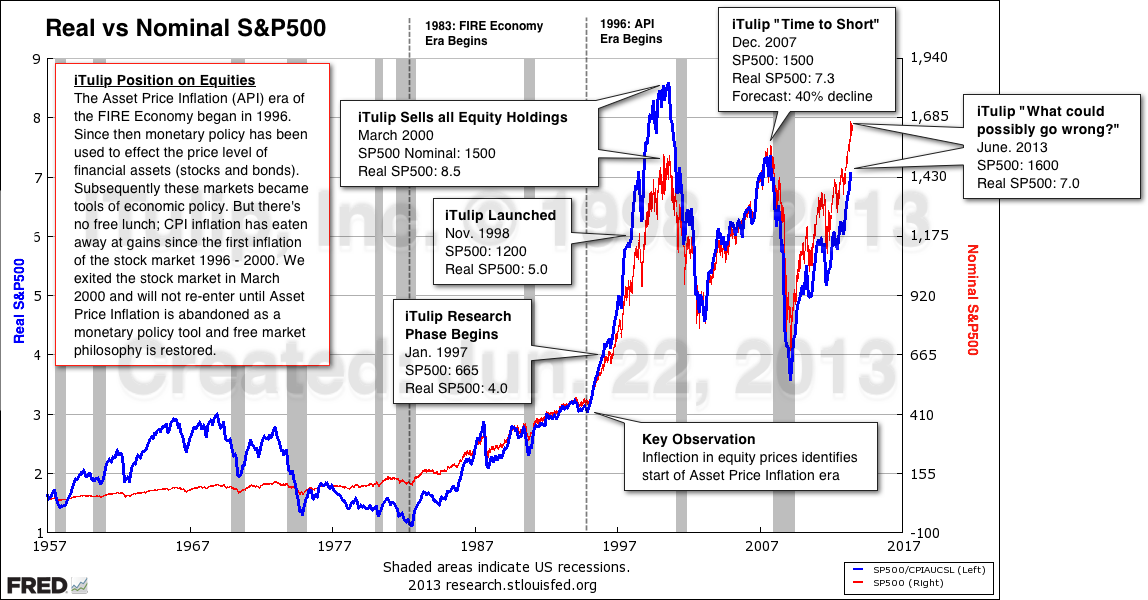

The S&P500, even at the peak of the latest Fed financed reflation rally – trillions in the bargain – is in real terms still 20% below that heady top 13 years ago.

In that year of 2000, so long ago, Requiem for a Dream, American Psycho, and Memento played in theaters. A gallon of regular went for $1.40 and a share of Corning for $110. Gold traded at $270 and oil for $30. The unemployment rate was 4%.

That was in a different time and place. That was before, way back there.

And now? Now gasoline is $3.50 and GLW trades for $14, gold is $1200, oil $95, and the unemployment rate is 6.7%.

Hardly anyone remembers any of this.

Running this site for so many years I’m Leonard Shelby, posting snapshots and graphs to cope with our readers’ anterograde amnesia induced by a business media compelled by intense competition to chase the brightest shiny object that best attracts and holds media consumer attention from one hour to the next. As our economy hurls through time and space events appear out the window as a rush of disconnected images, as if events occur at random with no process, no direction, no eventuality.

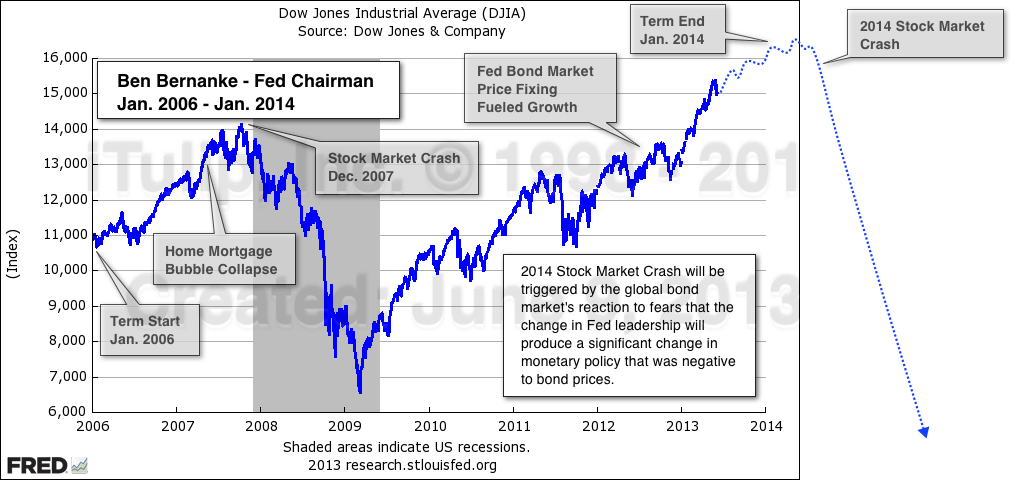

Take another look at the chart above. Clearly something went wrong in the engine room of the economy around 1996 as reflected in the stock index price rise inflection.

What was it?

A steady flow of bond market refi cash pumped the economy up from the starting point of high interest rates and low inflation from 1983 to 1990. But that wasn’t good enough for our ambitious Fed chairman Alan Greenspan. No, he wanted more. He wanted asset price inflation, a hyper-flow of money into the markets to use as political leverage, produced by a combination of ultra-low rates and the careless mixing (via banking deregulation) of liquidity-based speculative investing with staid bank finance.

Greenspan tried to modulate his monster in 1993. Failing that he shrugged, stood back, and we got it in spades from 1996 to 2000.

Our current course was then set. Once speculative markets are inflated with credit economic expectations cannot be reset. From a political standpoint, an asset bubble-based economy once inflated it must be reflated over and over.

From a practical standpoint? Well, we shall see.

The Federal Reserve, the unelected pilot of our political economy, took this wrong turn in 1990 and set us on course to Planet ZIRP where we are today.

After that first bubble collapsed in 2000 the Fed and legislature, the former by monetary policy and the latter by fiscal policy, reflated it not once but twice since, as anyone can see by looking at the chart above. But reflating that first bubble a second time took everything they had.

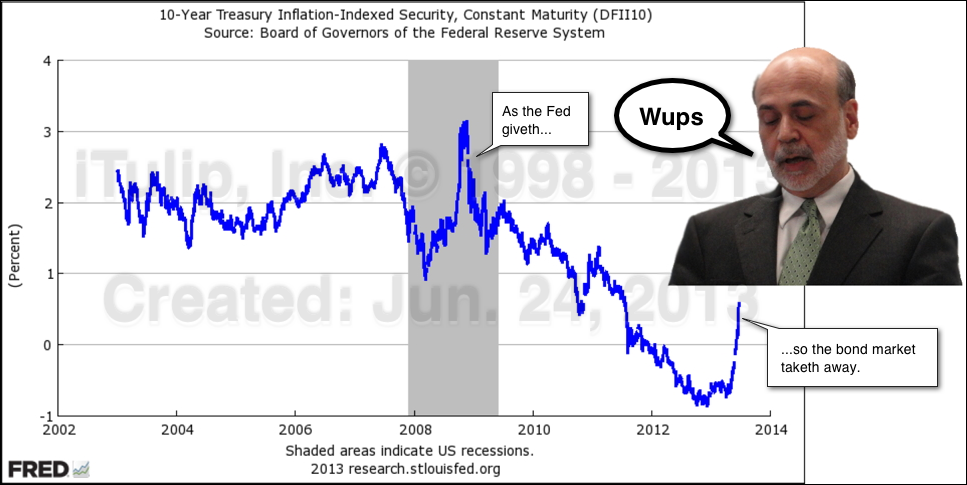

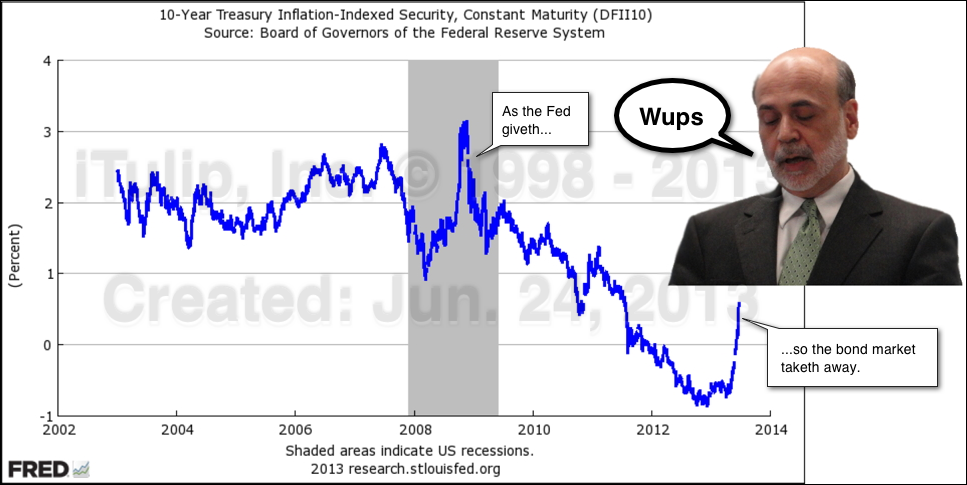

The Fed put in five years of mad experimentation in the engine room of the U.S. economy since late 2008. The most lunatic gambit was the short-circuiting of normal bond market price signals to keep the credit engines running full throttle.

This year they at last achieved their goal of a second asset price reflation of the original 1996 to 2000 asset bubble, the recognition of which led to the founding of this site 15 years ago.

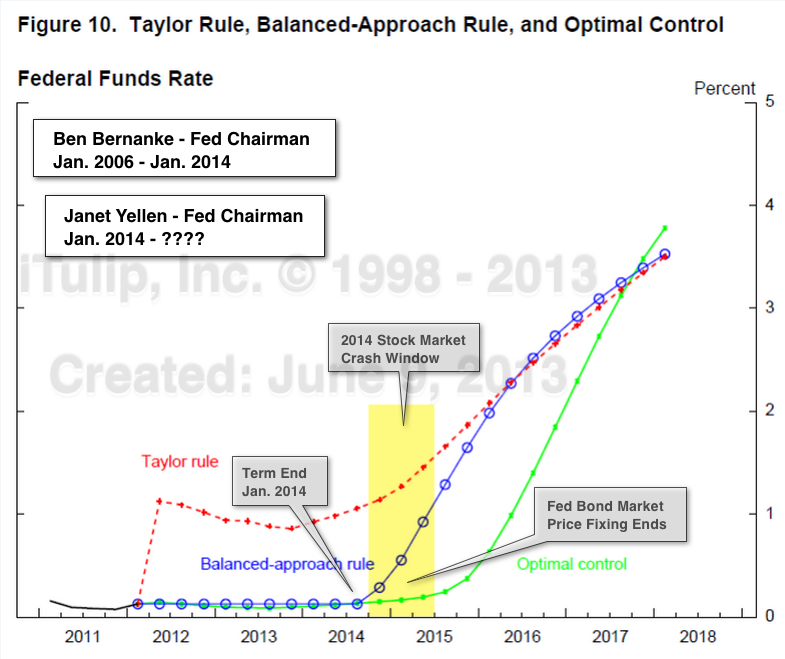

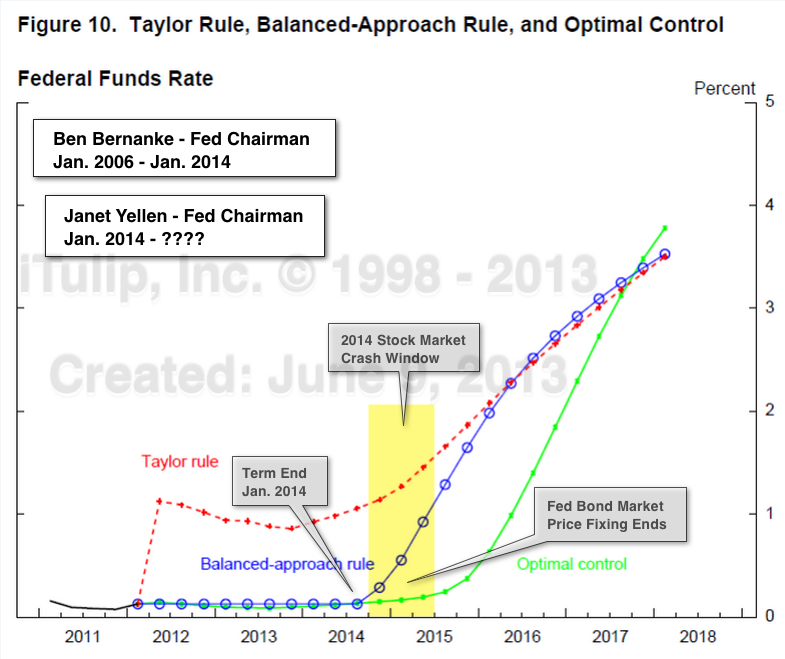

How much longer can they keep it humming? Possibly until the end of 2013, but absolutely not until the end of 2014. After Bernanke leaves and Yellen takes over in December of next year, the lugging, the pre-ignition popping, and the grinding of gears, begins.

That’s the game plan, if you’re Ben Bernanke.

In Part II we review the troubled history of Fed chair transitions. Imperial power transitions in archaic dictatorships appear smooth and benign by comparison.

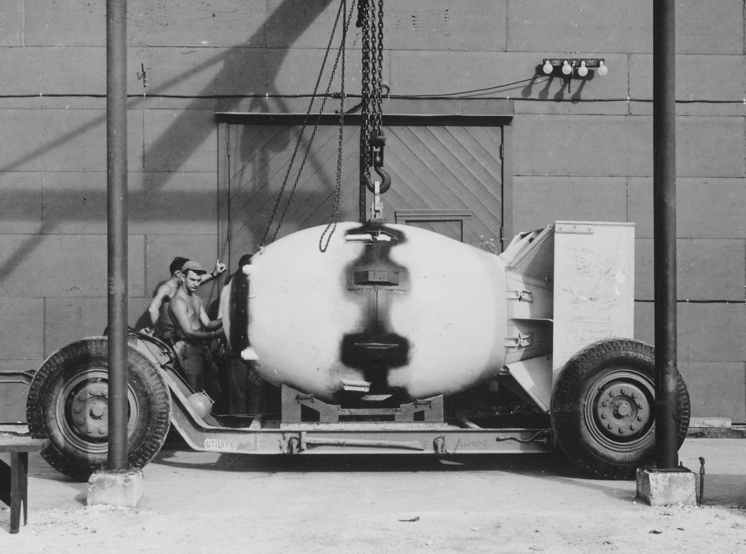

2014 is the year that the $34 trillion USD bond market bomb, fused by ultra-low interest rates,

gets tossed to the next Fed chair. Good luck with that, Janet.

Look at the stock market chart above, please, one more time. Given the history, does the stock market so presented appeal to any reasonable person’s conception of “cheap”? What could possibly go wrong?

But if not stocks, then what is cheap? In Part II we tour the asset classes in search of the beaten down and derided that due to the two Inexorable Trends must rise again.

In a credit inflation produced by a central bank engaged in bond price fixing for years on end, how can investors tease apart the credit-financed holograms from the solid objects, the daydream from the day?

Disoriented we are left to go on instinct, on gut.

The thing is, gut is as reliable on Planet ZIRP as a compass in space. Not even gravity works the same. Pour water in a glass and it fills top to bottom. Pitch a ball and it circles the planet forever. Get off of your bicycle and it doesn’t fall over but stands like a statue in place.

Our human nature, our tendency to adapt to the absurd, leads us astray on ZIRP. We look for what we expect to see and see it for the wanting. On planet ZIRP, that is a dangerous habit.

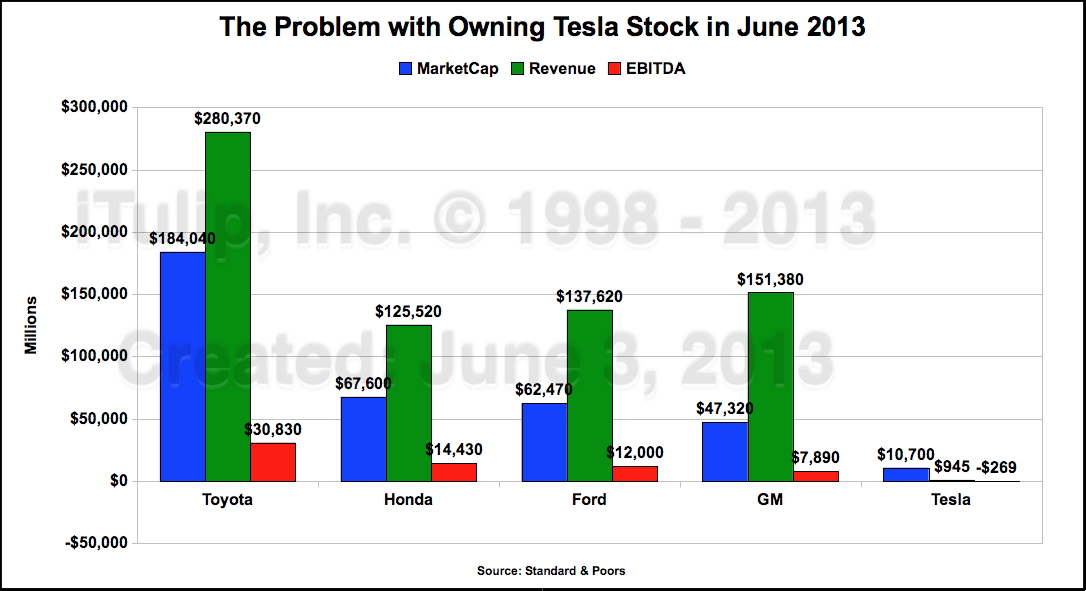

We need to filter out that which only makes sense in a world created by central banks with a political mandate to keep asset prices inflated. For example, Tesla Motors.

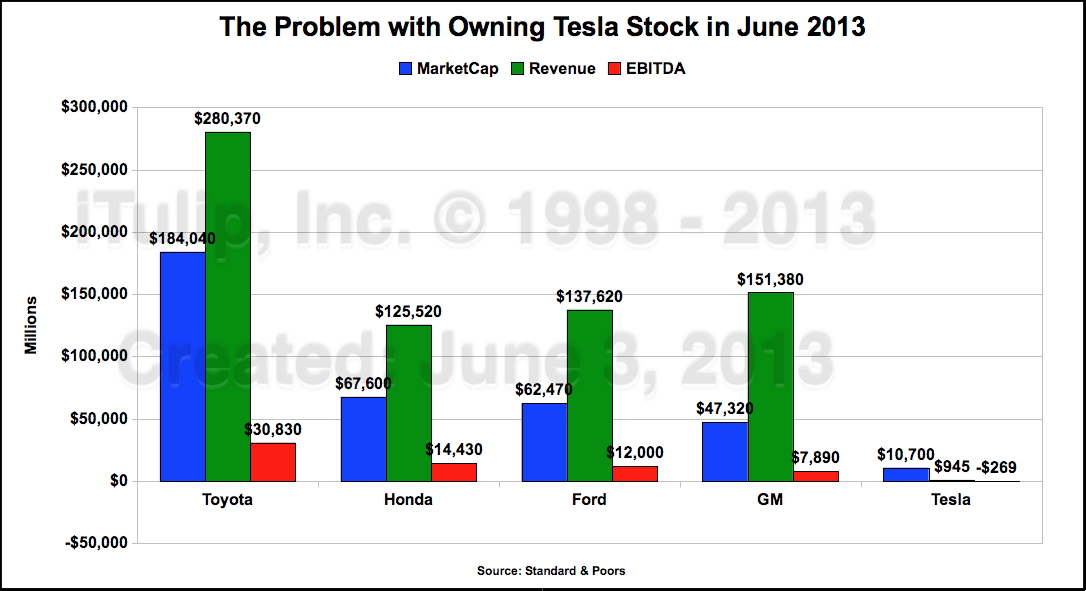

If you thought public venture capital died with pets.com and the NASDAQ bubble look no further than Tesla Motors.

Tesla’s $100,000 Electric muscle car marvel needs a six-hour nap every 200 miles but that hasn’t kept thousands of green fashion conscious winners in Bernanke’s stock and bond market lottery from buying them and investors from pushing TSLA stock up to nearly a quarter of GM’s market cap.

Really 23% of GM's market cap? Have TSLA investors noticed that Tesla’s sales are literally a rounding error on GM’s balance sheet, 0.62% of GM’s sales to be exact?

What’s that, TSLA shareholders? I don’t get it? Get what? Oh, right. Musk is a genius and GM is a tired old brand. Tesla is a growth stock, the future. Okay. Thank you for the explanation.

Here on Planet ZIRP Tesla Motors makes perfect sense. One part engineering genius, two parts marketing panache, one part government industrial welfare recipient, and four parts central bank QE beneficiary. A sexy high tech aluminum sculpture of silicon, wires, batteries and bullshit. In Part II we delve into Tesla in detail as the company and the stock emblematically reflect the mindset of investors whose judgment has been thrown off by 15 years of asset price manipulation by central banks.

Like gravity, facts don’t operate well on Planet ZIRP. Facts are suspect. Lengthy, detailed explanations like this one are eschewed. Who has the time? A short, well-delivered opinion is preferred.

A show, a rant, a sly performance put on by an authority. A tipster. A man in the know.

Deep voice, cleft chin, broad shoulders, piercing eyes. For a few bucks he’ll let us in on his secret.

Or bald and yelling, honking horns and throwing chairs. Between the antics watch the brokerage ads that pay for the show.

Don’t forget to trade.

The opinions we most prefer from him comfort and reassure us in our confusion and loss for words.

Neglect to buy gold before the price reached $500? Relax, says the credentialed equities salesman of the financial products division of the FIRE Economy business media. You didn’t miss anything. Gold’s days are over.

On Planet ZIRP the FIRE Economy – the economy of fees and interest payments on money – is the economy.

The real economy of profits from value-add production, which profits pay the wages and salaries of employees, which wages and salaries finance consumption -- previously known simply as “The Economy” -- is secondary.

The man in the know has a half-baked theory to explain the 2013 gold price correction, never mind that he had no theory of gold’s continuous 10-year rise from 2001 to 2011.

What does he know about gold? That gold was a bubble that popped, or pooped, or something.

That’s another thing we insist on from our man in the know on Planet ZIRP: no complicated explanations, please.

Gold is a bubble and Moby Dick is a book about a whale. Yes, that will do.

Floating miles above ZIRP and looking down, seeing analytically with emotional distance, we can see what actually happened or rather what is happening to gold.

As simply as I can put it, it goes like this.

The U.S. dollar as “good as gold for oil” or not

At the dawn of the industrial age the industrial state became dependent on a continuous supply of a single commodity without which any such state will fail in short order: oil.

Further, if that state cannot meet its own oil demand with domestic supply it must import oil. As most states are not oil producers, most states are oil importers.

Further, as the U.S. dollar is the primary parallel currency used by all nations to buy and sell oil, all countries that import oil must maintain USD reserves sufficient to cover oil import payments over a prescribed period of time.

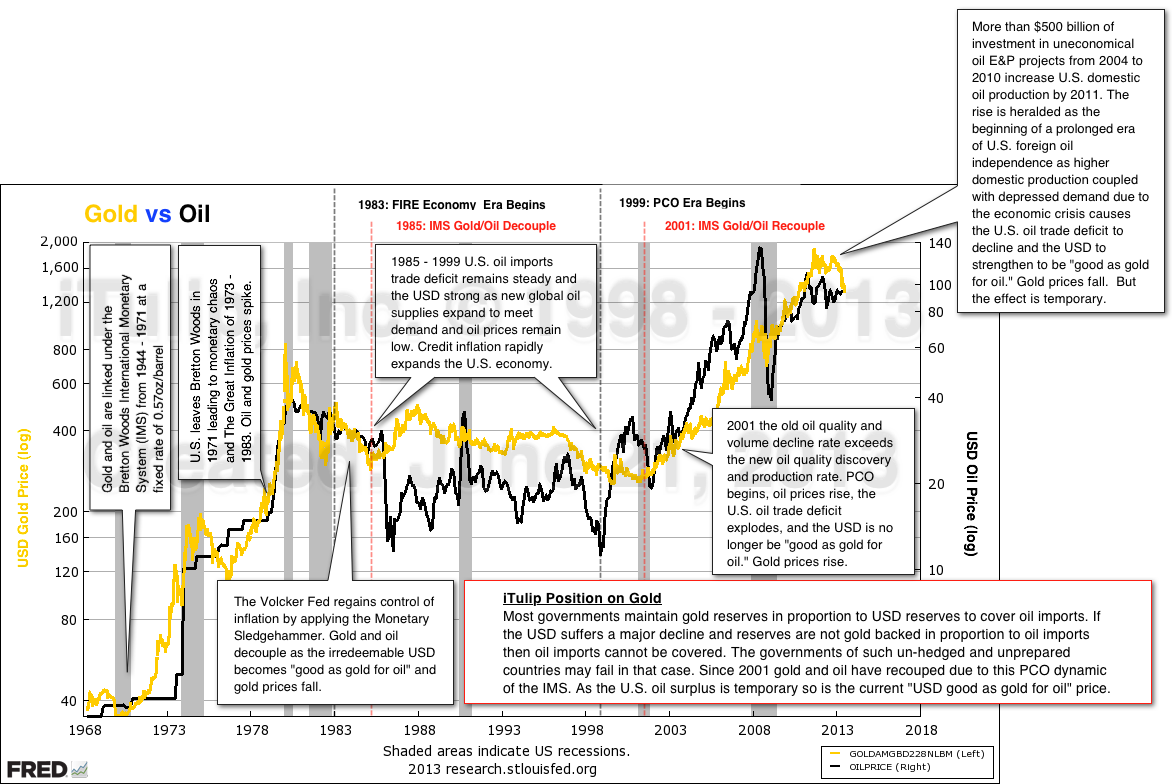

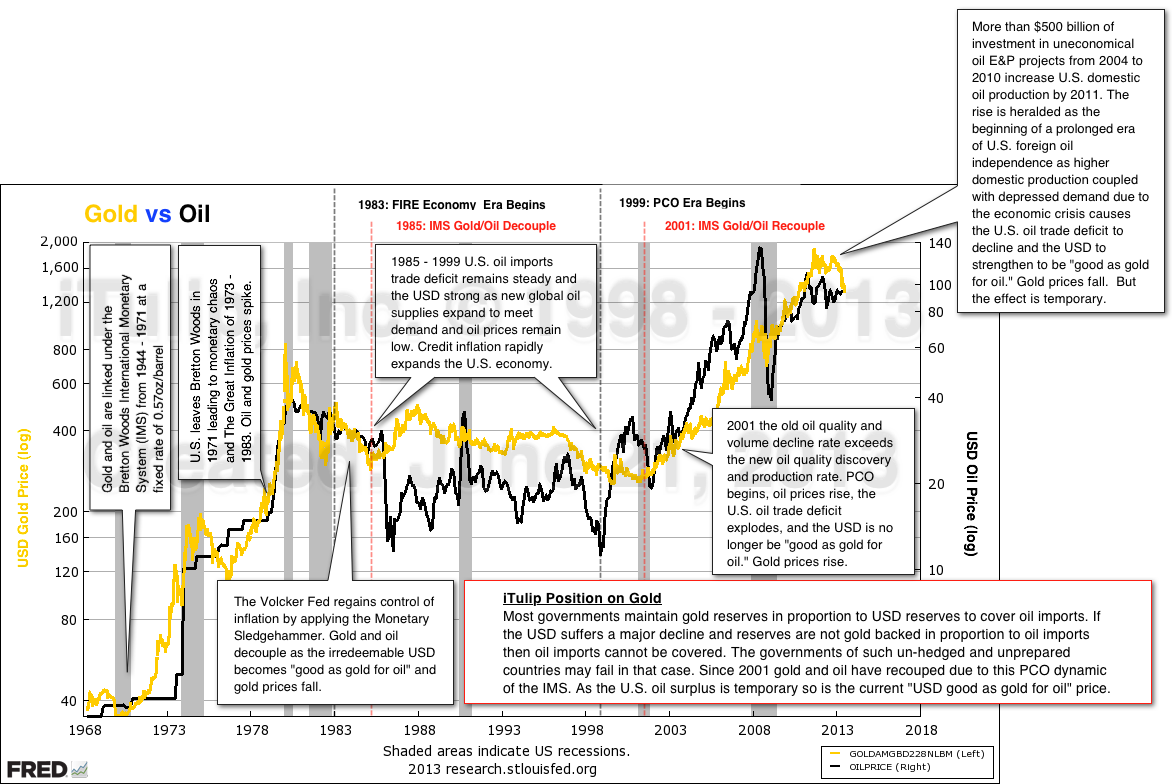

Gold and oil are connected through the International Monetary System (IMS) where the USD is made as “good as gold for oil”

via fractional gold backing on reserve account of central banks.

Global central banks maintain a fixed ratio of gold to USD reserves by value to guarantee payments for oil imports for a set length of time should the USD fail the test of time as a store of value and render it useless as a medium of payment for oil imports. As the USD price of oil rises and falls, so too does the gold price, perfectly hedging USD reserves in a critical amount of USD volume of oil imports for each participating nation.

The USD was “good as gold for oil” or GAGFO for short, from 1985 until 2000, for 15 years out of the past century, since industrialized nations became dependent on the one and only high energy density liquid suitable for use as a scalable transportation fuel.

Before 1971, USD held as reserves by central banks could be redeemed for gold held by the U.S. Treasury per the international gold standard system agreed on by the international community at Bretton Woods in 1944. Fiscal and monetary mismanagement combined with a balance of payments deficit and a weakening USD in the 1960s forced the U.S. to abandon the international gold redemption system in 1971. Suddenly, USD reserves were no longer guaranteed by being redeemable for U.S. gold. The USD was no longer GAGFO.

An irredeemable USD might have retained GAGFO status if the fiscal and monetary malfeasance that drove the U.S. off the Bretton Woods system had been corrected. But they were not. Instead the errors were perpetuated until high inflation compounded the sins of the issuer of the world’s parallel currency. Even though gold was no longer an official part of the IMS, gold on reserve account at central banks tracked the fast-rising price of oil priced in USD, as you can see in the chart above.

Application of the Monetary Sledgehammer by the Fed under chairman Paul Volcker and subsequent monetary discipline gave the world a 15-year period when the USD was once again “good as gold for oil.” That brief monetary nirvana lasted until three strikes against the U.S. eroded the status of the USD as GAGFO starting in the year 2000.

The first strike was the equity bubble collapse in 2000. With that spectacle of monetary malfeasance and regulatory chicanery the U.S., in the eyes of the world’s central bankers, ceased to be a beacon of light in a dark sea of economic vulgarity.

The Fed under the iniquitous leadership of Alan Greenspan had colluded with financial sector elites – guys like Robert Rubin and Larry Summers – to use asset price inflation as a tool of political economic policy.

President Clinton famously cut a deal with Greenspan to get a second term: reduce the federal budget deficit with defense spending cuts in exchange for low interest rates and “market liberalization.” The former channeled a river of money into securities markets while the latter produced a thick stack of Get Out of Jail Free cards for Greenspan’s former Wall Street clients in the investment banking industry who scooped them up.

The resulting extraordinary capital gains tax receipts coupled with minimalist defense spending produced the last budget surplus we’re likely to see in our lifetimes.

Of course the bubble popped -- and right when we said it would in the spring of 2000. The economy shrank and the surplus evaporated.

For foreign holders of USD denominated U.S. Treasury Bonds (UST) this egregious display of political venality was Strike One for the USD as “good as gold for oil.”

The degeneration of the USD as GAGFO began.

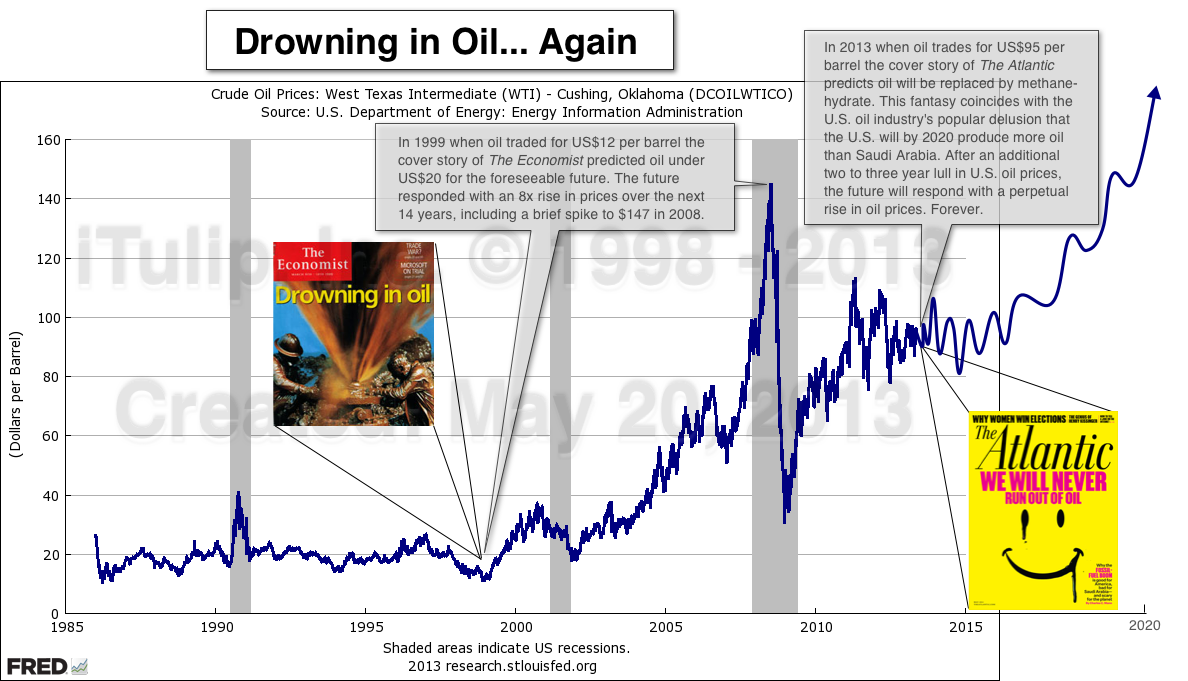

A year or so after Greenspan’s stock market bubble collapsed, Strike Two in the form of Peak Cheap Oil (PCO) arrived.

PCO is a concept I developed in 2006 to address the question of how the economy and markets were to react to a steady decline in the quality and quantity of the world oil endowment as it is used up from best to worst, and from easiest to hardest to access.

The obvious implication of PCO is that the price of oil will rise. But within that long-term, inexorable trend are short-term exorable diversions.

To wit: Fortress America, an idea we started to use here two years ago to describe the shift in the U.S. foreign policy approach to get what we in the U.S. want from the world generally and from oil producers specifically.

Under the Fortress America policy framework, U.S. oil companies ditched uneconomical foreign energy projects to return home to increase domestic oil and gas supplies to meet the political objective of the Obama administration to reduce energy imports.

But before that, from 2001 to 2011, an ever-rising oil price – on average 15% per year –accelerated the U.S. oil trade deficit. That put foreign holders of USD reserves for oil on edge.

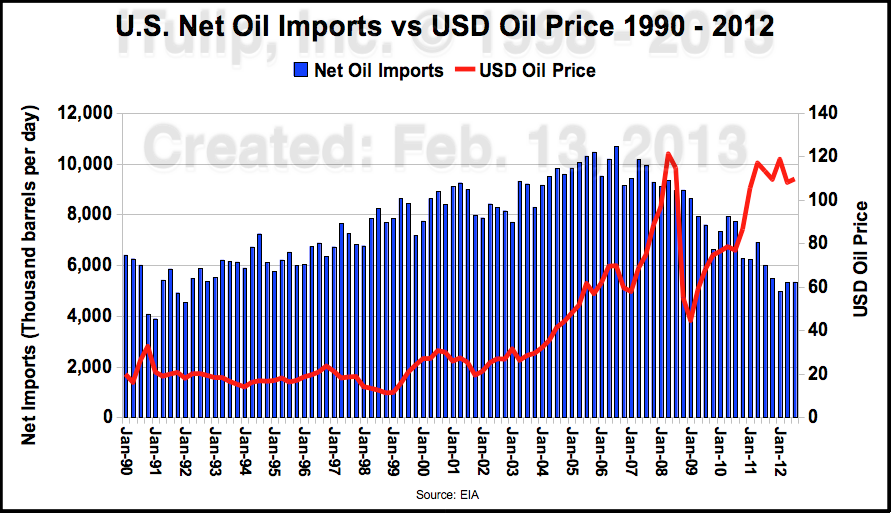

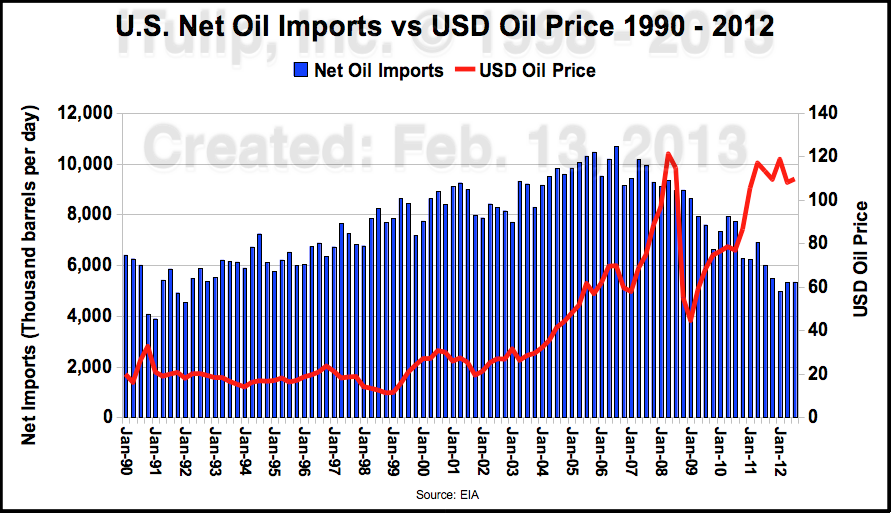

From 1990 to 2001, U.S. net oil imports doubled from 4 million to 8 million barrels per day.

The oil trade deficit doubled but this increase did not worry foreign UST holders because oil prices were stable.

Then oil imports increased from 8 million to 10 million barrels as oil prices tripped from $20 to $60.

At the peak of oil imports volume and price in 2008, the U.S. was shelling out $110 a barrel

for 9 million barrels of oil or around $1 billion per day.

The combination of the rising oil price and rising oil trade deficit was Strike Two for a USD “as good as gold for oil.” As from 1971 to 1983 gold on reserve account again tracked the USD oil price as can be seen in the Gold vs Oil chart above. This occurred even in the absence of the kind of all-goods price inflation that happened in the U.S. from 1971 to 1980. We discuss the mechanism of this correlation in Part II.

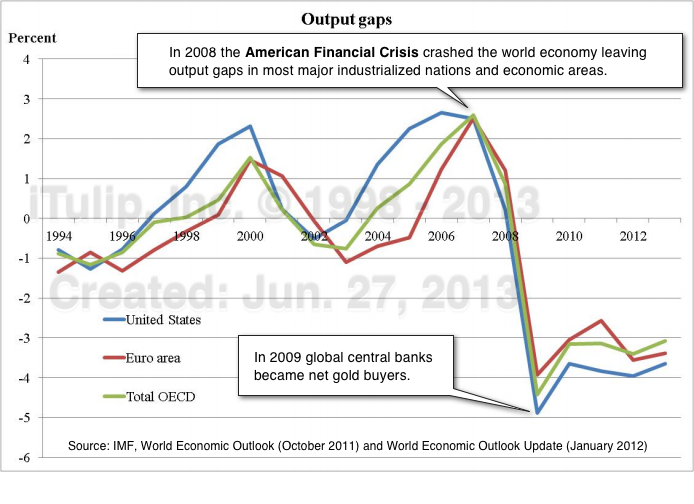

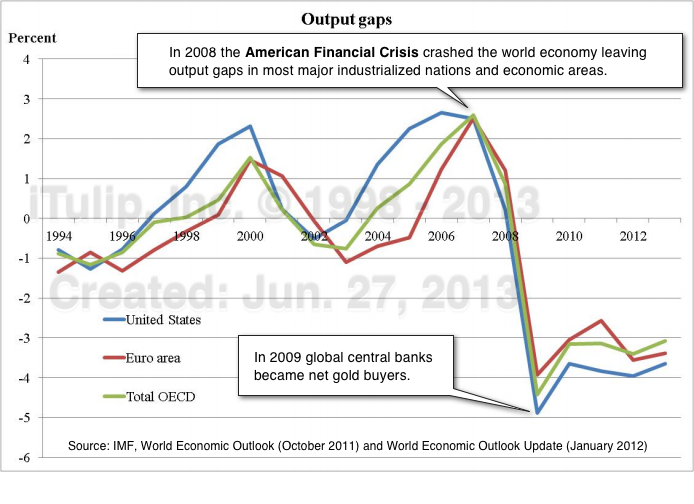

Then in 2007 the U.S. securitized mortgage debt bubble popped and launched the American Financial Crisis that crashed the world economy.

How to make enemies and influence people badly: Grow a multi-trillion dollar financial bubble then smash the world economy when it collapses.

With the U.S. economy in free-fall, unemployment skyrocketing, and incomes and tax receipts plummeting, the U.S. government went hat in hand to its largest creditors and politely asked if they’d be kind enough to buy about $1 trillion in U.S. Treasury bonds so as to finance the reflation of the U.S. economy to prevent a second Great Depression, please?

That was USD “good as gold for oil” Strike Three.

At that the central banks of the world’s largest economies decided that a country that issues the world’s primary parallel currency cannot also be the same country that repeatedly engages in dangerous large-scale financial speculation with that currency, and also runs an oil trade deficit to the tune of 3% of GDP.

Collectively they told the U.S., “Get your act together. In the mean time we’ll increase gold holdings to hedge our USD holdings just in case you don’t or can’t.” For the first time since the 1970s, central banks became net gold buyers in Q2 2009.

With that background we are finally ready to ask the question, Why did the gold price level off in 2011 and drop precipitously in 2013?

GAGFO as Market Variable

Turns out that GAGFO is a variable. That is, the degree to which the dollar is as “good as gold for oil” changes in response to oil prices, trade flows, demand, exchange rates, and other economic changes. We believe that we have perhaps devised a way to measure GAGFO. Unfortunately, we didn’t devise it before the gold price fell, but we think this tool will help us going forward. While the formula is proprietary in Part II we give a theoretical overview of the GAGFO variable and a How Low can Gold Go? estimate on the gold price in the current pricing environment based on it.

For the sake of simplicity, say the output of our GAGFO “black box” value generator is a scale from 1 to 10, with 10 representing a USD that is viewed as exactly GAGFO, with 5 representing a USD that is imperfectly GAGFO, and a 1 as the condition of the USD as not at all trusted to cover oil imports for a “period of necessity.” The U.S. covers this exigency in a unique way, first by holding far more gold than any other country – more than 8,000 tons – and second by hoarding oil in a 700 million barrel strategic reserve that is more than ten times as large as all other national strategic oil reserves combined (60 million barrels). It's enough to cover all politically risked U.S. oil imports for a year.

What can the U.S. do to improve the GAGFO status of the USD, resulting in a reduction of the gold price on reserve account of central banks?

The U.S. can lower its budget deficit by generating more tax revenue from economic growth while reducing federal government spending. It can be relatively less frightening a place to invest than other countries in absolute terms. It can reduce its oil trade deficit by producing more oil domestically.

In the event the U.S. has done all three of these things since 2011.

Fortress America policy has been good for the dollar. If GAGFO was at a low point of, say, 3 in 2009, as of Q1 2013 it improved to a 5. Gold adjusted by falling from $1900 to $1200.

Of the three ways to improve the GAGFO status of the USD, the last one – reduced oil imports – has had the most profound impact.

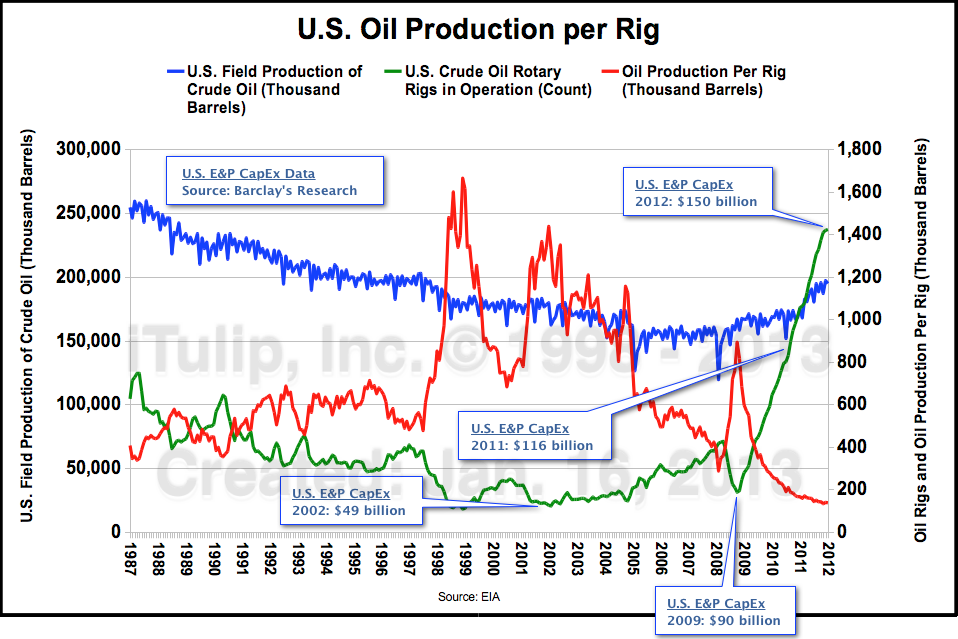

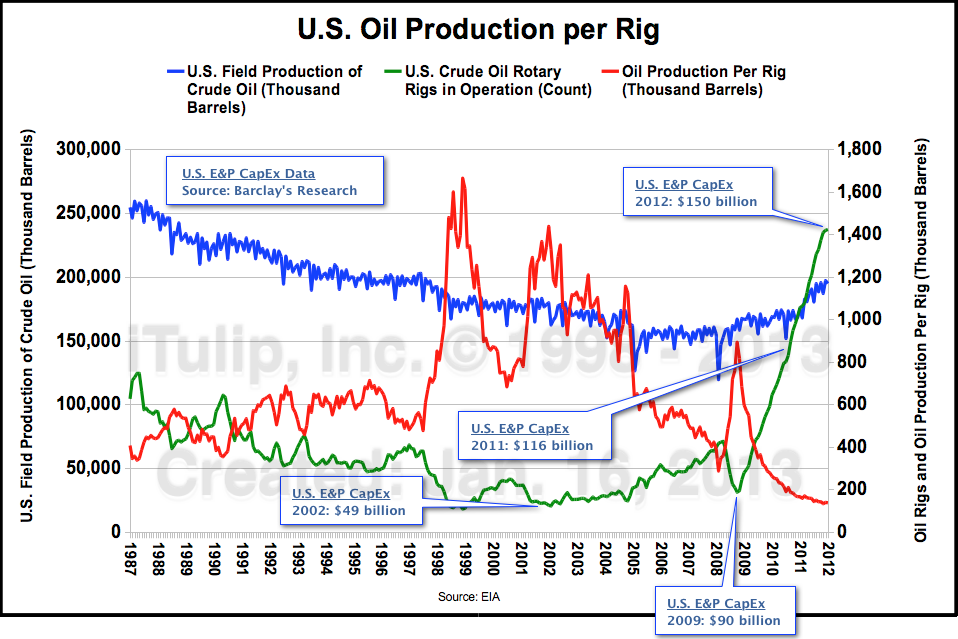

Hundreds of billions of dollars invested in domestic exploration and production in the U.S. since 2003 finally started to pay off in 2006. Then the crash and recession cut demand starting in 2009. Then over-investment in U.S. oil production increased the operating onshore and offshore rig count seven-fold from 200 to 1400 between 2009 and 2012.

Hundreds of billions invested in domestic exploration and production in the U.S. since 2003 finally started to pay off in 2006. Then the crash and recession cut demand starting in 2009. Then over-investment in U.S. oil production increased the operating onshore and offshore rig count seven-fold from 200 to 1400 between 2009 and 2012.

The U.S. hasn’t produced this much oil since 1996, but it’s taking more than three times as many rigs now as it took back then to do it.

By the end of 2011, the one-two punch of lower demand and rising output cut U.S. net oil imports in half, to 5 million barrels per day from 10 million in 2006. For the first time on record the WTI (domestic) oil price diverged from the Brent (International) price. As oil imports declined the U.S. oil trade deficit fell with it.

But it won't last. Most of this intense oil production activity in the U.S. rather than adding to supply that was not accessible previously instead largely brings future production forward. New technology is producing some additional oil that was not formerly recoverable, but the ratio of previously recoverable old oil brought forward to new additional supply is estimated at about 80/20. That means the U.S. is using up its oil supply faster and at a lower price than if older production technologies had been used over a longer time period.

There is not more oil, we are just using faster.

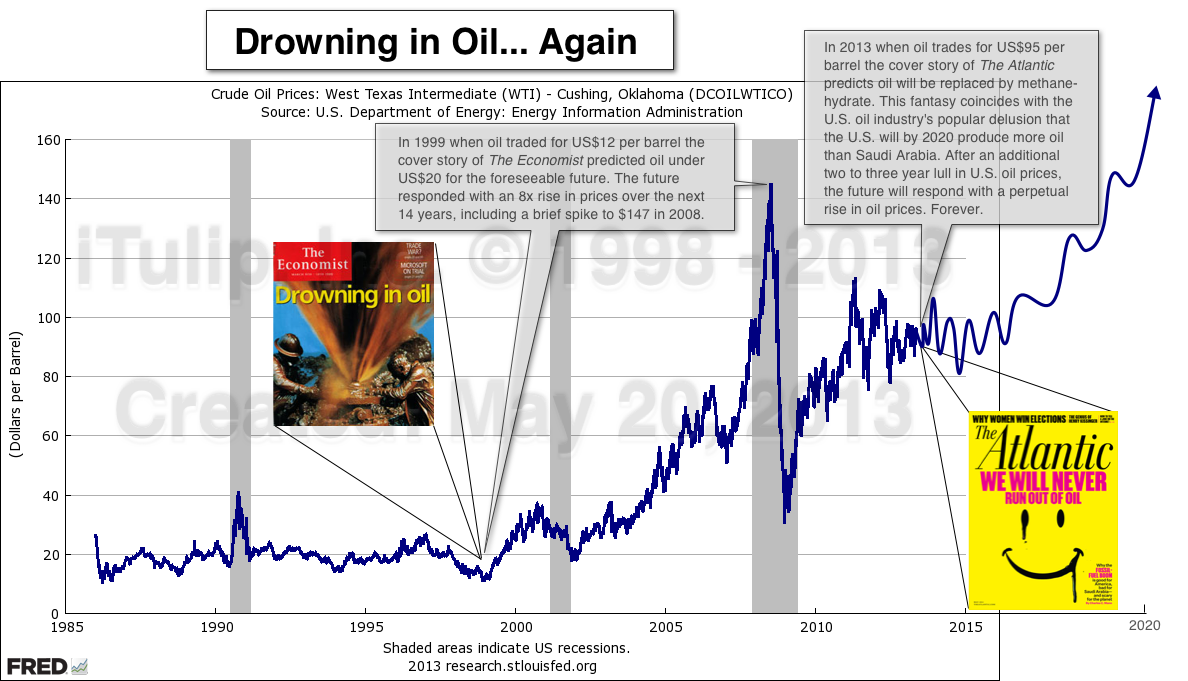

The media has extrapolated this expensive and temporary boost in domestic production into a permanent trend toward U.S. oil independence. The hype is approaching a level not seen since the famous “Drowning in Oil” cover article of The Economist in 1999, unfortunately for that publication’s reputation, published around the time PCO began.

Within a few years the short-term trend of flat WTI oil prices will reverse and rejoin Brent in the long-term inexorable PCO trend upward.

As uneconomic shale oil plays peter out, U.S. domestic oil production will plummet.

Oil imports will rise and gold prices will rise, too, as USD reserves overseas are again less “good as gold for oil” than they are today.

Except this time it will be a one way trip, implying a rising gold price unless an alternative USD hedging arrangement is devised.

The mechanism of a rising GAGFO and falling gold prices is more complex than I am describing here in this outline. In Part II we delve into the way various players in the gold market responded to events.

The Post-Market Economy – Part II: The Crash of 2014 (more... $ubscription)

The fuse on the $34 trillion bond market bomb gets lit at a 10-Year UST rate over 3%. Duration is not your friend.

• Bernanke’s exit stage left and the Crash of 2014

• China’s controlled credit supernova

• The shale oil mirage and the GAGFO gold trade: How low can it go?

• State of the U.S. economy

• Japan’s too little, too late attempt at The Foolproof Way out of deflation

• Too expensive: Tesla’s Cost-of-Goods and CapEx conundrum

• Too cheap: Coal

• A bunch of charts and comments in no particular order

Bernanke’s exit stage left and the Great Crash of 2014

What is the market price for a U.S. Treasury Bond (UST) today? Who knows? The Fed has held bond prices up and yields down for so long through its price fixing – ahem – “yield curve shaping” and QE operations that trying to determine a market price of UST is like guessing at the market price of copper pipe after the government has spent five years filling two dozen warehouses with it to keep the price up, and is promising to keep at it.

One thing is certain in my view: interest rates have been suppressed for so long that when the artificial scarcity ends and bonds are finally marked-to-market the re-pricing will be sudden and violent.

Who will want to own copper pipe once the Fed throws open the warehouse doors? The market will rationally back-track prices fully to the start. Interest rates will adjust accordingly.

Last week Bernanke hinted that the Fed’s pipe buying binge might end some day. The bond market answered by selling off and sending rates through the roof.

What are they thinking?

At meetings I’ve attended I get the distinct impression that they believe that they can modulate this tendency of markets to efficiently price in the total amount of the price distortion produced by government bond price supports. They think they have their hands on a variable control knob and they can control the rate of the price re-adjustment.

But it’s not a potentiometer. It’s a switch. On or off. Binary.

What will they do? Switch it on and off a few times until they figure out that it’s a switch. Then it’s back to the drawing board to come up with another way to reverse the price fixing operation.

Not Mr. Bernanke, though. He’ll be long gone before that in the great tradition of Fed chair transitions: dump your mistakes on the next guy

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2012 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Faith can overcome evidence but not forever.

Two trends will be with us for the next 20 years:

Inexorable Trend #1: Peak Cheap Credit

Inexorable Trend #2: Peak Cheap Oil

Within these two long term trends, the latest diversions

• Late gold investors on board since 2008 exit market as the USD again becomes GAGFO as Europe, Japan, and China falter

• Credit Bubble temporarily reflated

• Stock market temporarily levitated

• U.S. oil import trade deficit and dollar crisis temporarily averted

• Housing market temporarily… you get the idea

Six months. That’s how long we’ve wrestled this greased pig, this drunken monkey, this long, stinky cat running for its life barely inches ahead of a pack of rabid coyotes.

These markets. This economy.

Sheesh.

The problem is not in understanding human nature. That never changes.

We want. We hope. We kid ourselves.

We fuss about the house. Fix the broken gutter, the rotted trim, the chipped paint, the cracked concrete step. But our hair is on fire.

We don’t notice. No one told us and there are no mirrors on Planet ZIRP.

No, we understand human nature. Humans want and what we want more than anything is to be told what to believe.

A story that makes sense of the world, that puts it all together in logical order with a happy ending.

The good and hard working, the brave, the smart, and the righteous, will prevail.

“We” deserve to win, don’t we?

Except those are not the rules on Planet ZIRP.

I get this all the time. The questions.

What’s with the stock market? Bonds? Housing? Gold?

My answer: Do you really want to know?

We exited stock mutual funds, stock indexes, and individual tech stocks in the spring of 2000.

The S&P500, even at the peak of the latest Fed financed reflation rally – trillions in the bargain – is in real terms still 20% below that heady top 13 years ago.

In that year of 2000, so long ago, Requiem for a Dream, American Psycho, and Memento played in theaters. A gallon of regular went for $1.40 and a share of Corning for $110. Gold traded at $270 and oil for $30. The unemployment rate was 4%.

That was in a different time and place. That was before, way back there.

And now? Now gasoline is $3.50 and GLW trades for $14, gold is $1200, oil $95, and the unemployment rate is 6.7%.

Hardly anyone remembers any of this.

Running this site for so many years I’m Leonard Shelby, posting snapshots and graphs to cope with our readers’ anterograde amnesia induced by a business media compelled by intense competition to chase the brightest shiny object that best attracts and holds media consumer attention from one hour to the next. As our economy hurls through time and space events appear out the window as a rush of disconnected images, as if events occur at random with no process, no direction, no eventuality.

Take another look at the chart above. Clearly something went wrong in the engine room of the economy around 1996 as reflected in the stock index price rise inflection.

What was it?

A steady flow of bond market refi cash pumped the economy up from the starting point of high interest rates and low inflation from 1983 to 1990. But that wasn’t good enough for our ambitious Fed chairman Alan Greenspan. No, he wanted more. He wanted asset price inflation, a hyper-flow of money into the markets to use as political leverage, produced by a combination of ultra-low rates and the careless mixing (via banking deregulation) of liquidity-based speculative investing with staid bank finance.

Greenspan tried to modulate his monster in 1993. Failing that he shrugged, stood back, and we got it in spades from 1996 to 2000.

Our current course was then set. Once speculative markets are inflated with credit economic expectations cannot be reset. From a political standpoint, an asset bubble-based economy once inflated it must be reflated over and over.

From a practical standpoint? Well, we shall see.

The Federal Reserve, the unelected pilot of our political economy, took this wrong turn in 1990 and set us on course to Planet ZIRP where we are today.

After that first bubble collapsed in 2000 the Fed and legislature, the former by monetary policy and the latter by fiscal policy, reflated it not once but twice since, as anyone can see by looking at the chart above. But reflating that first bubble a second time took everything they had.

The Fed put in five years of mad experimentation in the engine room of the U.S. economy since late 2008. The most lunatic gambit was the short-circuiting of normal bond market price signals to keep the credit engines running full throttle.

This year they at last achieved their goal of a second asset price reflation of the original 1996 to 2000 asset bubble, the recognition of which led to the founding of this site 15 years ago.

How much longer can they keep it humming? Possibly until the end of 2013, but absolutely not until the end of 2014. After Bernanke leaves and Yellen takes over in December of next year, the lugging, the pre-ignition popping, and the grinding of gears, begins.

That’s the game plan, if you’re Ben Bernanke.

In Part II we review the troubled history of Fed chair transitions. Imperial power transitions in archaic dictatorships appear smooth and benign by comparison.

2014 is the year that the $34 trillion USD bond market bomb, fused by ultra-low interest rates,

gets tossed to the next Fed chair. Good luck with that, Janet.

Look at the stock market chart above, please, one more time. Given the history, does the stock market so presented appeal to any reasonable person’s conception of “cheap”? What could possibly go wrong?

But if not stocks, then what is cheap? In Part II we tour the asset classes in search of the beaten down and derided that due to the two Inexorable Trends must rise again.

In a credit inflation produced by a central bank engaged in bond price fixing for years on end, how can investors tease apart the credit-financed holograms from the solid objects, the daydream from the day?

Disoriented we are left to go on instinct, on gut.

The thing is, gut is as reliable on Planet ZIRP as a compass in space. Not even gravity works the same. Pour water in a glass and it fills top to bottom. Pitch a ball and it circles the planet forever. Get off of your bicycle and it doesn’t fall over but stands like a statue in place.

Our human nature, our tendency to adapt to the absurd, leads us astray on ZIRP. We look for what we expect to see and see it for the wanting. On planet ZIRP, that is a dangerous habit.

We need to filter out that which only makes sense in a world created by central banks with a political mandate to keep asset prices inflated. For example, Tesla Motors.

If you thought public venture capital died with pets.com and the NASDAQ bubble look no further than Tesla Motors.

Tesla’s $100,000 Electric muscle car marvel needs a six-hour nap every 200 miles but that hasn’t kept thousands of green fashion conscious winners in Bernanke’s stock and bond market lottery from buying them and investors from pushing TSLA stock up to nearly a quarter of GM’s market cap.

Really 23% of GM's market cap? Have TSLA investors noticed that Tesla’s sales are literally a rounding error on GM’s balance sheet, 0.62% of GM’s sales to be exact?

What’s that, TSLA shareholders? I don’t get it? Get what? Oh, right. Musk is a genius and GM is a tired old brand. Tesla is a growth stock, the future. Okay. Thank you for the explanation.

Here on Planet ZIRP Tesla Motors makes perfect sense. One part engineering genius, two parts marketing panache, one part government industrial welfare recipient, and four parts central bank QE beneficiary. A sexy high tech aluminum sculpture of silicon, wires, batteries and bullshit. In Part II we delve into Tesla in detail as the company and the stock emblematically reflect the mindset of investors whose judgment has been thrown off by 15 years of asset price manipulation by central banks.

Like gravity, facts don’t operate well on Planet ZIRP. Facts are suspect. Lengthy, detailed explanations like this one are eschewed. Who has the time? A short, well-delivered opinion is preferred.

A show, a rant, a sly performance put on by an authority. A tipster. A man in the know.

Deep voice, cleft chin, broad shoulders, piercing eyes. For a few bucks he’ll let us in on his secret.

Or bald and yelling, honking horns and throwing chairs. Between the antics watch the brokerage ads that pay for the show.

Don’t forget to trade.

The opinions we most prefer from him comfort and reassure us in our confusion and loss for words.

Neglect to buy gold before the price reached $500? Relax, says the credentialed equities salesman of the financial products division of the FIRE Economy business media. You didn’t miss anything. Gold’s days are over.

On Planet ZIRP the FIRE Economy – the economy of fees and interest payments on money – is the economy.

The real economy of profits from value-add production, which profits pay the wages and salaries of employees, which wages and salaries finance consumption -- previously known simply as “The Economy” -- is secondary.

The man in the know has a half-baked theory to explain the 2013 gold price correction, never mind that he had no theory of gold’s continuous 10-year rise from 2001 to 2011.

What does he know about gold? That gold was a bubble that popped, or pooped, or something.

That’s another thing we insist on from our man in the know on Planet ZIRP: no complicated explanations, please.

Gold is a bubble and Moby Dick is a book about a whale. Yes, that will do.

Floating miles above ZIRP and looking down, seeing analytically with emotional distance, we can see what actually happened or rather what is happening to gold.

As simply as I can put it, it goes like this.

The U.S. dollar as “good as gold for oil” or not

At the dawn of the industrial age the industrial state became dependent on a continuous supply of a single commodity without which any such state will fail in short order: oil.

Further, if that state cannot meet its own oil demand with domestic supply it must import oil. As most states are not oil producers, most states are oil importers.

Further, as the U.S. dollar is the primary parallel currency used by all nations to buy and sell oil, all countries that import oil must maintain USD reserves sufficient to cover oil import payments over a prescribed period of time.

Gold and oil are connected through the International Monetary System (IMS) where the USD is made as “good as gold for oil”

via fractional gold backing on reserve account of central banks.

Global central banks maintain a fixed ratio of gold to USD reserves by value to guarantee payments for oil imports for a set length of time should the USD fail the test of time as a store of value and render it useless as a medium of payment for oil imports. As the USD price of oil rises and falls, so too does the gold price, perfectly hedging USD reserves in a critical amount of USD volume of oil imports for each participating nation.

The USD was “good as gold for oil” or GAGFO for short, from 1985 until 2000, for 15 years out of the past century, since industrialized nations became dependent on the one and only high energy density liquid suitable for use as a scalable transportation fuel.

Before 1971, USD held as reserves by central banks could be redeemed for gold held by the U.S. Treasury per the international gold standard system agreed on by the international community at Bretton Woods in 1944. Fiscal and monetary mismanagement combined with a balance of payments deficit and a weakening USD in the 1960s forced the U.S. to abandon the international gold redemption system in 1971. Suddenly, USD reserves were no longer guaranteed by being redeemable for U.S. gold. The USD was no longer GAGFO.

An irredeemable USD might have retained GAGFO status if the fiscal and monetary malfeasance that drove the U.S. off the Bretton Woods system had been corrected. But they were not. Instead the errors were perpetuated until high inflation compounded the sins of the issuer of the world’s parallel currency. Even though gold was no longer an official part of the IMS, gold on reserve account at central banks tracked the fast-rising price of oil priced in USD, as you can see in the chart above.

Application of the Monetary Sledgehammer by the Fed under chairman Paul Volcker and subsequent monetary discipline gave the world a 15-year period when the USD was once again “good as gold for oil.” That brief monetary nirvana lasted until three strikes against the U.S. eroded the status of the USD as GAGFO starting in the year 2000.

The first strike was the equity bubble collapse in 2000. With that spectacle of monetary malfeasance and regulatory chicanery the U.S., in the eyes of the world’s central bankers, ceased to be a beacon of light in a dark sea of economic vulgarity.

The Fed under the iniquitous leadership of Alan Greenspan had colluded with financial sector elites – guys like Robert Rubin and Larry Summers – to use asset price inflation as a tool of political economic policy.

President Clinton famously cut a deal with Greenspan to get a second term: reduce the federal budget deficit with defense spending cuts in exchange for low interest rates and “market liberalization.” The former channeled a river of money into securities markets while the latter produced a thick stack of Get Out of Jail Free cards for Greenspan’s former Wall Street clients in the investment banking industry who scooped them up.

The resulting extraordinary capital gains tax receipts coupled with minimalist defense spending produced the last budget surplus we’re likely to see in our lifetimes.

Of course the bubble popped -- and right when we said it would in the spring of 2000. The economy shrank and the surplus evaporated.

For foreign holders of USD denominated U.S. Treasury Bonds (UST) this egregious display of political venality was Strike One for the USD as “good as gold for oil.”

The degeneration of the USD as GAGFO began.

A year or so after Greenspan’s stock market bubble collapsed, Strike Two in the form of Peak Cheap Oil (PCO) arrived.

PCO is a concept I developed in 2006 to address the question of how the economy and markets were to react to a steady decline in the quality and quantity of the world oil endowment as it is used up from best to worst, and from easiest to hardest to access.

The obvious implication of PCO is that the price of oil will rise. But within that long-term, inexorable trend are short-term exorable diversions.

To wit: Fortress America, an idea we started to use here two years ago to describe the shift in the U.S. foreign policy approach to get what we in the U.S. want from the world generally and from oil producers specifically.

Under the Fortress America policy framework, U.S. oil companies ditched uneconomical foreign energy projects to return home to increase domestic oil and gas supplies to meet the political objective of the Obama administration to reduce energy imports.

But before that, from 2001 to 2011, an ever-rising oil price – on average 15% per year –accelerated the U.S. oil trade deficit. That put foreign holders of USD reserves for oil on edge.

From 1990 to 2001, U.S. net oil imports doubled from 4 million to 8 million barrels per day.

The oil trade deficit doubled but this increase did not worry foreign UST holders because oil prices were stable.

Then oil imports increased from 8 million to 10 million barrels as oil prices tripped from $20 to $60.

At the peak of oil imports volume and price in 2008, the U.S. was shelling out $110 a barrel

for 9 million barrels of oil or around $1 billion per day.

The combination of the rising oil price and rising oil trade deficit was Strike Two for a USD “as good as gold for oil.” As from 1971 to 1983 gold on reserve account again tracked the USD oil price as can be seen in the Gold vs Oil chart above. This occurred even in the absence of the kind of all-goods price inflation that happened in the U.S. from 1971 to 1980. We discuss the mechanism of this correlation in Part II.

Then in 2007 the U.S. securitized mortgage debt bubble popped and launched the American Financial Crisis that crashed the world economy.

How to make enemies and influence people badly: Grow a multi-trillion dollar financial bubble then smash the world economy when it collapses.

With the U.S. economy in free-fall, unemployment skyrocketing, and incomes and tax receipts plummeting, the U.S. government went hat in hand to its largest creditors and politely asked if they’d be kind enough to buy about $1 trillion in U.S. Treasury bonds so as to finance the reflation of the U.S. economy to prevent a second Great Depression, please?

That was USD “good as gold for oil” Strike Three.

At that the central banks of the world’s largest economies decided that a country that issues the world’s primary parallel currency cannot also be the same country that repeatedly engages in dangerous large-scale financial speculation with that currency, and also runs an oil trade deficit to the tune of 3% of GDP.

Collectively they told the U.S., “Get your act together. In the mean time we’ll increase gold holdings to hedge our USD holdings just in case you don’t or can’t.” For the first time since the 1970s, central banks became net gold buyers in Q2 2009.

With that background we are finally ready to ask the question, Why did the gold price level off in 2011 and drop precipitously in 2013?

GAGFO as Market Variable

Turns out that GAGFO is a variable. That is, the degree to which the dollar is as “good as gold for oil” changes in response to oil prices, trade flows, demand, exchange rates, and other economic changes. We believe that we have perhaps devised a way to measure GAGFO. Unfortunately, we didn’t devise it before the gold price fell, but we think this tool will help us going forward. While the formula is proprietary in Part II we give a theoretical overview of the GAGFO variable and a How Low can Gold Go? estimate on the gold price in the current pricing environment based on it.

For the sake of simplicity, say the output of our GAGFO “black box” value generator is a scale from 1 to 10, with 10 representing a USD that is viewed as exactly GAGFO, with 5 representing a USD that is imperfectly GAGFO, and a 1 as the condition of the USD as not at all trusted to cover oil imports for a “period of necessity.” The U.S. covers this exigency in a unique way, first by holding far more gold than any other country – more than 8,000 tons – and second by hoarding oil in a 700 million barrel strategic reserve that is more than ten times as large as all other national strategic oil reserves combined (60 million barrels). It's enough to cover all politically risked U.S. oil imports for a year.

What can the U.S. do to improve the GAGFO status of the USD, resulting in a reduction of the gold price on reserve account of central banks?

The U.S. can lower its budget deficit by generating more tax revenue from economic growth while reducing federal government spending. It can be relatively less frightening a place to invest than other countries in absolute terms. It can reduce its oil trade deficit by producing more oil domestically.

In the event the U.S. has done all three of these things since 2011.

Fortress America policy has been good for the dollar. If GAGFO was at a low point of, say, 3 in 2009, as of Q1 2013 it improved to a 5. Gold adjusted by falling from $1900 to $1200.

Of the three ways to improve the GAGFO status of the USD, the last one – reduced oil imports – has had the most profound impact.

Hundreds of billions of dollars invested in domestic exploration and production in the U.S. since 2003 finally started to pay off in 2006. Then the crash and recession cut demand starting in 2009. Then over-investment in U.S. oil production increased the operating onshore and offshore rig count seven-fold from 200 to 1400 between 2009 and 2012.

Hundreds of billions invested in domestic exploration and production in the U.S. since 2003 finally started to pay off in 2006. Then the crash and recession cut demand starting in 2009. Then over-investment in U.S. oil production increased the operating onshore and offshore rig count seven-fold from 200 to 1400 between 2009 and 2012.

The U.S. hasn’t produced this much oil since 1996, but it’s taking more than three times as many rigs now as it took back then to do it.

By the end of 2011, the one-two punch of lower demand and rising output cut U.S. net oil imports in half, to 5 million barrels per day from 10 million in 2006. For the first time on record the WTI (domestic) oil price diverged from the Brent (International) price. As oil imports declined the U.S. oil trade deficit fell with it.

But it won't last. Most of this intense oil production activity in the U.S. rather than adding to supply that was not accessible previously instead largely brings future production forward. New technology is producing some additional oil that was not formerly recoverable, but the ratio of previously recoverable old oil brought forward to new additional supply is estimated at about 80/20. That means the U.S. is using up its oil supply faster and at a lower price than if older production technologies had been used over a longer time period.

There is not more oil, we are just using faster.

The media has extrapolated this expensive and temporary boost in domestic production into a permanent trend toward U.S. oil independence. The hype is approaching a level not seen since the famous “Drowning in Oil” cover article of The Economist in 1999, unfortunately for that publication’s reputation, published around the time PCO began.

Within a few years the short-term trend of flat WTI oil prices will reverse and rejoin Brent in the long-term inexorable PCO trend upward.

As uneconomic shale oil plays peter out, U.S. domestic oil production will plummet.

Oil imports will rise and gold prices will rise, too, as USD reserves overseas are again less “good as gold for oil” than they are today.

Except this time it will be a one way trip, implying a rising gold price unless an alternative USD hedging arrangement is devised.

The mechanism of a rising GAGFO and falling gold prices is more complex than I am describing here in this outline. In Part II we delve into the way various players in the gold market responded to events.

The Post-Market Economy – Part II: The Crash of 2014 (more... $ubscription)

The fuse on the $34 trillion bond market bomb gets lit at a 10-Year UST rate over 3%. Duration is not your friend.

• Bernanke’s exit stage left and the Crash of 2014

• China’s controlled credit supernova

• The shale oil mirage and the GAGFO gold trade: How low can it go?

• State of the U.S. economy

• Japan’s too little, too late attempt at The Foolproof Way out of deflation

• Too expensive: Tesla’s Cost-of-Goods and CapEx conundrum

• Too cheap: Coal

• A bunch of charts and comments in no particular order

Bernanke’s exit stage left and the Great Crash of 2014

What is the market price for a U.S. Treasury Bond (UST) today? Who knows? The Fed has held bond prices up and yields down for so long through its price fixing – ahem – “yield curve shaping” and QE operations that trying to determine a market price of UST is like guessing at the market price of copper pipe after the government has spent five years filling two dozen warehouses with it to keep the price up, and is promising to keep at it.

One thing is certain in my view: interest rates have been suppressed for so long that when the artificial scarcity ends and bonds are finally marked-to-market the re-pricing will be sudden and violent.

Who will want to own copper pipe once the Fed throws open the warehouse doors? The market will rationally back-track prices fully to the start. Interest rates will adjust accordingly.

Last week Bernanke hinted that the Fed’s pipe buying binge might end some day. The bond market answered by selling off and sending rates through the roof.

What are they thinking?

At meetings I’ve attended I get the distinct impression that they believe that they can modulate this tendency of markets to efficiently price in the total amount of the price distortion produced by government bond price supports. They think they have their hands on a variable control knob and they can control the rate of the price re-adjustment.

But it’s not a potentiometer. It’s a switch. On or off. Binary.

What will they do? Switch it on and off a few times until they figure out that it’s a switch. Then it’s back to the drawing board to come up with another way to reverse the price fixing operation.

Not Mr. Bernanke, though. He’ll be long gone before that in the great tradition of Fed chair transitions: dump your mistakes on the next guy

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2012 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment