|

Last week a financial journalist pinched off another one of those articles on gold that plops out of mainstream business press at least once a year. On the front page of the personal investing section of the Wall Street Journal, Larry Light published Catching The Gold Bug. Riddled with oft repeated disparaging characterizations and misrepresentations of fact, Larry didn't miss any of the dozens of gold bashing techniques I’ve seen over the years, including the obligatory invidious and inaccurate comparison of gold performance versus the stock market.

It’s as if the writers of these articles intend to make gold out to be a terrible investment so that investors will be inclined to buy more of the financial products that the Wall Street Journal sells for Wall Street—stocks, bonds, and real estate. Let’s set the record straight.

The article starts off well enough, with a quotation of a credible gold investor, a physician named Scott Van Steyn. Larry does Scott the favor of not painting him as an apocalypse freak hiding in a cabin in the deep woods with gold bars buried under the porch that he guards with a pack of pit bulls and an M14.

Worried about a harrowing, inflation-ridden future, Scott Van Steyn has found the answer in a batch of glittering one-ounce gold coins. In fact, they make up a large chunk of the physician’s assets.

“There’s 2,000 years of history to show that gold is the best thing to own during bad inflation,” says Dr. Van Steyn, a 45-year-old orthopedic surgeon in Columbus, Ohio. “People used to laugh at me for buying gold. They don’t anymore.”

I can relate to that. Back in 2001 when I wrote “Gold: Questioning Fashionable Investment Advice,” I caught holy hell from just about everyone. Friends, neighbors, business associates. Keeping in mind investors’ rule #1—buy cheap—I argued that 2001 was the right time to buy, after the collapse of the tech stock bubble when gold hit 20 year lows. A chorus of “deflation!” issued from central bankers at the time even as they turned the knob on the printing press from “Low” to “High” to “Crazy.” A 38% dollar devaluation ensued that took the dollar from over 110 in 2001 to under 70 by 2008. Some deflation. “There’s 2,000 years of history to show that gold is the best thing to own during bad inflation,” says Dr. Van Steyn, a 45-year-old orthopedic surgeon in Columbus, Ohio. “People used to laugh at me for buying gold. They don’t anymore.”

Dollar performance since the beginning of the first stage of the FIRE Economy in 1971: down.

The dollar has undergone a process of losing its status as the sole global reserve currency since 1971. As in the case of the pound sterling, the entire process may take 50 or 60 years.

The dollar has undergone a process of losing its status as the sole global reserve currency since 1971. As in the case of the pound sterling, the entire process may take 50 or 60 years.

Gold, the Fourth Currency, appreciated relative to dollars from 2001 to 2005, and later against all currencies between 2005 and 2008.

Chart from my keynote presentation to the Hard Assets Conference, Las Vegas 2007.

Among the few who did not give me a hard time about buying gold in 2001? My wife, thank you. When I told her I wanted to put 15% of our net worth into gold, and why, she responded, “Governments and their money come and go.”

She is Chinese. Not sure where it stands on the cultural to-do list, but protecting assets from desperate governments is up there, which explains the fact of a high savings rate in China and most Asian countries. Protection of the family's fortune from abuses by government, given an ignominious track record, is deeply embedded in Asian culture. A culture in continuous operation for a few thousand years can’t avoid accumulating wisdom.

Not so Larry and his editor who shoveled a few more loads onto the mountainous heap that has accumulated on the topic of gold over the years.

Bank bailouts. Micro-management of the U.S. auto industry. A run up of the fiscal deficit to more than 12% of GDP only a year after the Congressional Budget Office forecast deficits in the range of 4%. A crackdown on offshore tax havens.

None of this inspires confidence in the management of USA, Inc. nor in the future value of common shares in the Company, the U.S. dollar.

They bought gold.

So, Larry makes a fair point. But then he wanders down the well-worn stocks-bonds-real estate trade rag path, rattling off a list of gold ownership gotchas that, taken together, should make any reader feel good who has already made the mistake of not buying gold when it was cheap and seeks to compound it by not buying it before it gets even less cheap.

We are expected to believe that the 401K robber will put it back, but what if that does not happen for 20 years? Right about now it is dawning on millions of stock mutual fund investors that maybe they will not see their retirement savings again before they are too old to need it.

But, never mind that. Instead, Larry proceeds to the obligatory gold bashing.

If we go back to 1980 to make the gold versus stocks performance comparison, from the very end of the gold bull market and beginning of a bull market in stocks, gold does not shine—nor should it.

A glutton for punishment holds gold through a period of positive real and falling nominal interest rates, and a strengthening currency, such as occurred from 1980 to 2001. Conversely an investor will not be disappointed by holding gold through a period of negative real and rising nominal interest rates, and weakening currencies, such as from 1973 to 1980, and since 2001 until the meltdown in September 2008. Gold outperformed stocks during both periods. But explaining this requires that the journalist know something about interest rates, the dollar--and gold.

Making historical comparisons also requires that a journalist know the first thing about the history of gold investing in the U.S. From 1933 until 1975 gold bullion ownership by U.S. citizens was not possible because it was illegal, so who knows how well U.S. gold investors might have done before that time. Likely quite well, especially during the inflationary war years.

Unfortunately, history supplies us with only three, relevant, modern time periods to use to evaluate gold performance versus stocks for U.S. citizens: from 1974 to 1980 when gold did well and was legal for U.S. citizens to own, from 1980 to 2001 when it did not do well, and since 2001 when gold performed well again. The small sample size leaves a lot of room for interpretation, either positive or negative. The moral of the story is that “now” is not always the best time to buy gold or stocks, although true gold bugs will disagree. Conversely, the mainstream business media invariably try to make the argument that stock ownership is always best and gold ownership never makes sense. But you never hear them called “stock bugs.”

One factor is universal among critics of gold investing: they don’t own any. They feel silly for not buying gold at low prices, or for buying in at a low price then selling too early in, say, 2006 when a legion of bonehead analysts wrote that gold was a bubble, and I told them otherwise. Now they are afraid to buy at current prices.

I’m often asked, if I didn’t buy gold at $270 would I buy it today at over $900?

Yes, but I’d do so knowing that buying at less than 50% of the previous inflation-adjusted peak price today is more risky than buying at 15% of 1980 peak prices, at the tail end of a 20 period of declining prices. Gold is no longer cheap. But that fact has to be weighed against the other elements of the long-term gold investment thesis we developed in 2001. We review them at the end of this article.

That will not happen to the dollar because reserve currencies are political not market-based. The managed depreciation of the dollar under the floating exchange rate regime will continue, recent deleveraging-based hiccup aside. Under the managed floating exchange rate regime, a reserve currency is not transitioned out in big step functions as the British pound sterling was in the days of fixed exchange rates.

Today’s virtual fixed exchange rate system is accomplished by central banks buying and selling each other’s sovereign debt.

Among the few who did not give me a hard time about buying gold in 2001? My wife, thank you. When I told her I wanted to put 15% of our net worth into gold, and why, she responded, “Governments and their money come and go.”

She is Chinese. Not sure where it stands on the cultural to-do list, but protecting assets from desperate governments is up there, which explains the fact of a high savings rate in China and most Asian countries. Protection of the family's fortune from abuses by government, given an ignominious track record, is deeply embedded in Asian culture. A culture in continuous operation for a few thousand years can’t avoid accumulating wisdom.

Not so Larry and his editor who shoveled a few more loads onto the mountainous heap that has accumulated on the topic of gold over the years.

More and more investors are acquiring physical gold, or bullion, in the form of small bars the size of iPhones or coins like American Eagles and South African Krugerrands. Individuals’ bullion purchases almost doubled last year, amid apocalyptic panic over the financial system, to 862 metric tons. Lately, that panic-driven demand has given way to a more subdued, yet still potent, fear that stocks will suffer as the recession grinds on for a long time, so gold makes sense. At the same time, there’s a rising anxiety about inflation among people like Dr. Van Steyn, resulting from the Obama administration’s massive stimulus spending.

During the peak of the financial crisis last fall, I received calls from friends and associates from my industry looking to make gold purchases of $10 million or more. They were motivated as much by the emotional heat emitted by the meltdown as by the government’s reaction to the crisis. Bank bailouts. Micro-management of the U.S. auto industry. A run up of the fiscal deficit to more than 12% of GDP only a year after the Congressional Budget Office forecast deficits in the range of 4%. A crackdown on offshore tax havens.

None of this inspires confidence in the management of USA, Inc. nor in the future value of common shares in the Company, the U.S. dollar.

They bought gold.

So, Larry makes a fair point. But then he wanders down the well-worn stocks-bonds-real estate trade rag path, rattling off a list of gold ownership gotchas that, taken together, should make any reader feel good who has already made the mistake of not buying gold when it was cheap and seeks to compound it by not buying it before it gets even less cheap.

Certainly, holding bullion carries its own risks, such as keeping it safe.

Not like stock mutual funds, eh, Larry? Millions of investors with 401K accounts saw 40% of their retirement savings vanish in 2008 and 2009 just as surely as the grabbing mitts of a robber stealing cash and gold out of a wall safe. We are expected to believe that the 401K robber will put it back, but what if that does not happen for 20 years? Right about now it is dawning on millions of stock mutual fund investors that maybe they will not see their retirement savings again before they are too old to need it.

But, never mind that. Instead, Larry proceeds to the obligatory gold bashing.

And you also run the risk that gold, as it has in the past, will disappoint investors lured by the storied metal’s special gleam.

One is “lured” into buying gold while real estate, stock, and bond purchases result only from a rigorous and unbiased education in personal finance by a disinterested financial media. If you believe that, then you may also buy the notion that gold “disappoints” while stocks reward, even though as an asset class stocks have consistently disappointed investors since 1998. If we go back to 1980 to make the gold versus stocks performance comparison, from the very end of the gold bull market and beginning of a bull market in stocks, gold does not shine—nor should it.

A glutton for punishment holds gold through a period of positive real and falling nominal interest rates, and a strengthening currency, such as occurred from 1980 to 2001. Conversely an investor will not be disappointed by holding gold through a period of negative real and rising nominal interest rates, and weakening currencies, such as from 1973 to 1980, and since 2001 until the meltdown in September 2008. Gold outperformed stocks during both periods. But explaining this requires that the journalist know something about interest rates, the dollar--and gold.

Making historical comparisons also requires that a journalist know the first thing about the history of gold investing in the U.S. From 1933 until 1975 gold bullion ownership by U.S. citizens was not possible because it was illegal, so who knows how well U.S. gold investors might have done before that time. Likely quite well, especially during the inflationary war years.

Unfortunately, history supplies us with only three, relevant, modern time periods to use to evaluate gold performance versus stocks for U.S. citizens: from 1974 to 1980 when gold did well and was legal for U.S. citizens to own, from 1980 to 2001 when it did not do well, and since 2001 when gold performed well again. The small sample size leaves a lot of room for interpretation, either positive or negative. The moral of the story is that “now” is not always the best time to buy gold or stocks, although true gold bugs will disagree. Conversely, the mainstream business media invariably try to make the argument that stock ownership is always best and gold ownership never makes sense. But you never hear them called “stock bugs.”

One factor is universal among critics of gold investing: they don’t own any. They feel silly for not buying gold at low prices, or for buying in at a low price then selling too early in, say, 2006 when a legion of bonehead analysts wrote that gold was a bubble, and I told them otherwise. Now they are afraid to buy at current prices.

I’m often asked, if I didn’t buy gold at $270 would I buy it today at over $900?

Yes, but I’d do so knowing that buying at less than 50% of the previous inflation-adjusted peak price today is more risky than buying at 15% of 1980 peak prices, at the tail end of a 20 period of declining prices. Gold is no longer cheap. But that fact has to be weighed against the other elements of the long-term gold investment thesis we developed in 2001. We review them at the end of this article.

While gold use for industrial and jewelry purposes is way down because of the recession, robust investor demand has kept prices aloft. In April, when talk of inflation resurfaced, gold prices climbed over $900 per ounce, hitting $983 in early June. It has since drifted down to $909, thanks to such factors as India’s recent doubling of import taxes on gold.

Don’t tell the American deflationists who still think you can divide the number of units of a currency, the money supply, by the depreciated exchange rate value of each unit of that currency and still get a larger quotient. Hyperinflation is the extreme case—a divide by zero problem—when the dividend of the debt equation goes to infinity and the divisor goes to nada. In that case it hardly matters if you have a billion, a trillion, or a quintillion units of debt if the exchange rate value of the currency unit has collapsed a billion times. That will not happen to the dollar because reserve currencies are political not market-based. The managed depreciation of the dollar under the floating exchange rate regime will continue, recent deleveraging-based hiccup aside. Under the managed floating exchange rate regime, a reserve currency is not transitioned out in big step functions as the British pound sterling was in the days of fixed exchange rates.

Today’s virtual fixed exchange rate system is accomplished by central banks buying and selling each other’s sovereign debt.

Rolling a reserve currency, the modern way

When someone asks you, might the dollar lose reserve currency status? The answer is that it has been in the process of losing its status as dominant reserve currency since 1971 when the U.S. unilaterally abandoned the international gold standard.

Central banks still hold more than 20% of all the gold ever produced 38 years after the international gold standard was “suspended,” permanently, as it turns out. Why do central banks still hold gold if the metal has no role as a reserve asset in the monetary system? No financial journalists ask this question, and certainly not Larry. I believe they hold it to hedge the potential failure of the political arrangement that the dollar represents, and that is reason enough for private individuals and institutions to own it, too.

Don’t warn readers that these horror show services on average pay gold sellers 15 cents on the dollar for their heirlooms. Don’t explain that a desperate and indebted middle class is selling gold to pay property taxes and mortgage bills while wealthy investors like physician Scott Van Steyn buy gold to hedge inflation risk. Talk about a wealth transfer.

We don’t see as many Cash4Gold ads these days as we did last year. Has the middle class sold all of its gold? Sure looks that way.

Now what happens to them if the inflation appears that well-healed gold investors like Scott expect? The wealth class dichotomy of gold investing is the final irony of the collapsing FIRE Economy that deposited 90% of all personal debt in the laps of the bottom 40% net worth group. Imagine what happens when prices start to rise even more than they already have, while unemployment continues to rise with it? That's been our forecast since last year.

But no one talks about that, least of all the Wall Street Journal.

Certified Financial Planners are certified to sell Wall Street financial products: stocks, bonds, and real estate. Period. Most of them act as an extended Wall Street sales force (see Debt Deflation Bear Market Update Part I: 2009 Windup).

Not all of them, mind you. Some go off the reservation and recommend allocations in gold that they have determined independently to be in the best interest of their clients.

One of these renegades lives in my town. While recommending a position in gold to his clients, he has since 2001 accumulated more than $3 million for himself and his family.

His clients are either lucky or smart. But they didn’t get a clue about getting out of stocks and housing and buying gold by reading the Wall Street Journal, that’s for sure.

The second fallacy Larry reinforces has to do with owning physical gold versus gold ETFs or stock in gold mining companies. Obviously, an investor has greater control over an asset that he or she physically manages versus virtually as shares in a fund. There is a liquidity versus certainty trade-off; you can’t trade physical gold via your brokerage account. On the other hand you can’t count on the management of an ETF to track the gold price or of a mining company to not run the company into the ground.

The third and fourth fallacies are that all gold investors are hedging apocalypse and for that purpose it has no practical application. “Chip off a piece of your gold to buy milk at the store”? Cute, Larry, but what if your readers are not morons?

Instead of chipping off chunks of gold to buy milk, how about this: sell an ounce of gold for $900 in 2009 that you paid $270 for in 2001 when gasoline cost $1.30 and use the proceeds to buy gasoline in 2009 for $2.80. I do this all the time. In effect, I’m paying less for gasoline with gold today than I paid for gas in cash ten years ago. Can’t do that with my stock or bond portfolio, now can I Larry? Chip that one off and chew on it.

Care to quantify “on a tear”? Of course not. That will make stocks appear to be a terrifically bad investment compared to gold over the period.

When someone asks you, might the dollar lose reserve currency status? The answer is that it has been in the process of losing its status as dominant reserve currency since 1971 when the U.S. unilaterally abandoned the international gold standard.

Central banks still hold more than 20% of all the gold ever produced 38 years after the international gold standard was “suspended,” permanently, as it turns out. Why do central banks still hold gold if the metal has no role as a reserve asset in the monetary system? No financial journalists ask this question, and certainly not Larry. I believe they hold it to hedge the potential failure of the political arrangement that the dollar represents, and that is reason enough for private individuals and institutions to own it, too.

For much of the last decade, though, gold has been on a tear, with prices tripling since 2002. Over that time, the Dow Jones Industrial average is down 10%.

Ten points for Larry. This is why since 1998 we own no long term stock positions but Treasury bonds, and CDs, and gold as well since 2001.All this comes at a time when the supply of newly mined gold is dwindling. Fresh discoveries of deposits are on the wane, and numerous cash-for-gold businesses have sprung up to feed demand. Some employ a Tupperware-party format, where people hold gatherings at home to sell dealers their jewelry and other gold items that can later be melted down.

In one of the most confused paragraphs in the history of financial journalism, the second sentence starts off with a statement about tight gold supply due to a dearth of new gold mines but ends by asserting that retail gold buying rip-off schemes like Cash4Gold appeared to fill the demand that gold mines can’t meet. What? Don’t warn readers that these horror show services on average pay gold sellers 15 cents on the dollar for their heirlooms. Don’t explain that a desperate and indebted middle class is selling gold to pay property taxes and mortgage bills while wealthy investors like physician Scott Van Steyn buy gold to hedge inflation risk. Talk about a wealth transfer.

We don’t see as many Cash4Gold ads these days as we did last year. Has the middle class sold all of its gold? Sure looks that way.

Now what happens to them if the inflation appears that well-healed gold investors like Scott expect? The wealth class dichotomy of gold investing is the final irony of the collapsing FIRE Economy that deposited 90% of all personal debt in the laps of the bottom 40% net worth group. Imagine what happens when prices start to rise even more than they already have, while unemployment continues to rise with it? That's been our forecast since last year.

But no one talks about that, least of all the Wall Street Journal.

Many mainstream financial advisers, however, are leery about owning gold in its physical form. “If we get total chaos, are you going to chip off a piece of your gold to buy milk at the store?” says Michael Goodman, president of Wealthstream Advisors in New York.

Here Larry packs more fallacies about gold into one paragraph than I have seen in entire articles on gold written by idiots who know even less about it than Larry does. I targeted mainstream advisors when I wrote “Gold: Questioning Fashionable Investment Advice” in 2001. They were wrong about gold in 2001 and every year since, including 2009, apparently, if Larry’s report is accurate. These stopped clocks will be right about gold eventually, but for all the wrong reasons. Certified Financial Planners are certified to sell Wall Street financial products: stocks, bonds, and real estate. Period. Most of them act as an extended Wall Street sales force (see Debt Deflation Bear Market Update Part I: 2009 Windup).

Not all of them, mind you. Some go off the reservation and recommend allocations in gold that they have determined independently to be in the best interest of their clients.

One of these renegades lives in my town. While recommending a position in gold to his clients, he has since 2001 accumulated more than $3 million for himself and his family.

His clients are either lucky or smart. But they didn’t get a clue about getting out of stocks and housing and buying gold by reading the Wall Street Journal, that’s for sure.

The second fallacy Larry reinforces has to do with owning physical gold versus gold ETFs or stock in gold mining companies. Obviously, an investor has greater control over an asset that he or she physically manages versus virtually as shares in a fund. There is a liquidity versus certainty trade-off; you can’t trade physical gold via your brokerage account. On the other hand you can’t count on the management of an ETF to track the gold price or of a mining company to not run the company into the ground.

The third and fourth fallacies are that all gold investors are hedging apocalypse and for that purpose it has no practical application. “Chip off a piece of your gold to buy milk at the store”? Cute, Larry, but what if your readers are not morons?

Instead of chipping off chunks of gold to buy milk, how about this: sell an ounce of gold for $900 in 2009 that you paid $270 for in 2001 when gasoline cost $1.30 and use the proceeds to buy gasoline in 2009 for $2.80. I do this all the time. In effect, I’m paying less for gasoline with gold today than I paid for gas in cash ten years ago. Can’t do that with my stock or bond portfolio, now can I Larry? Chip that one off and chew on it.

And while they often recommend putting 10% of your portfolio into commodities such as gold for the long term, a number of advisers think that no gold should be included, physical or held in other vehicles such as exchange-traded funds. The thinking is that gold performs best during times of unrest, and not so well at other times.

The “number of advisers think that no gold should be included” roughly matches the count of those who told their clients to not buy gold in 2001 and stay in stocks instead. As Larry noted early in his article, that resulted in a 10% nominal loss to the portfolio while “gold was on a tear.” Care to quantify “on a tear”? Of course not. That will make stocks appear to be a terrifically bad investment compared to gold over the period.

Gold has returned over 300% since 2001. Sssssh. Don't tell anyone.

Gold is not a commodity like any other, nor is gold money. Money is any commodity that acts both as a store of value and means of exchange. In the past I’ve used the example of cigarettes in a prison. Gold does not meet the definition of money because it is not accepted as a means of exchange, except in some international transactions. Before you can buy goods in a store, gold has to be converted into cash first.

Gold is currency. It maintains a unique international exchange value for historical reasons and because central banks still rely on it as a fallback. We call it the Fourth Currency. The other three are the dollar, yen, and euro.

A kilo gold bar (1,000 grams or about 32.15 troy ounces) at a spot price of $920 sells for $30,000, as much as a five year old BMW M3. How’s that? I can buy a used BMW M3 for the same price as a lump of metal that represents less technological innovation and human intellectual value-add than you can find in a lug nut on a German sports sedan? Such is the sorry state of our money system after the value-subtract of our central bankers and their clients.

This explains why gold was “on a tear” since then. Today gold investors buy gold to hedge the risk that the dollar will depreciate even more. A second order effect of that depreciation is cost-push inflation, as import prices rise, just as we saw from 2002 until 2008.

And while I appreciate Chris’ point, gold is not so much insurance against the unknown as the known the tendency of governments to depreciate currencies to manage debt deflation, and of markets to punish a currency for a government engaged in egregious fiscal mismanagement. For a political currency such as the dollar, that means no sudden dollar crash, unless a geopolitical mishap occurs. That is possible but poses another reason to own gold not avoid it.

The problem with gold mining companies is that they are run by gold mining company executives. I moderated a panel of gold mining CEOs at an investor’s conference a couple of years ago. After hearing the 10th mining chief executive’s pitch to potential investors, I had the formula down. Each of them stood and said in effect: “I have a PhD in geology. We are mining a huge ore body. Here are the high tech 3D pictures of the ore body produced by our completely foolproof high tech measurement system. The ore is worth $x in stock value if gold sells for $y. This is all true. I am not lying.”

I’d never seen so many men in one room profess their honesty with such vigor. It made quite an impression on me. It made me want to avoid mining stocks even more than ever before.

Woops! Larry almost forget to restate for the obligatory gold basher's line that gold does not pay dividends or interest.

With stories like Larry’s, is it any wonder that Americans remain grossly uninformed on the topic of gold investing?

Gold is not a commodity like any other, nor is gold money. Money is any commodity that acts both as a store of value and means of exchange. In the past I’ve used the example of cigarettes in a prison. Gold does not meet the definition of money because it is not accepted as a means of exchange, except in some international transactions. Before you can buy goods in a store, gold has to be converted into cash first.

Gold is currency. It maintains a unique international exchange value for historical reasons and because central banks still rely on it as a fallback. We call it the Fourth Currency. The other three are the dollar, yen, and euro.

Over the past four decades, gold has been one-third more volatile than the Standard & Poor’s 500-stock index, and yet has delivered a lower return: an annualized 8.4%, versus 9.1% for the S&P index, says Steve Condon, director of investor advisory services at Truepoint Capital in Cincinnati.

First of all, there was no way to own the S&P 500 for 40 years. The composition of the index changed continuously. Survivor bias exaggerates returns of stock indexes. The quoted 9.1% S&P 500 returns are theoretical while the 8.4% gold returns are not. But even if we accept these comparative rates of return as fact, I readily concede the negative implications for the dollar in the fact that a lump of metal produced anywhere near the same returns as the S&P 500 over the past 40 years. This testifies to decades of political mismanagement of the dollar. A kilo gold bar (1,000 grams or about 32.15 troy ounces) at a spot price of $920 sells for $30,000, as much as a five year old BMW M3. How’s that? I can buy a used BMW M3 for the same price as a lump of metal that represents less technological innovation and human intellectual value-add than you can find in a lug nut on a German sports sedan? Such is the sorry state of our money system after the value-subtract of our central bankers and their clients.

As an inflation hedge, gold’s record isn’t perfect either. After reaching a record high of $850 per ounce in January 1980, gold’s price fell almost 44% in two months. It didn’t reach $850 again until January 2008, meaning it was flat while inflation rose 175%, Mr. Condon calculates. Indeed, today’s gold price is far below its 1980 apex when inflation is factored in: That $850 is worth $2,206 in today’s dollars.

Another mind bogglingly confused paragraph. Larry, tell your editor to lay off the weed. Gold is not an inflation hedge. Gold is a hard currency. It is a fiat currency hedge. Inflation can result from a depreciating currency, as occurred in the U.S. between 2001 and mid 2008, and is again as a weaker dollar and rising energy import prices move food and other whole costs up starting in Q3 2009, as we forecast last year. This explains why gold was “on a tear” since then. Today gold investors buy gold to hedge the risk that the dollar will depreciate even more. A second order effect of that depreciation is cost-push inflation, as import prices rise, just as we saw from 2002 until 2008.

Gold as a store of value has been getting a bad rap from some quarters at least since the days of economist John Maynard Keynes, who once sneeringly called it a “barbarous relic.” Contemporary gold lovers bridle at such slights. “Owning bullion,” says gold investor Chris Martenson, 46, a scientist from Montague, Mass., “is buying insurance against the unknown.”

Keynes believed that government should inflate an economy out of a deflation spiral by depreciating the currency. The gold standard got in the way. Quoting Keynes on the value of gold in the monetary system is like quoting the opinion of a carjacker on the value of a large and active police force. And while I appreciate Chris’ point, gold is not so much insurance against the unknown as the known the tendency of governments to depreciate currencies to manage debt deflation, and of markets to punish a currency for a government engaged in egregious fiscal mismanagement. For a political currency such as the dollar, that means no sudden dollar crash, unless a geopolitical mishap occurs. That is possible but poses another reason to own gold not avoid it.

Gold’s tangible quality is reassuring to its owners. Gold owner Richard Dempsey, 63, a vice-president at Bank of New York Mellon, keeps some of his 60 gold coins in a safe at his Point Pleasant, N.J., home and some in a safe-deposit box. “I like to know it’s there,” he says.

Richard Dempsey needs to understand that reporters love to publish personal information provided by their sources. Brings color and authenticity to the story. In this case, it may bring the Richard some unpleasant uninvited company some day. Wives being generally more sensible about these matters, I can imagine Richard’s giving his balding dome a flat-handed whack or two for revealing the location of his gold stash to Larry to be published in a newspaper.The biggest threat to bullion, aside from a price collapse, is theft. “The only way to lose gold is if someone steals it,” says Dan Deighan, president of Deighan Financial Advisors in Melbourne, Fla., who advocates that his clients own some bullion.

The biggest threat to the products the Wall Street Journal sells for Wall Street—stocks, bonds, and real estate—is a collapse in stock, bond, and housing prices. But you won’t read about that in the Wall Street trade magazine like the Wall Street journal until after the event, when it’s too late to avoid it.The truest gold buffs, though, want nothing to do with ETFs or mining stocks. Mr. Martenson, who runs an investing Web site, dismisses them as creatures beholden to untrustworthy managements and financiers. “I’ve lost faith in how Wall Street does business,” says Mr. Martenson, who keeps more than half his portfolio in bullion.

ETFs generally, and gold ETFs especially, almost never work as advertised. We avoid them. And we have never once purchased a gold mining stock. The problem with gold mining companies is that they are run by gold mining company executives. I moderated a panel of gold mining CEOs at an investor’s conference a couple of years ago. After hearing the 10th mining chief executive’s pitch to potential investors, I had the formula down. Each of them stood and said in effect: “I have a PhD in geology. We are mining a huge ore body. Here are the high tech 3D pictures of the ore body produced by our completely foolproof high tech measurement system. The ore is worth $x in stock value if gold sells for $y. This is all true. I am not lying.”

I’d never seen so many men in one room profess their honesty with such vigor. It made quite an impression on me. It made me want to avoid mining stocks even more than ever before.

Owning bullion has its own challenges. You have to worry about storing, securing and insuring it. Under a standard homeowner’s policy from Allstate Corp., for example, gold kept in the house is covered only up to around $200 in value. Special riders are available: Allstate will ensure $20,000 worth of household gold for an annual premium of $684, with a $250 deductible, for example.

At last. A nugget of useful information. Insurance is another reason to keep gold in a safe deposit box, another being that a reporter may call you and ask you to tell him where potential thieves can find your gold in your home.Buying the stuff is not cheap. Markups on bullion are around 5%. Since the Internal Revenue Service considers gold a collectible, not an investment, it is ineligible for the 15% maximum federal capital gains tax—the rate for gold is 28%.

The story here, Larry, is that the government does not want you to own gold. No Goldie Mae to offer government-financed loans to buy gold. No annual interest rate tax deduction on gold debt. No long-term capital gains tax benefits. No special capital gains freebies. The government views gold ownership with the same contempt as the Wall Street Journal does, and probably not a coincidentally. Woops! Larry almost forget to restate for the obligatory gold basher's line that gold does not pay dividends or interest.

Unlike stocks and bonds, gold pays no dividends or interest.

Right, except when it does. See 300% return since 2001, above. With stories like Larry’s, is it any wonder that Americans remain grossly uninformed on the topic of gold investing?

We got into gold as Innovators in 2001. With the announcement by Northwestern Mutual Life Insurance Co. on June 1, 2009 of the purchase of $400 million in gold, we declared the end of the Early Adopters stage and the beginning of the Early Majority stage of market development.

To see where we are in the process, we review our top three reasons for buying gold in 2001 to see if the investment thesis still holds:

Some day it will be time to say goodbye to gold, as it was in 1980. I am certain that by that time, when we are on the downward slope of the adoption curve, many will cling to their gold investments like housing investors did in 2006 after we told them housing had topped, and stock mutual fund investors after we’d warned them in December 2007, and tech stock investors all the way back in March 2000 when we warned that the stock market bubble was over.

Investors with outsized positions in any asset class are vulnerable to what we call the Desperate Optimism of the Invested. The psychology applies as much to gold as to the homeowner whose life’s savings were tied up in real estate in 2006, as to the 401K holder whose retirement money was concentrated in stock mutual funds in 2007. We do not keep all of our eggs in one basket because the Desperate Optimism of the Invested causes us to not see that which we cannot afford to see, emotionally or financially. It pays to grow attached to people, but never to investments. Unlike a person, assets like gold or stocks don’t care about us, and we should not care about them.

Conclusion

We cannot say when the top in gold prices will occur. We can only model possible outcomes and compare our models to actual events as they unfold, adjusting as necessary, as we have in previous cases over the past 11 years.

The world is no longer as economically or politically U.S.-centric as before, and the price of gold reflects the tensions that have built up over decades within the outmoded monetary system. These have been brought to light by the global financial and economic crisis last year. But replacement of the U.S.-centric dollar-based global monetary system alone is not sufficient. We have a bigger problem, Peak Cheap Oil**, which we believe began in 2006.

Peak Cheap Oil drives cycles of endemic cost-push inflation that will require a complete retooling of the entire global monetary and credit system to prevent geopolitically dangerous stresses between net oil consuming countries. Energy commodity payments are made globally with the same currency as other economic activities. As cheaply accessible oil supplies diminish along with dollar hegemony, we will experience cycles of inflation and credit bust until the system is revamped.

At some point in the future, perhaps as soon as 2011, I expect an echo of 2007 and 2008 when oil prices increased to $147 and food riots occurred in several third world countries as commodity cost-push inflation followed high oil prices through the supply chain. The next high oil price cycle will later be followed by another economic crash through the credit system.

Governments of oil producers will exacerbate the Peak Cheap Oil crisis by attempting to extract more cash from domestic oil production via taxation and nationalization, discouraging exploration and thus putting additional stress on supplies. Central banks may attempt to manage Peak Cheap Oil using policies that reduce the credit money supply that finances energy-related economic activity. They will do this using similar methods that produced asset price inflation in the FIRE Economy, through credit money policies separate from goods and services inflation and wage inflation in the Producer/Consumer Economy, but with the opposite objective: to manage energy prices down, versus real estate prices up. The recent move by the U.S. Commodity Futures Trading Commission to restrict “speculative oil trading” is the leading edge of this development.

If any analyst has a viable scenario that is negative for gold during the process described above we have not heard it. We’ll keep looking, though. Maybe we should ask Larry.

* In any transition away from a fiat dollar-based international system to a unilateral or other system, there is no scenario that leaves the dollar stronger, and crisis is likely due to a high external debt position combined with high and unsustainable capital inflow requirements. Transition from an old to new monetary order has historically occurred only after war provided the necessary political forcing function.

** Peak Cheap Oil by our definition is a process of markets pricing in a future peak in supplies of oil that can be profitably extracted. In our Peak Cheap Oil scenario oil production becomes increasingly labor and time intensive despite technological advances. As energy is in addition to labor a critical input cost to oil production. Rising energy prices cause oil production costs to rise more quickly than producers can raise final prices in order to maintain profit margins. Netted out, Peak Cheap Oil means oil prices rise even as demand steadily declines.

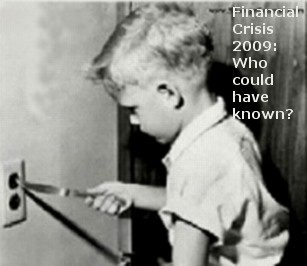

Who could have known? Revenge of the Accountants - Eric Janszen ($ubscription) July 15, 2009, iTulip

“She was asking me if these things are so large, how come everyone missed it?”

- Luis Garicano on the Queen’s visit to LSE, November 2008

“The financial crisis will hopefully stimulate a revival of accounting scholarship aimed at understanding the relationship between accounting practice and the macro political and economic environment in which it operates.”

- Patricia Arnold, June 2009

Dirk J. Bezemer of the University of Groningen, founded in 1614, just published a paper titled, “No One Saw This Coming”: Understanding Financial Crisis Through Accounting Models. In it Bezemer notes a number of economists who correctly forecast not only the financial crisis and recession but noted its root causes and used techniques not employed by most economists to do it: a combination of macro-economic modeling and accounting, methods that provide a critical understanding of the dynamics of a finance-based political economy. That is why they worked. What do current models built using these methods tell us about the future? More ($ Subscription) …

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

To see where we are in the process, we review our top three reasons for buying gold in 2001 to see if the investment thesis still holds:

- Gold is cheap – No longer true.

- Out-of-date and strained U.S.-centric global monetary system due to experience a less than smooth transition* – Still true.

- Large scale gold holdings by global central banks to hedge a potential breakdown of the system – Still true.

Some day it will be time to say goodbye to gold, as it was in 1980. I am certain that by that time, when we are on the downward slope of the adoption curve, many will cling to their gold investments like housing investors did in 2006 after we told them housing had topped, and stock mutual fund investors after we’d warned them in December 2007, and tech stock investors all the way back in March 2000 when we warned that the stock market bubble was over.

Investors with outsized positions in any asset class are vulnerable to what we call the Desperate Optimism of the Invested. The psychology applies as much to gold as to the homeowner whose life’s savings were tied up in real estate in 2006, as to the 401K holder whose retirement money was concentrated in stock mutual funds in 2007. We do not keep all of our eggs in one basket because the Desperate Optimism of the Invested causes us to not see that which we cannot afford to see, emotionally or financially. It pays to grow attached to people, but never to investments. Unlike a person, assets like gold or stocks don’t care about us, and we should not care about them.

Conclusion

We cannot say when the top in gold prices will occur. We can only model possible outcomes and compare our models to actual events as they unfold, adjusting as necessary, as we have in previous cases over the past 11 years.

“All models are wrong, but some are useful.”

Recent research points us in the direction of gold prices rising for the foreseeable future, although as always not in a straight line. Gold’s price rise will occur due to complex mix of monetary and commodity influences. Silver, platinum, and other metals prices will also rise but for less complicated reasons. The world is no longer as economically or politically U.S.-centric as before, and the price of gold reflects the tensions that have built up over decades within the outmoded monetary system. These have been brought to light by the global financial and economic crisis last year. But replacement of the U.S.-centric dollar-based global monetary system alone is not sufficient. We have a bigger problem, Peak Cheap Oil**, which we believe began in 2006.

Peak Cheap Oil drives cycles of endemic cost-push inflation that will require a complete retooling of the entire global monetary and credit system to prevent geopolitically dangerous stresses between net oil consuming countries. Energy commodity payments are made globally with the same currency as other economic activities. As cheaply accessible oil supplies diminish along with dollar hegemony, we will experience cycles of inflation and credit bust until the system is revamped.

At some point in the future, perhaps as soon as 2011, I expect an echo of 2007 and 2008 when oil prices increased to $147 and food riots occurred in several third world countries as commodity cost-push inflation followed high oil prices through the supply chain. The next high oil price cycle will later be followed by another economic crash through the credit system.

Governments of oil producers will exacerbate the Peak Cheap Oil crisis by attempting to extract more cash from domestic oil production via taxation and nationalization, discouraging exploration and thus putting additional stress on supplies. Central banks may attempt to manage Peak Cheap Oil using policies that reduce the credit money supply that finances energy-related economic activity. They will do this using similar methods that produced asset price inflation in the FIRE Economy, through credit money policies separate from goods and services inflation and wage inflation in the Producer/Consumer Economy, but with the opposite objective: to manage energy prices down, versus real estate prices up. The recent move by the U.S. Commodity Futures Trading Commission to restrict “speculative oil trading” is the leading edge of this development.

If any analyst has a viable scenario that is negative for gold during the process described above we have not heard it. We’ll keep looking, though. Maybe we should ask Larry.

* In any transition away from a fiat dollar-based international system to a unilateral or other system, there is no scenario that leaves the dollar stronger, and crisis is likely due to a high external debt position combined with high and unsustainable capital inflow requirements. Transition from an old to new monetary order has historically occurred only after war provided the necessary political forcing function.

** Peak Cheap Oil by our definition is a process of markets pricing in a future peak in supplies of oil that can be profitably extracted. In our Peak Cheap Oil scenario oil production becomes increasingly labor and time intensive despite technological advances. As energy is in addition to labor a critical input cost to oil production. Rising energy prices cause oil production costs to rise more quickly than producers can raise final prices in order to maintain profit margins. Netted out, Peak Cheap Oil means oil prices rise even as demand steadily declines.

|

Who could have known? Revenge of the Accountants - Eric Janszen ($ubscription) July 15, 2009, iTulip

“She was asking me if these things are so large, how come everyone missed it?”

- Luis Garicano on the Queen’s visit to LSE, November 2008

“The financial crisis will hopefully stimulate a revival of accounting scholarship aimed at understanding the relationship between accounting practice and the macro political and economic environment in which it operates.”

- Patricia Arnold, June 2009

Dirk J. Bezemer of the University of Groningen, founded in 1614, just published a paper titled, “No One Saw This Coming”: Understanding Financial Crisis Through Accounting Models. In it Bezemer notes a number of economists who correctly forecast not only the financial crisis and recession but noted its root causes and used techniques not employed by most economists to do it: a combination of macro-economic modeling and accounting, methods that provide a critical understanding of the dynamics of a finance-based political economy. That is why they worked. What do current models built using these methods tell us about the future? More ($ Subscription) …

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

I just bought more CEF yesterday.

I just bought more CEF yesterday.

Comment