Economics is not hard - Part I: Don’t let professional economists tell you otherwise

Follow the money, let the data lead you, stay independent, and accept the fact that the political economy is not quantifiable

In his impetuous missive “Economics is Hard. Don’t Let Bloggers Tell You Otherwise” Richmond Fed researcher Kartik Athreya goes after the economics blogging community like a blindfolded kid batting a piñata full of hornets. He received a series of predictably stinging responses. Presenting his own views and not those of his employer, he argued that bloggers practicing economics without a license have sent millions of unsuspecting economics consumers to hell in a hand basket of “incoherent or misleading” advice.

Economics is brain surgery, you see. Don’t let one of these freelance practitioners of the dismal science inside your skull. They’ll leave it scrambled and confused, he warns in an appeal to “open-minded consumers of the economics blogosphere.”

Athreya wants us to believe that a PhD in economics is an effective prophylactic against consumer quality violations. But the argument is a tough sell after a decade of economic booms and busts that taught the American public the hard way that accreditation offers no measure of protection to consumers of the output of professional economic analysts.

In fact, the failures and foibles of the macroeconomics profession created the market for economics bloggers in the first place.

License to kill your portfolio and your economic future

Let’s compare the economic forecasts of this non-credentialed economics blogger to the top economists who run the outfit that signs Athreya’s paycheck, the Federal Reserve.

"But bubbles generally are perceptible only after the fact. To spot a bubble in advance requires a judgment that hundreds of thousands of informed investors have it all wrong."

- Testimony of Federal Reserve Chairman Alan Greenspan, Joint Economic Committee, U.S. Congress, June 1999

“Right now he [Greenspan] is enjoying a reputation as the smartest central banker in history. But he's making nearly the same mistakes as his predecessors in the 1920s, providing too much liquidity at the wrong time, fueling a speculative mania during a time of rapid technological innovation. What will be learned from this -- again -- is that the Fed's interest rate and money supply moves can distort the market's utilization of capital, leading to credit and asset value excesses and a bust. Greenspan will not go down in history as a hero.”

- Eric Janszen, iTulip.com, January 1999

[A recession caused by a collapse of the housing bubble] is a pretty unlikely possibility. We've never had a decline in house prices on a nationwide basis. So what I think is more likely is that house prices will slow, maybe stabilize – might slow consumption spending a bit. I don't think it's going to drive the economy too far from its full employment path, though.

- Fed Chairman Ben Bernanke, July 2007

“Fact is, housing bubbles, like stock market bubbles, are not at all hard to spot. Granted they are politically challenging to discuss in public, especially when they are needed to prevent the aftermath of a previous monetary disaster, the 1990s stock market bubble, from dragging the real economy into a deflationary depression. The historical average for the cost of a mortgage is 25% of gross income. That's what the banks used to recommend before they got desperate for households to sell mortgages to. In a bubbly real estate market like Boston's today the average mortgage has reached 44% of income. That's a housing bubble. Period.”

- Eric Janszen, iTulip.com, August 2002

“The recession that starts in 2007 from the combined housing, private-equity, hedge fund, and foreign investment market corrections will be major. The stock market along with many inflated asset classes will follow. Maybe the Gods will be laughing in 2007, but a lot of homeowners and investors won't be."

- Eric Janszen, iTulip.com, January 2006

Consumers can be forgiven for concluding that professional economics training is a kind of indoctrination into the Academy of Data-blindness and Bad Forecasting, but the root cause of the record for inaccuracy is not methodological but political. - Testimony of Federal Reserve Chairman Alan Greenspan, Joint Economic Committee, U.S. Congress, June 1999

“Right now he [Greenspan] is enjoying a reputation as the smartest central banker in history. But he's making nearly the same mistakes as his predecessors in the 1920s, providing too much liquidity at the wrong time, fueling a speculative mania during a time of rapid technological innovation. What will be learned from this -- again -- is that the Fed's interest rate and money supply moves can distort the market's utilization of capital, leading to credit and asset value excesses and a bust. Greenspan will not go down in history as a hero.”

- Eric Janszen, iTulip.com, January 1999

[A recession caused by a collapse of the housing bubble] is a pretty unlikely possibility. We've never had a decline in house prices on a nationwide basis. So what I think is more likely is that house prices will slow, maybe stabilize – might slow consumption spending a bit. I don't think it's going to drive the economy too far from its full employment path, though.

- Fed Chairman Ben Bernanke, July 2007

“Fact is, housing bubbles, like stock market bubbles, are not at all hard to spot. Granted they are politically challenging to discuss in public, especially when they are needed to prevent the aftermath of a previous monetary disaster, the 1990s stock market bubble, from dragging the real economy into a deflationary depression. The historical average for the cost of a mortgage is 25% of gross income. That's what the banks used to recommend before they got desperate for households to sell mortgages to. In a bubbly real estate market like Boston's today the average mortgage has reached 44% of income. That's a housing bubble. Period.”

- Eric Janszen, iTulip.com, August 2002

“The recession that starts in 2007 from the combined housing, private-equity, hedge fund, and foreign investment market corrections will be major. The stock market along with many inflated asset classes will follow. Maybe the Gods will be laughing in 2007, but a lot of homeowners and investors won't be."

- Eric Janszen, iTulip.com, January 2006

Plausible quasi-scientific formulas that are supposed to describe human and institutional behavior that is heavily influenced by the actions of government actors and government subsidized industries coat the politically motivated opinions of mainstream economics in a fine patina of disinterestedness and respectability. Time and time again over the past decade, optimistic forecasts that were favorable to vested interests, that thinly obscured obvious economic pre-conditions to crisis, were blown away by economic realities.

The certified financial planner was authorized, or rather trained, to repeat Wall Street financial product marketing slogans like “buy-and-hold” dressed as professional investment advice, leading millions of retail stock investors to make costly investment mistakes from which Wall Street firms profited. Similarly, a PhD in economics licensed the unaccountable to interpret economic data and events in ways that proved to be little more than sales pitches for economic policies friendly to FIRE Economy interests.

Trillions of dollars in net worth losses and untold personal hardship for millions of Americans is their legacy.

Consumers turned to disinterested, non-credentialed economics bloggers for an alternative. iTulip.com started in 1998, well before the end of the first excess credit-induced faux economic boom of the late 1990s ended. Athreya writes about us, apparently without a hint of self-doubt you’d expect from an employee of one of the least respected institutions of central banking:

“Some of them have great ideas, for sure. But this is irrelevant. The real issue is that there is extremely low likelihood that the speculations of the untrained, on a topic almost pathologically riddled by dynamic considerations and feedback effects, will offer anything new. Moreover, there is a substantial likelihood that it will instead offer something incoherent or misleading. Note also that intelligence is not the issue. Many of those I am telling you not to listen to will more than successfully be able to match wits, in any generalized sense, with me. This is irrelevant. The question is: can they provide you, the reader, with an internally consistent analysis of a dynamic system subject to random shocks populated by thoughtful actors whose collective actions must be rendered feasible?”

Wrong question. The right question is, Why did economics bloggers appear in the years after the collapse of the tech bubble in the early 2000s and flourish during the rise of the housing bubble starting in 2002? Answer: to fill the vacuum created by the professional economics community that repeatedly failed to protect consumers from the ravages of not one but two asset bubbles in ten years that resulted in the greatest wealth transfer in world history and the near dismantling of the remnants of the world’s once most productive economy. “What’s your name and who do you work for?” – Hunter Thomson

To understand where Athreya is coming from, here are the four ways economics is performed for an audience in the United States.

First and ubiquitous is macroeconomics as Sales and Marketing of financial products. The object is to pitch a financial product such as mortgage debt as homeownership, stocks as volatile but high long-term gains, and bonds as “safe” by painting a macro-economic picture that calls readers to log into their brokerage account and purchase the financial product sold by the fund or firm for gain or wealth preservation. This editorial arrangement is popularly referred to as “talking your book.”

The best at it appear to be talking philosophically, like a sports announcer commenting on the possibility that a player’s recent injury may hurt the team’s chances for a victory, except that in the case of the economist as pitchman the commentator’s patron has money riding on the opposing team’s loss.

Bond funds sell a risky, low inflation future of high unemployment, sub-par economic growth, weak earnings, and a stagnant or declining stock market. Commodity funds sell supply shortages and rising global demand, and some also sell inflation from monetary and fiscal mismanagement. Optimistic gold funds sell a future of high inflation and depreciating currencies while pessimistic ones sell a Mad Max to Blade Runner outlook, possibly depending on whether the firm’s setting is urban or country.

As Oprah Winfrey once said of public speakers, “They’ll never remember what you said, but they will remember how you made them feel.” No one understands this better than the purveyors of Sales and Marketing macroeconomics. This field is dominated by the most theatrical commentators, from Jim Rogers and Peter Schiff on the Right to, well, no one on the Left. As Michael Hudson told us years ago, the Left doesn’t have an economic theory, only a social theory; the failure of socialism in the 1980s left the Left without a macroeconomic stand to hang a hat on. Among the financial products sales people are also the most erudite economists, such as PIMCO’s Bill Gross.

This group typically has the worst forecasting track record of all categories of macroeconomic analyst but few notice because readers and viewers are too busy jabbing the air with their fist and yelling “damn right!” as they react to a quip about evil bankers or incompetent government officials. There are many exceptions, such as is the Prudent Bear Fund’s Doug Noland who has doggedly tracked and forecast the credit markets week after week, year after year, in his Credit Bubble Bulletin for almost as long as iTulip has been around. The commentary is dry and data-packed. Who the hell wants that? Give me entertainment! Give me Jim Cramer!

That leads us to the second way to do macroeconomics in America, as economics performance artist for the trading and brokerage firms that sponsor investment-related online publications and TV shows. Not surprisingly, the content and programming is geared to trading and away from long-term investing. The producers don’t care if guests appearing on these shows and sites push stocks, bonds, or ETFs provided that the commentary suggests a trade – any trade – that gets viewers out of what they are in and into something else, to generate fees for the trading firms and brokerages that are paying for the show. You will rarely if ever hear the “C” word “cash” uttered. It doesn’t matter if guests are right or wrong. In fact, wrong is better because then the guest has to come back on the air later to correct the previous error — which, of course, requires another trade. Track record is irrelevant. No interviewer will ever ask; guests are not there to be right; they are there to incite the audience to trade.

The third form of macroeconomics practice is delivered by the hedge fund analyst. He or she is not wedded to any particular asset class, except perhaps by reputation or ideology, and instead invests the fund in a mix of asset classes according to the investment thesis implied by the analyst’s macroeconomic forecasts. The hedge fund economic analyst is among the most accountable and independent of any the consumer will encounter because if a fund manager is wrong that fact is quickly reflected in the performance of the fund, and if they are wrong more than once or twice their investors will exit the fund and they’ll go out of business.

The challenge for the consumer is finding hedge fund managers who are not one hit wonders; the skill set that was required to characterize and time one major market event may not be the same skill set needed to understand the next macroeconomic turn. Also, many but not all hedge fund managers have political or intellectual biases that get them into trouble. I know libertarian-minded hedge fund managers who have fallen deep into the “should” trap, as in Treasury bonds “should” decline and the dollar “should” crash.

“Should” is the most dangerous word in investing. Treasury bonds “should” not rise, say the Treasury bond bears who note the hair raising rise in the US debt-to-GDP ratio during the financial crisis, but that ratio is not the most important factor deciding the price of US debt during a global financial crisis; demand is, and that’s why we stayed in them. By the same token gold “should” not be up by a factor of four since 2001 when we bought it, and would not be if not for the currency risk created by the actions of governments to reflate busted economies. The best hedge fund managers I know understand this. Unfortunately for the average retail investor, they cannot participate in these hedge funds; the SEC keeps the recipients of the Sales and Marketing of FIRE Economy financial products out of the market for alternative financial products.

That takes us to the fourth and final way to perform macroeconomics, as an independent analyst working for paid subscribers. The analyst tries to figure out what happened, what’s going on now, and what’s likely to happen n the future no matter the implications for any particular asset class, whether the news is bad for stocks, bonds, commodities, real estate, or precious metals. The analysis is usually delivered in the form of a newsletter that suggests positions in various asset classes that are available to retail investors through a brokerage account.

The independent economics analyst offends everyone by failing either to align with the dominant ideology, such as the neo-Keynesian religion that Athreya’s employer follows, or mine a thick vein of anger and disillusionment that runs through an intellectually appealing but impossibly flawed counter-ideologies such as Austrian economics.

The primary objective of the independent economics analyst is to be right as often as possible because the independent analyst expects to be held accountable for his or her opinions. Track record matters, although it doesn’t hurt to have an entertaining writing and communication style. The secondary objective is to trade as little as possible to avoid transaction costs, such as brokerage fees and taxes, and to free the consumer up for more lucrative pursuits than trading, such as feeding ducks in the park or playing cards with the kids.

Your job as a consumer of economics analysis is to figure out which of these three types of economics you are consuming when you are reading economics from a web site or watching it on a TV show. Which group does Athreya belong to?

Accountable economics

Lack of independent sources of economic analysis through two disastrous asset bubbles and busts gave rise to the economics blogger that Kartik Athreya attacks for lack of credentials and professionalism. You didn’t need to be a professional economist to see what was going wrong during the bubble era. After being fooled not once but twice in ten years by mainstream economics analysis consumers now know that the economics profession is and has always been a tool of vested interests. The dismal science provides the ideal intellectual framework for representing the views of entrenched interests couched in the language of a dispassionate discipline like physics, as if human behavior and the decisions of politicians were as predictable as planetary orbits.

There are plenty of hacks in the economics blogging community, but this hardly distinguishes the amateur macro-economists from the professionals. Economics is not a science, nor does it need to be in order to allow the specialist to provide the one and only service of economics analysis that matters to consumers: accurate forecasts of future economic conditions in order to help them make informed decisions in their own self interest.

Good economics is accountable economics. Forecasting accuracy matters. But accurate forecasting cannot, paradoxically, be achieved by traditional economic analysis methods. Stylized, some may say unprofessional techniques of economic analysis are required. Data-driven analysis must be interpreted in the context of the economic policy paradigm that determines the economic outcomes.

The best professional economists I know used quantitative analysis to predict the financial crisis and debt deflation that followed the massive credit bubble and asset price inflation of the 2002 to 2007 period, much as we did in 2006 using our own methods. We translated a financial crisis forecast into a specific opinion to get out of the stock market in December 2007. But the excessive focus on quantitative analysis led even these economists who got the financial crisis forecast right to get the debt deflation outcome wrong. Excessive focus on the numbers led to erroneous forecasts of an out-of-control deflation spiral while our method of combining quantitative and qualitative analysis forecast a brief period of deflation quickly followed within a months by a resumption of pre-crisis inflation rates. Our forecasts also predict a period of dollar depreciation and high import price inflation once public liabilities begin to weigh on credit and currency markets. The challenge from here it to determine when that is likely to happen.

To the quants, reflation appeared mathematically impossible; they expected asset price deflation in the FIRE Economy to spill over into commodity and wage prices in the Productive Economy as occurred in the 1930s, producing a sustained price deflation spiral. The sheer size of private debts in 2007 were beyond the scope of monetary and fiscal policy reflation, they argued. I argued the opposite, that both the tools and the will to reflate were in place to stop a deflation spiral.

Most macroeconomics analysts do not understand that modern economies operate like a sports match run by spectacularly heavy-handed management. During game play, odds makers can accurately assess the chances of a team winning based on the track records of the players and other statistics. But if the economic game is not going the way management wants, it will swap the players off the field for new ones mid-play, reset the score board, and say “carry on” to the dismay of economic odds-makers who then cry foul because the interference by central banks and governments made a mockery of their diligent forecasts.

Our success at forecasting a brief deflation out of the financial crisis does not guarantee that we can precisely time and forecast the long-term secondary effects of reflation policy. We are, however, certain that hyper-inflation is not in the cards because the tools and will to prevent it are just as present as those that halted a deflation process in 2009. That’s what the 8,000 tons of gold in the US Treasury is for, as a tool to halt a hyperinflation process should one ever threaten.

Being right about deflation mattered a great deal to investors in gold and commodities who avoided transaction costs and asset value losses incurred by anyone trading in and out of commodity positions. Contrary to Athreya’s argument, the only measure of validity of economic analysis is track record. All other considerations are unscientific and designed to obscure the obvious truth that the economics profession, and the ideology it adheres to through any epoch of the political economy, always has and always will serve the interests of the politically dominant economic group that controls the levers of monetary and economic policy.

Accuracy matters

I created iTulip.com in 1998 to counter the din of Wall Street pitches for stock sales during the stock market bubble. Remember when economist Abbey Joseph Cohen pitched the “no bubble” theme for Goldman Sachs during the stock market bubble from 1998 to 2000? Remember when economist Alan Greenspan lauded the “New Economy” to justify a NASDAQ bubble price level that, ten years later, remains 50% below its peak? If he’d raised margin requirements and pressed Congress to implement a one-year holding period for stock issues in new public stock offerings he’d have cut the bubble short before it became too big to pop. In fact, all he needed to do was pronounce emphatically in the Wall Street Journal that the stock market was a dangerous bubble and let his reputation and position of authority do the rest. But Greenspan was on the other side, pitching for the investment banks.

I restarted iTulip in March 2006 to warn readers about the risks posed by the excesses of the finance and real estate industries that threatened to wreck the portfolios and retirement plans of millions who were exposed to a steady diet of optimism and misdirection from official sources of economic analysis. I’ve never represented myself as an economist, but for the purpose of determining when to sell out of technology stocks from April to July 2000, buy Treasury bonds in 2000 and gold in 2001, a PhD in economics was unnecessary.

Here is the track record that my methods have produced over the past 12 years. I’d gladly put it up against Athreya’s or anyone else’s.

- November 1998: Warns on Internet Bubble

- August 1999: No Y2K Disaster

- November 1999: How the Internet Bubble Will End

- March 2000: Internet Bubble Top

- April 2000: A Bear Market is Born

- January 2001: Post-Bubble Recession

- September 2001: Gold Price Bottom at US$270

- August 2002: Warns of Housing Bubble

- January 2004: How Housing Bubble will End

- January 2005: Housing Bubble Correction

- June 2005: Housing Bubble Top, crash to follow that leads to severe recession

- October 2006: Severe recession starts Q4 2007

- December 27, 2007: Start of Debt Deflation Bear Market, 40% decline to follow

- June 16, 2008: Top of commercial real estate market, crash to follow

- September 15, 2008: Fed Funds spread signals crash

- March 27, 2009: Debt Deflation Bear Market: First Bounce

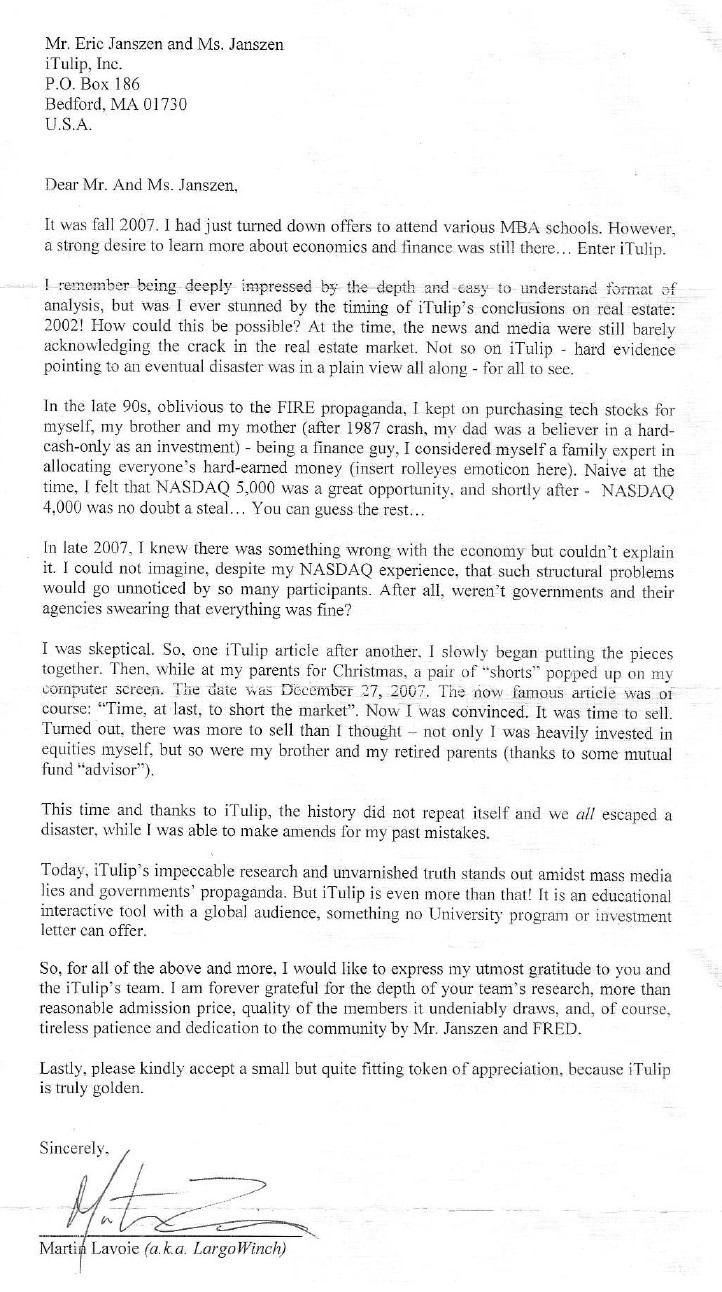

Did iTulip.com make a difference to its readers over the past 12 years? After the technology stock crash, we received dozens of letters like this one that you can read in the Letters section of the old iTulip.com site.

Dear iTulip.com,

As a long-time reader of your site I would like to commend you for the fine job you are doing. I am aware that you started this venture to poke fun at internet investors. Since that group is now more likely to be pitied than laughed at, you have chosen to take on the larger issue of investing by the little person. This is a much large role, one that demands a strong social conscience that is evident in your pieces. In other words, it appears as if you care what happens to Mr. and Mrs. Smith. The investment community, in large measure, does not care. How many apologies do you hear from the likes of Tom Galvin and Abby Cohen? I don't see them donating their bonuses to charity. Wall Street, as a business, lacks accountability to the society at large. Once again, I commend you for what you are doing. Somewhere, there should be a place where the carnival barker is accountable for the lousy show in the tent. I think you are that place. Keep up the fine work!

Michael S. April 15, 2001

And so we did, but only after cutting updates back to a minimum from 2002 to 2006, during the housing bubble era. We published only five articles during that period, starting “Yes, it’s a housing bubble” to note the fact of the housing bubble in August 2002 and my first note to readers in “Debtor Nations Dream of Deflation” to not expect a deflation spiral to result from the coming financial crash. But I didn’t crank iTulip.com back up again until March 2006 when we re-launched the site and started to issue warnings of “Peak Risk" culminating in our December 2007 “Time to short the stock market” notice to subscribers. As a long-time reader of your site I would like to commend you for the fine job you are doing. I am aware that you started this venture to poke fun at internet investors. Since that group is now more likely to be pitied than laughed at, you have chosen to take on the larger issue of investing by the little person. This is a much large role, one that demands a strong social conscience that is evident in your pieces. In other words, it appears as if you care what happens to Mr. and Mrs. Smith. The investment community, in large measure, does not care. How many apologies do you hear from the likes of Tom Galvin and Abby Cohen? I don't see them donating their bonuses to charity. Wall Street, as a business, lacks accountability to the society at large. Once again, I commend you for what you are doing. Somewhere, there should be a place where the carnival barker is accountable for the lousy show in the tent. I think you are that place. Keep up the fine work!

Michael S. April 15, 2001

By the end of 2008, we were again receiving letters from readers, such as this one publish with permission from the author.

“The comparison between the response of writers to the financial crisis and the silence that followed two cataclysmic events in another sphere of human life telling. These are, of course, the Tsunami in East Asia, and the recent earthquake in Haiti. These two events collectively took the lives of approximately half a million people, and disrupted many more. Each of these events alone, and certainly when combined, had larger consequences for human well-being than a crisis whose most palpable effect has been to lower employment to a rate that, at worst, still employs fully 85% of the total workforce of most developed nations. However, neither of these events was met by (i) a widespread condemnation of seismology, the organized scientific endeavor most closely “responsible” for our understanding of these events or (ii) a flurry of auto-didactics rushing to offer their own diagnosis for what had happened, and advice for how to avoid the next big one. Everyone understands that seismology is probably hard enough that one probably has little useful to say without first getting a PhD in it. The key is that macroeconomics, which involves aggregating the actions of millions to generate outcomes, where the constituents pieces are human beings, is probably every bit as hard. This is a message that would-be commentators just have to learn to accept.”

We don’t accept it. Seismology is a science; macroeconomics is not. Not even close. Our 12-year track record demonstrates that our approach, to analyze and forecast the political economy, succeeds where the methods of academic, numerological fantasy macro-economics consistently fails -- to protect the public from a politically interested economics practitioners who fraudulently present their art as science. With this in mind that we once again return to the task of trying to figure out what’s going to happen next. We reveal one of our methods that begins with the discovery of a data anomaly, follows with an exploration of the causes, and ends with an assessment of the implications.

Photo credit: Eric Janszen

Tree in front of home

Summer 2010

Economics is not hard - Part II: But accurate macroeconomic forecasting is

CI: Walk us through an iTulip “discovery process” as you called it in Part I.

EJ: Many of the insights we have come up with over the years begin with the discovery of a economic or market data anomaly. Maybe the correlation between two data sets that has held for many years suddenly stops correlating for no obvious reason, or two trends that have always confirmed each other no longer do. The next step is to see if anyone else has noticed this before, and if not develop a hypotheses to explain the change anomaly and then look for data to help test the hypotheses. Finally we try to explain the implications of the anomaly. What does it add to our understanding of how the economy works? What are the implications for our investment positions?

CI: And then you have a magic formula?

EJ: Not a formula but a with any luck a useful insight. There’s no magic to it but it is a lot of work. We might generate dozens of charts looking for an explanation for an anomaly and come up with nothing. I remember one particularly fruitless search for an explanation for an inflation data anomaly. It turned out that the BLS had changed the way they reported the data without documenting it the change. A phone call to the BLS cleared it up. We’ve probably thrown away a thousand charts and pages of analysis from explorations that turned up empty.

CI: You have one of these anomalies today to show us and why it exists?

EJ: This investigation started with a run through the iTulip tracking charts, the ones we’ve used to track the economy before, during, and after the Housing Bust Recession. more... $ubscription

Tulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2010 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment